News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Power restructuring in probability games.

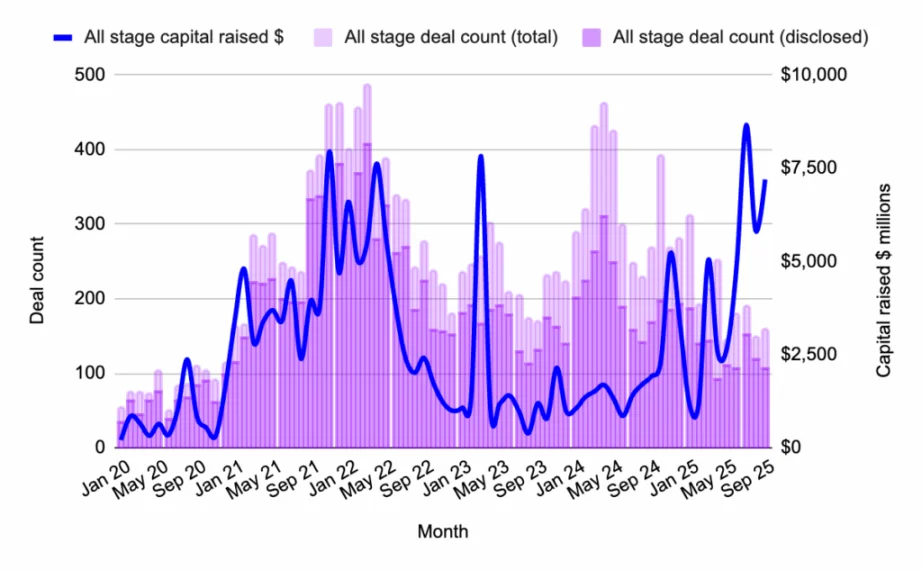

160 transactions raised $7.2 billions, marking the highest total since the spring surge.

ETF inflows dry up and digital asset trusts unwind as traders lose conviction; analysts say Bitcoin could revive sentiment with one strong breakout.

See how BlockDAG’s Buyer Battles boost activity, Hyperliquid gains from U.S. listings, and Cardano holds firm before a potential breakout.Hyperliquid Price Climbs After Robinhood LaunchCardano Maintains Strength Near $0.54 SupportBlockDAG’s Buyer Battles Drive Global Demand!Last Say: Which One Is the Best Crypto Investment

JPMorgan CEO Jamie Dimon says crypto is real and will improve transactions, marking a big shift from his earlier skepticism.Jamie Dimon: From Critic to Crypto Convert?Mainstream Finance Warming Up to CryptoWhy This Matters for the Industry

MicroStrategy earns $2.8B in Q3; Bitcoin holdings up $12.9B in 2025 with 26% BTC yield.Massive Bitcoin Holdings and High YieldWhat This Means for the Market

- 11:08U.S. stock index futures have all turned lower, with the S&P 500, Nasdaq, and Dow Jones each down 0.1%.Jinse Finance reported that US stock index futures have all turned lower, with S&P 500 index futures down 0.1%, Nasdaq 100 index futures down 0.1%, and Dow Jones index futures down 0.1%.

- 11:02Peter Schiff: The opportunity to sell bitcoin at prices above $100,000 won't last longChainCatcher news, Peter Schiff posted on X stating that bitcoin is not being sold at a discount, but is actually overpriced. If you sell bitcoin now, you can buy all the physical assets that are currently being sold at a discount. As a long-term gold supporter and bitcoin critic, Peter Schiff has always maintained a negative attitude towards cryptocurrencies.

- 10:55Opinion: If Bitcoin falls below the "bull-bear dividing line" 50-week moving average, it may face a 60% declineChainCatcher News, according to analyst @ali_charts, if bitcoin falls below the "bull-bear dividing line" 50-week moving average, it signals the arrival of a bear market. This pattern has been confirmed by the price movements in 2011, 2014, 2018, and 2020. If the previous trend repeats, bitcoin will face a 60% drop, which means it could bottom out around $40,000.