Bitcoin ETFs Are Back: Did the Crash Just End?

When money starts flowing back into bitcoin ETFs right after a bruising week of outflows, it usually tells you the market isn’t broken, just catching its breath. Wednesday delivered exactly that. After watching more than 2.2 billion dollars walk out of U.S. spot bitcoin ETFs over five straight days, fresh capital finally returned. And it arrived at a moment when bitcoin itself clawed its way back above 92,000 dollars. Let’s break it down.

Why Did Bitcoin ETFs Snap Back Into Inflows?

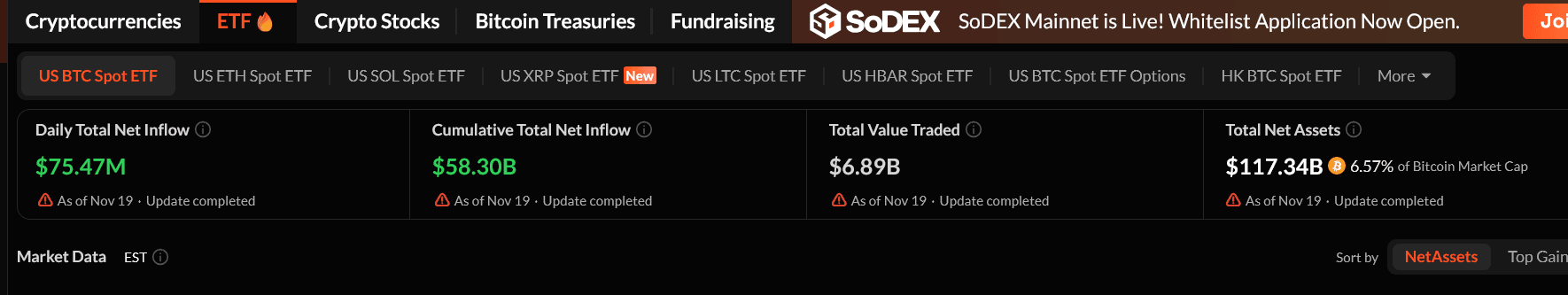

The latest data from SoSoValue shows U.S. spot bitcoin ETFs pulled in 75.47 million dollars on Wednesday. That may not sound explosive, but the context matters. BlackRock’s IBIT alone brought in 60.61 million dollars just a day after bleeding a record 523 million dollars. That’s a sharp reversal that signals institutions weren’t panicking; they were repositioning.

Grayscale’s Mini Bitcoin Trust also added 53.84 million dollars. These gains were partially held back by outflows from Fidelity’s FBTC and VanEck’s HODL, which lost 21.35 million and 17.63 million dollars, respectively. Still, the shift back to inflows shows appetite returning after a short but heavy sell window.

What Caused the Five-Day Outflow Spiral?

From November 12 to 18, bitcoin ETFs saw a brutal stretch, shedding more than 2.26 billion dollars. That drawdown lined up with bitcoin falling below 90,000 dollars for the first time in weeks. But Kronos Research CIO Vincent Liu gave a more grounded interpretation. He said the outflows weren’t capitulation. They were recalibration. Big players simply reduced exposure until macro signals—especially from the Fed—became clearer.

The market turbulence wasn’t helped by the 43-day U.S. government shutdown either. With federal agencies frozen out of discretionary spending, liquidity across risk markets tightened. Crypto tends to feel that squeeze first. Analysts expect liquidity to slowly return now that operations have resumed.

How Much Does the Fed Matter Right Now?

Quite a lot. Jerome Powell’s recent remarks pushed back expectations for a December rate cut, and traders are reacting. The CME FedWatch Tool now assigns just a 33.8 percent chance of a 25-basis-point cut next month, down from nearly 49 percent earlier in the week. That drop in confidence dragged sentiment into extreme fear territory, with the Crypto Fear and Greed Index printing 11.

