Interview | Stablecoins are fueling the next DeFi bull run: Solflare

Co-CEO of Solflare, Filip Dragoslavic, explains why DeFi is increasingly becoming competitive with tradFi and CEXs.

- Filip Dragoslavic of Solflare explains the key trends in DeFi

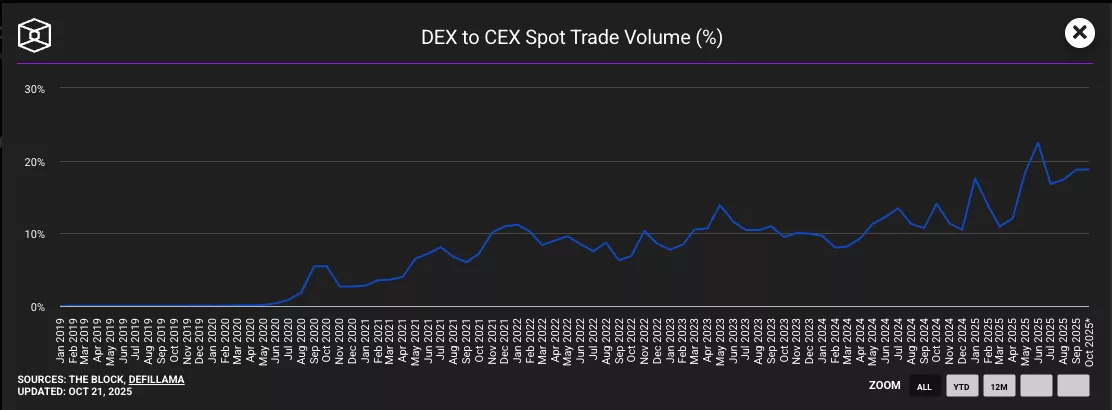

- The share of DEX trading volume has grown from 1% to 25% since 2022

- Solana has more than doubled its DeFi TVL, with even stronger performance in volumes

- Privacy-focused payments could be the next big thing for DeFi

DeFi is staging a comeback, and this time, it might stick. After two years of bear markets, the DeFi industry is approaching all-time highs, with tighter security, more users, and a new air of institutional legitimacy.

To discuss the growth and the future of DeFi, crypto.news spoke to Filip Dragoslavic, Co-CEO of Solflare, a non-custodial wallet for the Solana ecosystem. He explained how regulation, stablecoin adoption, and technical resilience contribute to DeFi’s growth.

crypto.news: The DeFi total value locked (TVL) is approaching levels we last saw in 2022. What’s behind this growth?

Filip Dragoslavic: There are a couple of reasons. First, the emergence of stablecoins is pulling both retail and institutional attention toward DeFi. Stablecoins are growing rapidly, and this wave of innovation and adoption around them is translating directly into renewed DeFi activity.

Second, DeFi protocols have proven themselves in volatile conditions. When centralized exchanges like Binance have struggled to fulfill orders during major sell-offs, DeFi platforms have continued operating smoothly.

One example is Hyperliquid, which functioned flawlessly under pressure. That level of operational resilience makes people trust DeFi more, especially compared to centralized platforms that can fail or freeze during stress. Also, Hyperliquid stands out as one of the most successful businesses on a per-employee profit basis, and that’s catching people’s attention.

CN: How is this DeFi cycle different from the last one in 2021–2022? And do you think the trend will continue?

FD: The last cycle was still dominated by centralized exchanges. At the time, decentralized exchange (DEX) volume was around 1% of total crypto trading; now it’s approaching 25%.

DEX to CEX spot trading volume | Source: The Block

DEX to CEX spot trading volume | Source: The Block

Centralized exchanges still have advantages, like speed and reliability, because they’re essentially trusted databases. But this time, we’re seeing more institutional players entering DeFi.

There’s also a more favorable stance from global governments, especially in the U.S. That gives DeFi additional legitimacy. People are seeing it as the future of financial infrastructure.

CN: U.S. regulators are talking about innovation exemptions for DeFi. What’s the significance of that?

FD: It’s huge. It gives DeFi room to experiment: a kind of “f*** around and find out” approach, if I’m being honest. Traditional finance hasn’t evolved meaningfully in decades. We live in a competitive, capitalist world, and if your systems don’t improve, you get left behind. The U.S. wants to stay ahead, so it’s giving DeFi some leeway to innovate and potentially lead the next generation of finance.

