Internet Computer (ICP) Price Soars: An In-Depth Look at the Forces Driving the Surge

- Internet Computer (ICP) surged over 6% in 2025, driven by institutional partnerships, infrastructure upgrades, and speculative trading. - TVL hit $237B via DeFi growth, while Fission/Chain Fusion upgrades boosted scalability and cross-chain interoperability with Bitcoin/Ethereum. - November 2025 saw 261% transaction volume spike, but DApp engagement fell 22.4%, highlighting adoption gaps despite technical progress. - Speculative fervor and AI platform Caffeine's launch fueled momentum, though security ri

On-Chain Adoption: Mixed Signals

Blockchain data presents a complex picture of both progress and obstacles. By November 2025, the number of active ICP wallets had exceeded 1.2 million, spurred by the debut of the AI-powered Caffeine platform and

There was also a sharp increase in transaction activity, with

Institutional Validation: Partnerships and TVL Expansion

Challenges and Risks

Despite the strong price movement, ICP continues to face significant hurdles. The 22.4% drop in DApp activity points to persistent adoption issues,

Conclusion: A Platform at a Turning Point

The Internet Computer’s late-2025 price rally is the result of institutional backing, technical upgrades, and speculative trading. While on-chain indicators such as active wallets and TVL point to a solid technical base, the reduction in DApp usage highlights the importance of focusing on user-driven innovation. For ICP to strengthen its standing in the blockchain sector, it must close the gap between institutional enthusiasm and organic user growth. Investors should keep an eye on developments in the fourth quarter of 2025, especially regarding the platform’s execution of its roadmap and its ability to attract real-world users.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CFTC’s Expanded Crypto Responsibilities Challenge Regulatory Preparedness and Cross-Party Cooperation

- Senate Agriculture Committee confirmed Trump's CFTC nominee Michael Selig along party lines, advancing his nomination for final Senate approval. - Selig, an SEC crypto advisor, would expand CFTC's oversight of crypto spot markets under the CLARITY Act, positioning it as a key digital asset regulator. - Democrats raised concerns about CFTC's limited resources (543 staff vs. SEC's 4,200) and potential single-party control after current chair's expected resignation. - Selig emphasized "clear rules" for cryp

Bitcoin Updates: Bitcoin Approaches Crucial Support Level Amid Heightened Fear, Indicating Possible Recovery

- Bitcoin fell to a seven-month low near $87,300, testing key support levels amid heavy selling pressure and extreme bearish sentiment. - Analysts highlight a "max pain" zone between $84,000-$73,000, with historical patterns suggesting rebounds after fear indices hit annual lows. - The Crypto Fear & Greed Index at 15—a level preceding past rebounds—aligns with historical 10-33% post-dip recovery trends. - A 26.7% correction triggered $914M in liquidations, but a 2% rebound to $92,621 shows resilience amid

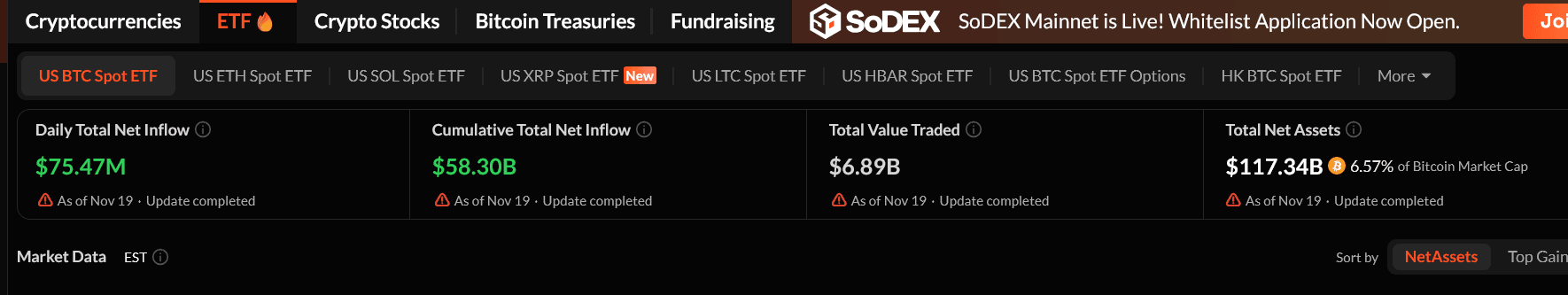

Bitcoin ETFs Are Back: Did the Crash Just End?

