Bitcoin Updates: The HODL Barrier Faces a Crucial Moment—Bitcoin’s $95,000 Challenge May Determine the Path Toward $85,000

- Bitcoin's drop below $100,000 tests the $95,000 HODL wall, where 65% of invested USD remains concentrated. - Sharp sell-offs ($655M liquidations) and ETF outflows ($961M since Nov) expose fragile market structure. - STHs hold 30% of LTH supply above $95,000, with 80% of recent sales at a loss as profit-loss ratios fall below 0.21. - A break below $95,000 could trigger a path to $85,000, contrasting with 2022's sharper $45K-to-$36K collapse. - LTH resolve determines whether the HODL wall stabilizes or acc

Bitcoin's recent drop below $100,000 has brought renewed attention to the $95,000 on-chain HODL wall—a crucial threshold where long-term holders (LTHs) have accumulated a large portion of the supply. The steep decline, which

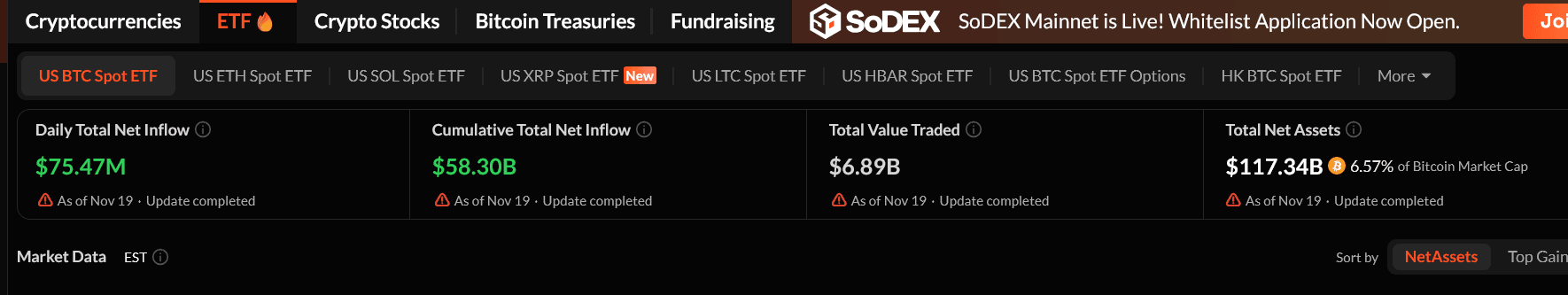

Coinbase's figures underscore the magnitude of this move:

The breakdown of the $112,000 STH cost basis has left recent entrants at a loss, while LTHs still have a layered cost structure just below the recent peaks. The unwinding of futures and ETF withdrawals have further weakened support between $106,000 and $118,000,

The $95,000 mark remains a key battleground. If long-term holders stand their ground, the HODL wall could absorb forced sales from STHs and the derivatives market. On the other hand,

Short-term market conditions remain unstable. ETF redemptions have replaced the steady inflows seen over the past year, perpetual funding rates and open interest have dropped since the leverage flush in October, and

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin ETFs Are Back: Did the Crash Just End?

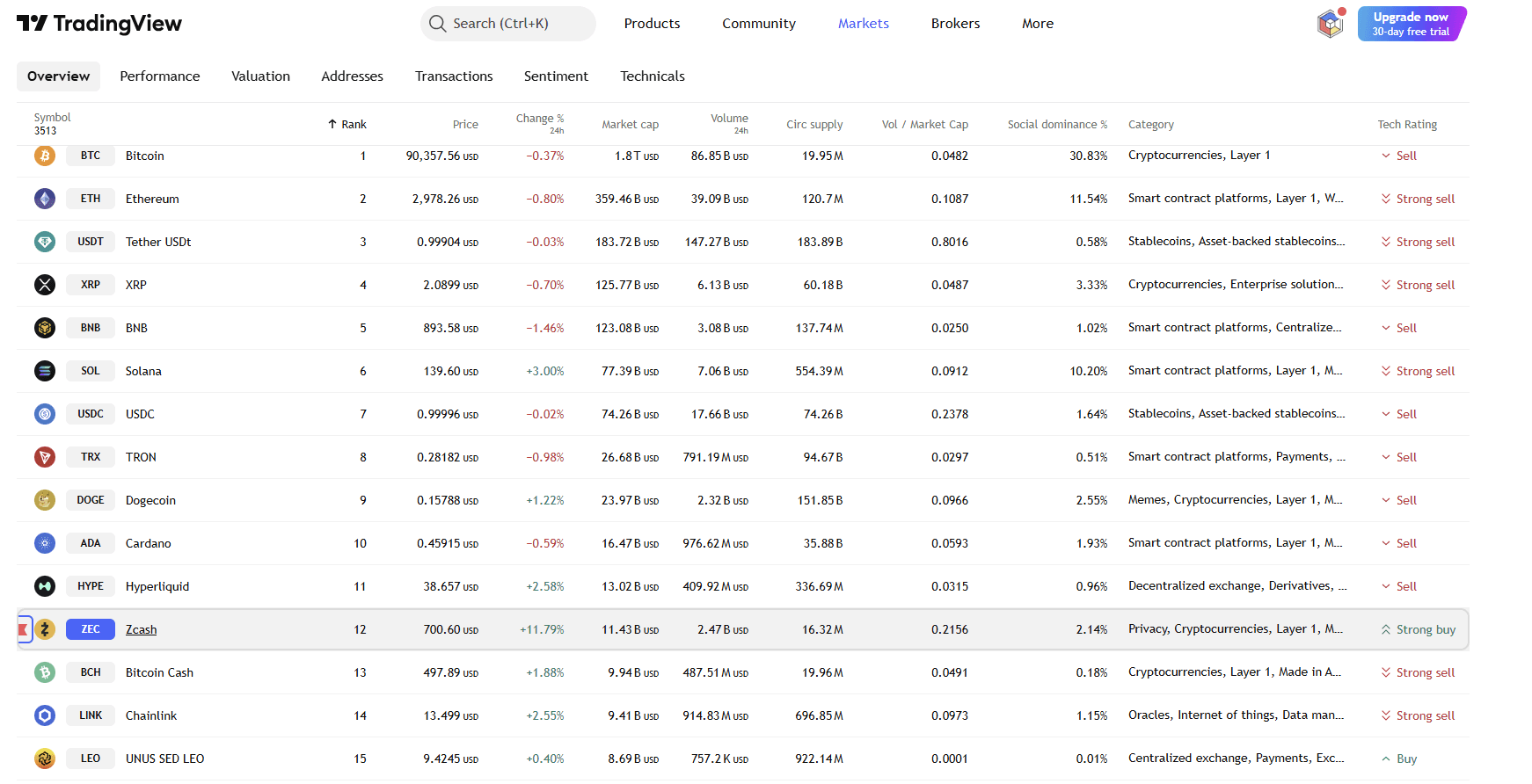

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening

Can Quantum Computers Break Crypto? Here's The Truth...

XRP News Today: Ripple Faces a Staking Dilemma on the XRP Ledger: Balancing Trust and Incentive Conflicts

- Ripple explores XRP Ledger staking to boost DeFi integration and institutional use. - CTO David Schwartz outlines two staking models, but implementation is distant due to architectural complexity. - Staking aims to enhance security and incentivize token holders, aligning with crypto trends while addressing bank needs for cost efficiency and compliance. - Ripple also seeks Fed account access to improve RLUSD stability, leveraging direct Treasury conversions for faster settlements.