When macro uncertainty drains confidence, ETFs feel the pressure. When that uncertainty lifts even slightly, flows tend to rebound quickly. Wednesday’s bounce fits that pattern.

Bitcoin Price: Is the Recovery Real?

Bitcoin has nudged back into the green, rising 0.72 percent over the past 24 hours to around 92,200 dollars. That’s a modest move, but it breaks the downward rhythm of the past week. For now, the ETF flow reversal suggests sentiment is stabilizing, not worsening.

What’s Happening With Ethereum and the Altcoin ETFs?

While bitcoin ETFs found some relief, spot Ethereum ETFs continued their losing streak. They posted another 37.35 million dollars in outflows, marking the seventh straight day of negative flows.

Altcoin ETFs told a very different story. Solana’s spot ETFs had a standout session with 55.6 million dollars in inflows. With two new Solana funds launching on Wednesday, there are now six SOL ETFs operating in the U.S., and institutional interest looks healthy.

Canary Capital’s spot XRP ETF saw 15.8 million dollars in net inflows, while its Hedera (HBAR) ETF added 577,180 dollars. Its Litecoin fund remained flat for the day.

The Bottom Line

The return to positive bitcoin ETF flows doesn’t mean the correction is over, but it does show institutions aren’t running for the exits. They’re waiting for clarity from the Fed, watching liquidity reopen after the shutdown, and recalibrating positions rather than abandoning them. For now, BTC hold above 92,000 dollars reflects a market that’s bruised, not broken.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Long-Term Investors Increase Holdings Amid Price Decline: Crypto Market Faces Growing Uncertainty

- Bitcoin and Ethereum face bearish pressure as ETF outflows persist, with Bitcoin near $95,000 and Ethereum below $3,200. - Institutional players like BitMine and FG Nexus adjust strategies amid declining hash prices and liquidity concerns. - Technical indicators like Bitcoin’s death cross and Ethereum’s oversold RSI signal prolonged weakness, with JPMorgan warning of risks for MSTR . - Coinbase’s D'Agostino sees the selloff as a buying opportunity for long-term holders, though structural buyer accumulati

Bitcoin Updates: Nvidia’s Surge in AI Drives Bitcoin Price Swings Amid Growing Concerns of a Market Bubble

- Nvidia's Q3 revenue hit $57.01B, driven by $51.2B in AI-focused data center sales, fueling Bitcoin's initial rebound above $91,000. - Bitcoin later fell to $86,400 amid AI bubble fears, mirroring 2025's pattern as analysts link its volatility to macroeconomic anxieties and overvaluation concerns. - CEO Huang highlighted sustained demand for Blackwell architecture, while regulators and investors warned of systemic risks from AI's rapid adoption and market fragility. - Bitcoin's 92% correlation with Nasdaq

Institutional integration and the Telegram network establish TON as the emerging benchmark in cryptocurrency

- TON (Telegram-integrated blockchain) gains traction as Coinbase expands $TON trading, boosting institutional adoption and liquidity. - TON Strategy Company (NASDAQ: TONX) reports $588.2M in digital assets, underscoring confidence in the token's long-term utility. - Analysts highlight TON's Telegram-driven ecosystem (1B+ users) and partnerships as key advantages over slowing projects like Chainlink (LINK). - Coinbase's Brazil DeFi expansion and stablecoin integration reinforce TON's positioning as a "glob

CBO reduces Trump tariff deficit by $1 trillion amid legislative disputes regarding rebate proposals

- CBO revised Trump-era tariff deficit savings downward by $1 trillion to $3 trillion through 2035, citing policy shifts like China-EU-Japan tariff cuts. - Legal challenges question Trump's executive authority on tariffs, with courts ruling against overreach while Supreme Court reviews cases. - Political clashes persist over $2,000 "tariff rebate" proposals, with Republicans prioritizing debt reduction over direct payments. - Economic analysis shows mixed impacts: short-term deficit reduction but uncertain