News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

CFTC Forms Innovation Advisory Committee to Guide Financial and Crypto Technologies

Cointribune·2026/01/13 14:45

PancakeSwap introduces vote to reduce max supply in deflationary push

Cointelegraph·2026/01/13 14:42

World Bank sees resilient global growth in 2026 despite tariffs, but fading dynamism

101 finance·2026/01/13 14:42

Delta Air Lines earnings: A bet on high-paying flyers as forecast disappoints

101 finance·2026/01/13 14:36

Franklin Templeton Converts MMFs into Groundbreaking Stablecoin Reserve Funds, Pioneering New Era

Bitcoinworld·2026/01/13 14:36

Robinhood Lists Spot DOT: A Strategic Expansion Transforming Retail Crypto Access

Bitcoinworld·2026/01/13 14:36

US CPI December 2025: Crucial Inflation Data Holds Steady at 2.7%, Matching Forecasts

Bitcoinworld·2026/01/13 14:36

Singapore Gulf Bank Taps J.P. Morgan for 24/7 USD Clearing Access

Coinpedia·2026/01/13 14:30

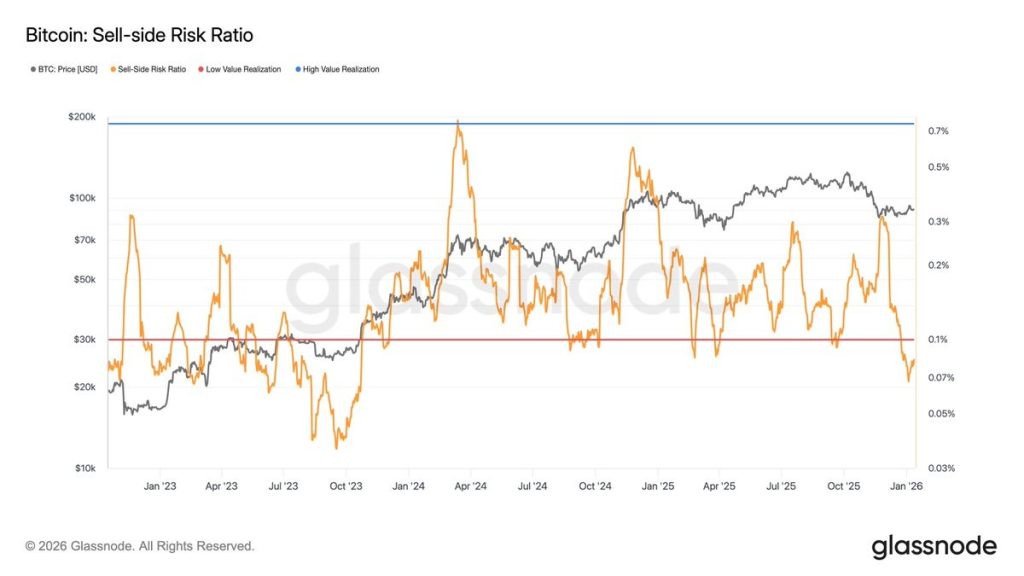

Sell Pressure Fades as Bitcoin Price Consolidates Above $91,000—Is $100K Next?

Coinpedia·2026/01/13 14:30

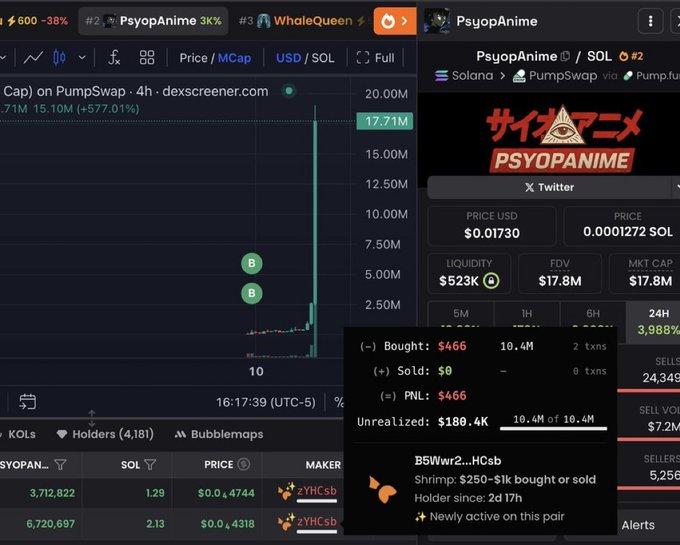

The Elon Musk Effect: Trader Turns $466 Into $180K as PsyopAnime Explodes

Coinpedia·2026/01/13 14:30

Flash

17:02

Large Bitcoin holders have accumulated 110,000 BTC in the past 30 daysAccording to Glassnode data, the "Fish-to-Shark" group has accumulated 110,000 bitcoins in the past 30 days, marking the largest increase since the FTX collapse in 2022.

16:10

$120 million Bitcoin ETF inflows seen as a bullish signalInstitutional investors are gradually betting on bitcoin's bullish trend and reducing complex "arbitrage" trades.

16:04

Zero Network, incubated by Zerion, relaunches and resumes operationsOn January 18, the L2 network Zero Network, incubated by Web3 wallet company Zerion, announced that it has relaunched and fully resumed operations. Zero Network stated that user funds are safe, and Caldera and ZKsync provided support for the resumption of operations.

News