News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Shiba Inu’s price is eyeing a potential 57% rally, but key resistance zones between $0.000015 and $0.000019 could slow the move. Here’s what the data says.

The SEC continues to delay several altcoin ETF applications, including Truth Social's Bitcoin ETF and Grayscale's Solana fund. Despite setbacks, approval for these products could still be on the horizon.

Corporate investments in altcoins like SUI, Solana, and HBAR highlight a shift away from Bitcoin, with firms prioritizing blockchain performance over price in their long-term strategies.

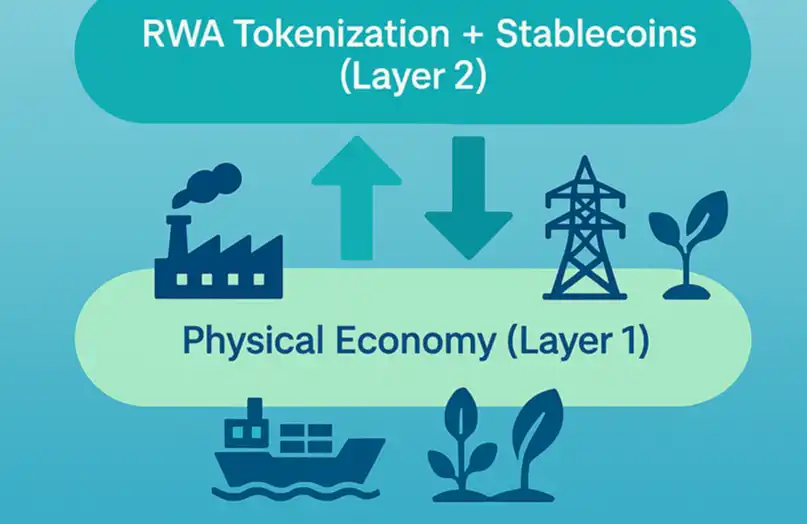

The RWA+Stablecoin system features an anchor in real-world legal and physical existence, an independent market and new gameplay, and a stablecoin serving as settlement fuel, enabling rapid asset movement and transparent transactions.

- 16:08Data: If ETH falls below $4,090, the total long liquidation volume on major CEXs will reach $1.645 billionsAccording to ChainCatcher, citing Coinglass data, if ETH falls below $4,090, the cumulative long liquidation intensity on major CEXs will reach $1.645 billions. Conversely, if ETH breaks above $4,486, the cumulative short liquidation intensity on major CEXs will reach $1.544 billions.

- 16:08Analyst: September rate cut is almost certain, options traders expect stable stock market performanceAccording to ChainCatcher, citing Jinse Finance, with a Federal Reserve rate cut in September almost a foregone conclusion, options traders generally expect the stock market to remain stable ahead of Thursday's CPI data release. The market's expectation for a rate cut is based on stagnant US employment growth and the need to stimulate the economy. Weak employment data released on Friday further reinforced expectations for a 25 basis point rate cut. Although US stocks fell slightly and the fear index rose marginally, it still remained below the key level of 20. Options traders expect the S&P 500 Index to experience about a 0.7% two-way swing after Thursday's CPI release.

- 16:07Data: Bitcoin illiquid supply exceeds 14.3 million, reaching a record highChainCatcher news, according to CoinDesk, in late August, the illiquid supply (the amount of bitcoin held by entities with little to no spending history) exceeded 14.3 million BTC, reaching a historic high. In the past 30 days, the net increase in illiquid supply reached 20,000 BTC. Of the current circulating 19.9 million BTC, about 72% of the total supply is in an illiquid state, held by long-term holders and cold storage investors. This growth highlights a continued accumulation trend, even during recent market volatility. In mid-August, bitcoin reached a historic high of $124,000, then pulled back by about 15%. Despite the price correction, the illiquid supply continued to rise, indicating that holders did not sell off due to short-term adjustments.