Crypto firms spend heavily on lobbying, but DeFi doesn’t really have that kind of representation. Why do you think DeFi is still getting regulatory attention?

Lobbying takes time, money, and massive resources. Only the biggest centralized players—like Coinbase—can afford to do that. DeFi, while growing, is still nascent. Most of the ecosystem is focused on building and making things work. Lobbying will probably come later.

But I think there are forward-looking people in governments who recognize DeFi’s potential and don’t want to ignore it. They’re giving it room to grow, even without heavy lobbying.

How far along are we in DeFi’s development? Are things “working” yet?

We’re still early. Traditional finance systems have evolved over decades. DeFi has only seriously taken off in the past few years. There’s a lot we can learn from TradFi, but DeFi also allows us to reinvent how financial systems can work.

Even wallets, which are fundamental to using DeFi, are still in their infancy. But the incentives to build meaningful things are strong. Users, volume, and even regulatory signals are all validating DeFi. That’s a powerful motivator for development.

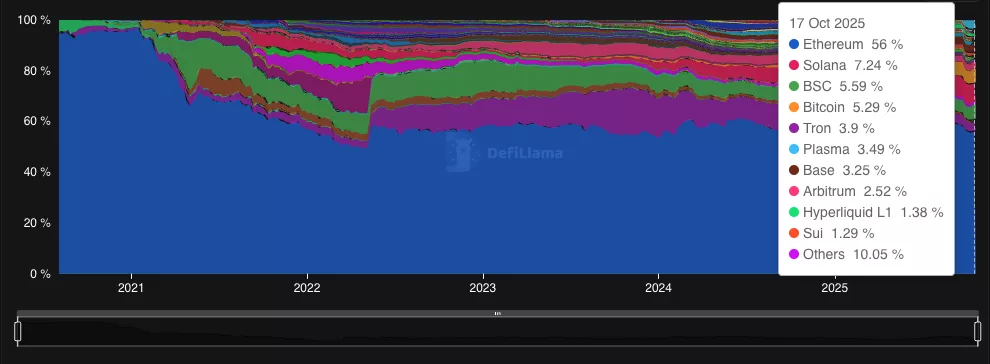

Since 2022, we’ve seen major shifts in DeFi in which protocols hold the most value. Ethereum is stable, but Solana has doubled its TVL. Meanwhile, Tron and BSC are declining. Why do you think that is?

It comes down to technical capabilities. Solana (SOL) is faster and cheaper, which allows developers to focus more on building the app, rather than working around limitations of the chain. Ethereum (ETH) still dominates for things like borrow-lend protocols, like Aave (AAVE) . But Solana is ideal for high-volume, high-speed applications.

DeFi TVL dominance by blockchain network | Source: DeFiLlama

DeFi TVL dominance by blockchain network | Source: DeFiLlama

That said, TVL isn’t a perfect metric. Efficient platforms don’t always need massive TVL. Volume matters more in some contexts, and Solana has a lot of on-chain volume. It’s shown it can withstand stress, so it’s well-positioned as a transactional chain.

DeFi still lags centralized exchanges in volume and user numbers. Why is that so?

It’s a combination of two things: functionality and trust. For one, it’s just easier to build trading interfaces on a centralized database. With DeFi, everything happens on-chain, which means coordination across many parties, not just one backend. It’s a harder technical challenge.

The second issue is trust. Centralized exchanges have been around longer and have invested heavily in branding and marketing. They sponsor sports teams, hold big events, and build recognition. That trust makes it easier to onboard new users.

How does user experience in DeFi compare to centralized exchanges?

The user experience when it comes to using an interface at this point is actually similar. What’s different is execution.

Centralized exchanges offer instant finality. There’s no block confirmation delay or gas fee. You can do high-frequency trading easily, which DeFi can’t support yet due to infrastructure limitations. But that comes with a tradeoff: all your assets are with one custodian.

It comes down to what users value more: speed and ease, or control and decentralization.

DeFi talks a lot about being “trustless,” but there are still hacks and scams. Is branding really the issue?

