Gold and Bitcoin Near Historic Valuation Relative to US Money Supply

Gold and Bitcoin near record valuation versus US M2 money supply as Fidelity’s Jurrien Timmer warns their inflation-fueled rally may be ending.

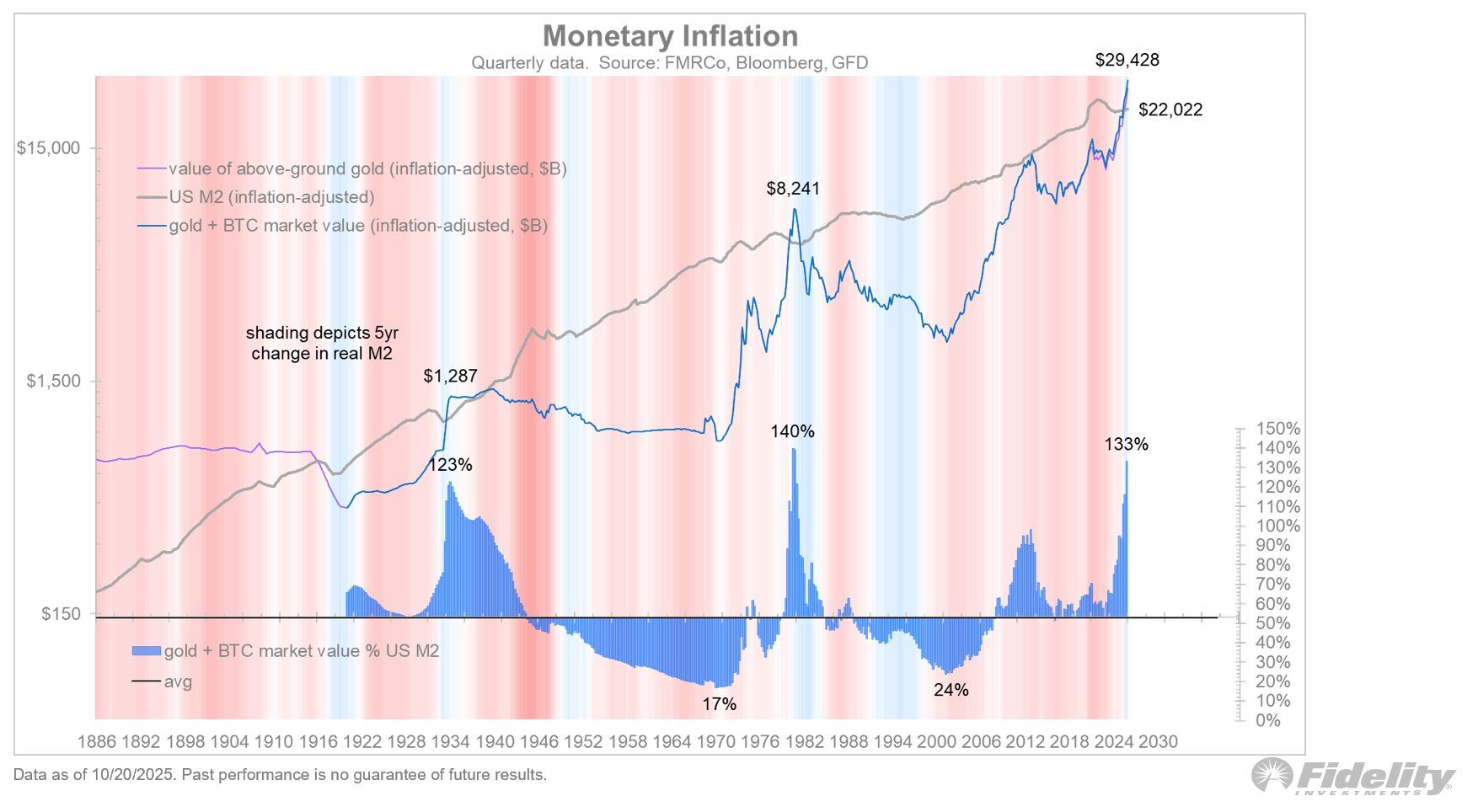

The combined value of gold and Bitcoin is approaching a historic level relative to the US M2 money supply.

A top market analyst now suggests the upside potential for using these assets as hedges against dollar devaluation and inflation may be nearing its limit. Jurrien Timmer, Director of Global Macro at Fidelity, shared his analysis on X (formerly Twitter) on Friday.

The End of the Easy Run?

Because of their limited supply, gold and Bitcoin are widely regarded as premier inflation hedges. Data from CoinGecko shows both assets have rallied strongly this year—gold is up 54.83%, while Bitcoin has gained 12.98%.

However, Timmer argues that this rally may be approaching its ceiling. He draws a comparison between current market conditions and those seen during the high-inflation peak of 1980.

Monetary Inflation. Source:

Jurrien Timmer’s X

Monetary Inflation. Source:

Jurrien Timmer’s X

Comparing Value Against US M2

Timmer’s analysis aggregates the inflation-adjusted market value of gold and Bitcoin, then compares the total to the US M2 money supply—a broad measure of money in circulation.

Historically, sharp expansions in M2 (monetary inflation) have coincided with significant rises in the value of hard assets like gold. According to Timmer, both gold and Bitcoin act as key forms of “hard money,” offering protection against currency debasement.

The Historical Ceiling

Timmer highlights two notable moments in the past century when inflation caused gold’s value to surge—1933 and 1980. During those peaks, gold’s total market value reached 123% and 140% of the US M2 money supply, respectively.

Today, the combined value of gold and Bitcoin is about $29 trillion, equivalent to 133% of the M2 money supply. That figure surpasses the 1933 peak and sits just below the 1980 high.

Timmer called this valuation a “critical point” to consider following gold’s recent aggressive rally.

“One reason to contemplate ringing the golden bell is that if gold is a play on US fiscal dominance, one could argue that the run is now complete,” he concluded.

This suggests that the massive rallies in gold and Bitcoin—largely driven by concerns over monetary expansion—may be running out of steam. While both assets remain structurally sound as long-term hedges, Timmer warns that the “easy returns” fueled by inflation fears may already have been realized.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.

Renewable Energy Training as a Key Investment to Meet Future Workforce Needs

- Farmingdale State College's Wind Turbine Technology program aligns with surging demand for skilled labor in decarbonizing economies, driven by U.S. renewable energy targets. - Industry partnerships with Orsted, GE Renewable Energy, and $500K in offshore wind funding validate the program's role in addressing workforce shortages in expanding wind sectors. - Hands-on training with GWO certifications and VR simulations prepares graduates for high-demand, high-salary roles ($56K-$67K annually), reducing corpo