News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

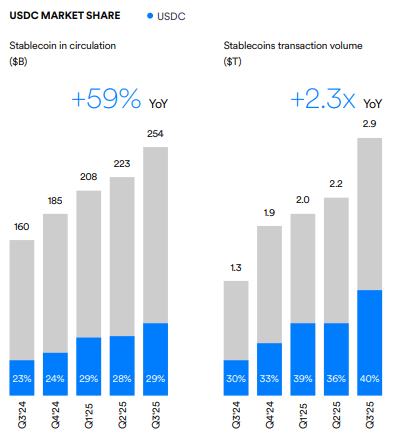

Circle: Stablecoins are the beginning of a new financial infrastructure

Cointelegraph·2026/01/13 18:00

BlockDAG Targets 2000x ROI in 2026, While Uniswap and Sui Navigate Consolidation

BlockchainReporter·2026/01/13 18:00

Why Udemy (UDMY) Shares Are Declining Today

101 finance·2026/01/13 17:51

Why Shares of THOR Industries (THO) Are Rising Today

101 finance·2026/01/13 17:51

Crypto YouTube Viewership is Crashing, Welcome To The Purgatory – Kriptoworld.com

Kriptoworld·2026/01/13 17:45

Solidify Chain: The Security Path from Inflation Incentives to Cash-Flow Coverage

Cointime·2026/01/13 17:43

Factbox-How independence came to be standard for global central banks

101 finance·2026/01/13 17:42

US Crypto Bill New Bill Offers XRP, Solana, and Other Major Altcoins ETF-level Exemption on Disclosure

Crypto Ninjas·2026/01/13 17:39

Solana Price Stalls Below $145 as Network Growth Remains Weak

CoinEdition·2026/01/13 17:39

Google to shift high-end Pixel development to Vietnam, breaking from China dependence

Cointelegraph·2026/01/13 17:39

Flash

17:02

Large Bitcoin holders have accumulated 110,000 BTC in the past 30 daysAccording to Glassnode data, the "Fish-to-Shark" group has accumulated 110,000 bitcoins in the past 30 days, marking the largest increase since the FTX collapse in 2022.

16:10

$120 million Bitcoin ETF inflows seen as a bullish signalInstitutional investors are gradually betting on bitcoin's bullish trend and reducing complex "arbitrage" trades.

16:04

Zero Network, incubated by Zerion, relaunches and resumes operationsOn January 18, the L2 network Zero Network, incubated by Web3 wallet company Zerion, announced that it has relaunched and fully resumed operations. Zero Network stated that user funds are safe, and Caldera and ZKsync provided support for the resumption of operations.

News