A big differentiator in DeFi is self-custody. You have ultimate control—but also ultimate responsibility. That’s a learning curve for users.

That said, scams and hacks happen everywhere, even in TradFi or everyday life, like SMS scams. The good news is: DeFi is getting safer. The ecosystem is improving rapidly, and security experts learn something from each incident.

For example, the users of our wallet hold more than $20 billion in assets. We’re constantly working on security because that’s the top priority. Every day, we feel more confident in our systems.

Are there any trends in DeFi that people are overlooking right now?

Yes, I think confidential or privacy-enabled trades will be an important topic coming up. Blockchains are transparent by design, but that makes it hard to trade in size. If there’s no confidentiality, you risk revealing your position before or during a trade.

For example, if I want to split a dinner bill with friends, I don’t want them to see my full wallet holdings. Until privacy improves, it’ll be hard to make crypto feel “normal” in real-world interactions.

That being said, a lot of companies are working on this problem. I know that privacy-focused solutions are about to launch on Solana.

Anything else on your mind—bigger-picture developments you think are significant?

Yes. Up until recently, most of the development in crypto focused on the DeFi trading side — DEXs, liquidity, order books. But now, there’s a second pillar forming: the stablecoin pillar.

There’s a lot happening in the stablecoin space, and it’s incredibly impactful. If we can get people to hold stablecoins regularly, we remove multiple roadblocks to DeFi adoption. People wouldn’t need to worry about converting fiat, buying ETH or SOL, or learning how to bridge. If they already hold stablecoins, they’re just one step away from using DeFi. That’s huge.

I’ve heard a projection that the number of DeFi participants could triple in the next two years. That would be huge for the space. And that growth will come from both stablecoins making DeFi more accessible, and from continued improvements in DeFi platforms.

Those two pillars will reinforce each other. The more people hold stablecoins, the more likely they are to engage with DeFi — and the better DeFi performs, the more trusted it becomes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Major Crypto Money Laundering Case Highlights Worldwide Battle Against Digital Financial Crimes

- Qian Zhimin, 47, was sentenced to 11 years for orchestrating a $5.6B crypto Ponzi scheme affecting 128,000 Chinese victims. - UK authorities seized 61,000 BTC ($6B) during the case, the largest cryptocurrency seizure in UK history. - Qian fled China in 2017, lived lavishly in the UK for seven years using forged documents before her 2021 arrest. - The case highlights cross-border crypto crime challenges, with global authorities recovering assets linked to Chinese cyberattacks. - Prosecutors face hurdles i

Shutdown-Related Data Shortfalls Lead Fed to Delay Reducing Rates

- U.S. government shutdown ended Nov 12, 2025, but left critical economic data gaps for Fed's December rate decision. - 1.4 million furloughed workers and $11B lost output highlight shutdown's severe economic impact despite mixed private-sector data. - Fed faces delayed/missing jobs reports and CPI data, increasing likelihood of rate cut pause as policymakers emphasize data caution. - Market expectations shifted from 95.5% to 53.6% chance of December cut, reflecting demand for evidence-based monetary polic

AAVE experiences a 14.6% decline over 7 days as large investors make moves and short positions are rebalanced

- AAVE fell 14.6% in 7 days amid whale activity, including a $561M ETH withdrawal from Aave to Binance. - BitMEX co-founder Arthur Hayes sold $4.96M in crypto assets, including 1,630 AAVE tokens, reflecting broader portfolio adjustments. - Whale short positions and leveraged trades highlight risks in DeFi markets, with $125M paper losses and $7M floating profits exposing high-stakes strategies.

Bitcoin News Today: Chinese Pensioners Defrauded in £4.6 Billion Cryptocurrency Pyramid Scheme, Mastermind Receives 11-Year Sentence in Historic UK Trial

- UK sentences Qian Zhimin to 11 years for £4.6B crypto Ponzi scheme defrauding 128,000 investors. - Case marks largest UK crypto seizure (61,000 BTC, $5-6B) in history, involving global cross-border investigation. - Victims, mostly Chinese retirees, lost life savings via patriotic-themed scams exploiting false political endorsements. - Sentencing highlights cross-border crypto crime challenges despite international cooperation between UK and Chinese authorities.