News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Dogecoin May Face Breakout or Pullback After Volume Spike, Market Cap Rises to $31.7B2World Liberty Financial (WLFI) Undertakes Token Burn as Possible Measure to Curb Post-Launch Price Decline3Yunfeng Financial, Linked to Jack Ma, Acquires 10,000 ETH and May Bolster Institutional Support for Ethereum in Hong Kong

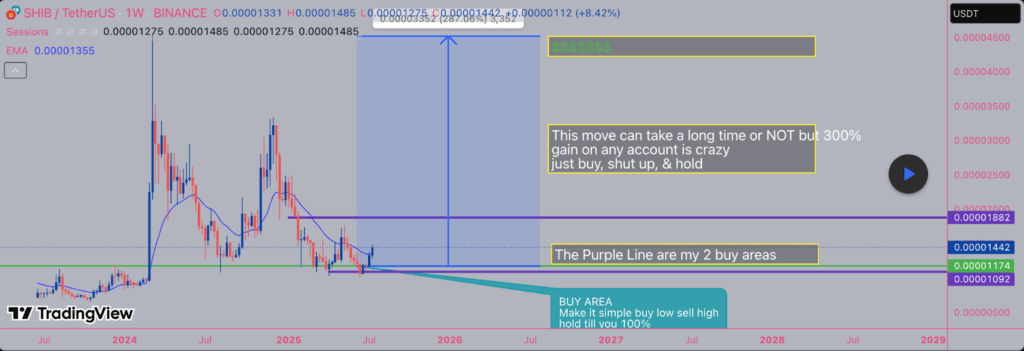

Shiba Inu Gains Strength: 3 Bullish Indicators for SHIB Investors to Watch

CryptoNewsNet·2025/07/19 16:25

Cardano looking to overtake Tron after rallying 10% today

Coinjournal·2025/07/19 16:11

Dogecoin breaks seven-month downtrend with 12.48 % price spike

Coinjournal·2025/07/19 16:11

Ethereum bull run just starting, analyst says as whale scoops $70m ETH

Coinjournal·2025/07/19 16:11

XRP price soars 24% last week: what’s next for the Ripple token?

Coinjournal·2025/07/19 16:10

Bitcoin Maintains Breakout Above $115K, Suggesting Potential Long-Term Target Near $320,000

Coinotag·2025/07/19 16:00

XRP Price Prediction for July 21, 2025: XRP Consolidates Near $3.45 After 50% Weekly Rise

CoinEdition·2025/07/19 16:00

Bitcoin Price Analysis: BTC Unlikely to Revisit ATH Before Testing $111K Support

Cryptopotato·2025/07/19 16:00

Crypto Liquidation: Shocking $270M+ Wiped Out in 24 Hours

BitcoinWorld·2025/07/19 15:50

Axie Infinity Hits Opportunity Buy Zone with Potential for Up to 16,000% Rally

CryptoNewsFlash·2025/07/19 15:40

Flash

- 00:21A newly created wallet withdrew 692 bitcoins from Galaxy Digital, worth approximately $77.32 million.According to Jinse Finance, Onchain Lens monitoring shows that a newly created wallet address has withdrawn 692 bitcoins from Galaxy Digital, valued at approximately $77.32 million.

- 00:17Yesterday, Grayscale BTC had a net inflow of $28.8 million, while ARKB saw a net outflow of $27.9 million.According to Jinse Finance, data monitored by Farside Investors shows that yesterday, Grayscale BTC had a net inflow of $28.8 million, while ARKB had a net outflow of $27.9 million.

- 00:06Bank of England Deputy Governor: Systemic stablecoins can hold "a portion" of government bondsJinse Finance reported that in a speech today, Bank of England Deputy Governor Sarah Breeden discussed stablecoins. When the central bank announced its stablecoin plans in 2023, the framework was not attractive to large or systemically important stablecoin issuers. Although the good news is that they can deposit their reserves at the central bank—which is considered desirable by most—the bad news is that these reserves would not earn any interest, undermining the current main business model. Breeden had previously hinted at softening this stance, and in her speech today, she made it clear that systemically important stablecoin issuers will be able to hold part of their backing assets in high-quality liquid assets, such as short-term government bonds. She also pointed out that the initial stablecoin plan mainly focused on retail use cases, but the situation has now changed. Currently, in the UK's Digital Securities Sandbox, both stablecoins and tokenized deposits will be used for the settlement of tokenized securities. This is a relatively new development, as stablecoins were initially excluded from the sandbox.