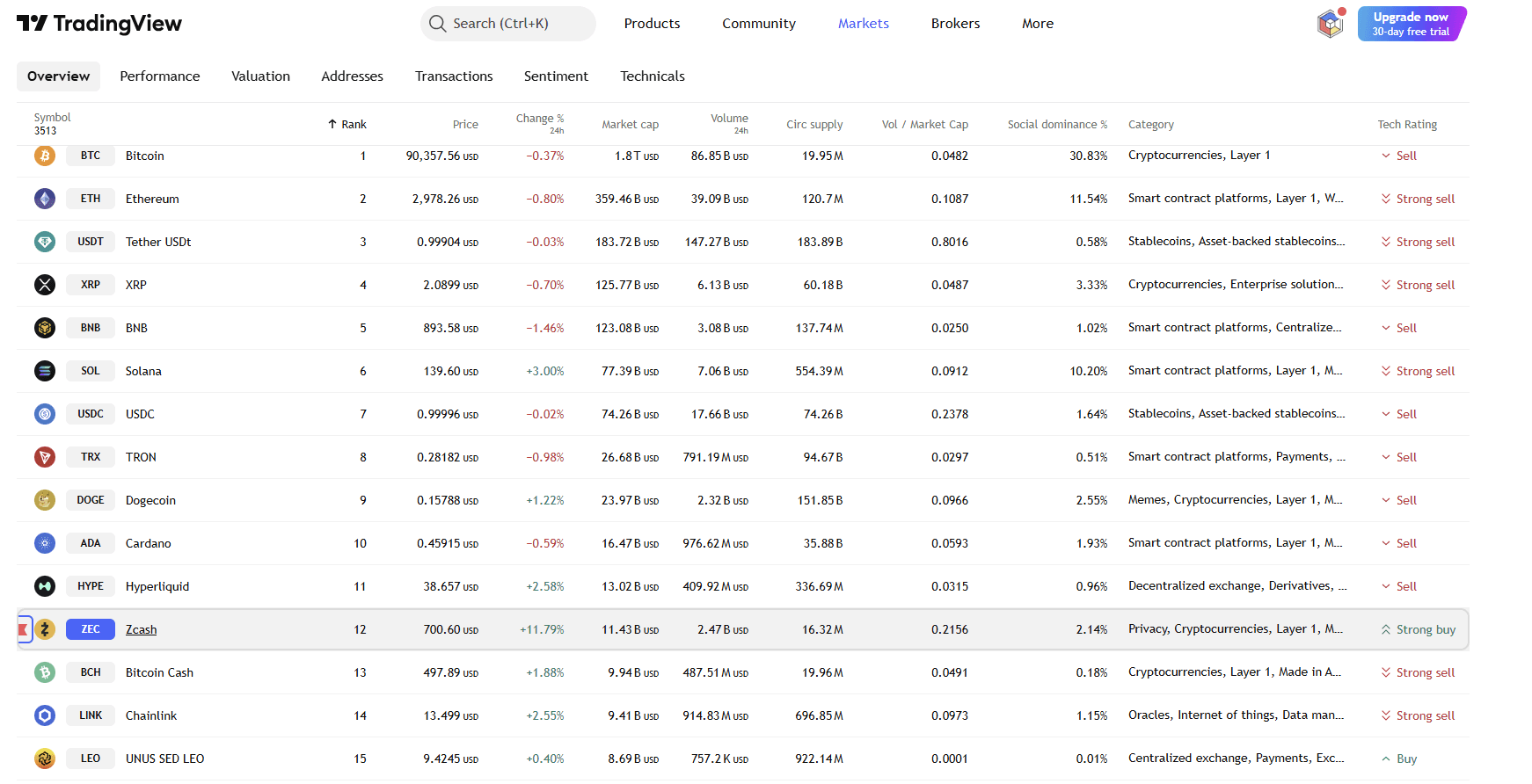

Should You Buy ZEC During the Market Crash? Here’s What’s Really Happening