News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Proposed billionaires' tax in California rattles Silicon Valley, entangles Gov. Newsom

101 finance·2026/01/14 05:18

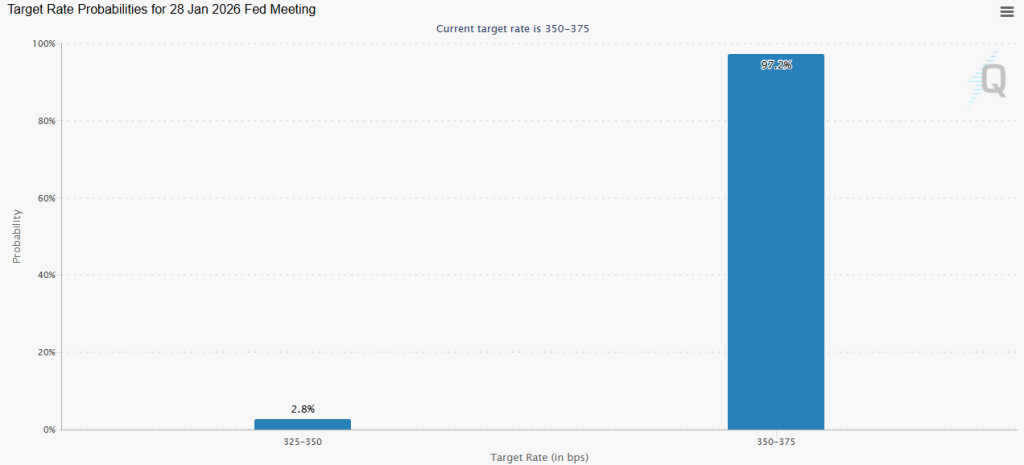

December US CPI: No Surprises in the Holiday Numbers

101 finance·2026/01/14 05:03

Senators propose over 75 changes to the crypto legislation, addressing areas such as yield and DeFi provisions

101 finance·2026/01/14 04:57

Equinor Obtains 35 Additional Licenses to Enhance Exploration on the Norwegian Continental Shelf

101 finance·2026/01/14 04:18

Why is Bitcoin Price Going Up Today?

Coinpedia·2026/01/14 03:30

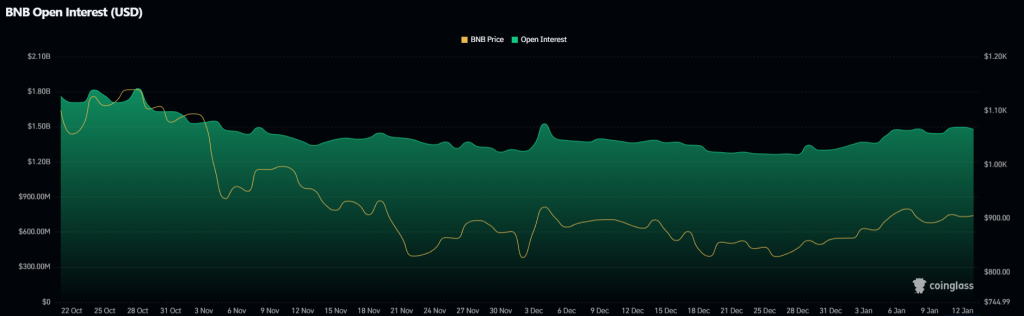

BNB Eyes $1,000 Due to Surging Derivatives Activity: Will BNB Price Make a Comeback?

Coinpedia·2026/01/14 03:30

Charles Hoskinson Slams XRP, ADA’s Inclusion in Trump Crypto Reserve as ‘Rule by Tweet’

Coinpedia·2026/01/14 03:30

Bitcoin Surges Above $93K Following Low CPI Data: What to Expect Next?

Coinpedia·2026/01/14 03:30

Flash

11:27

British media: Anthropic plans to raise $25 billion or more; Sequoia Capital to participate in the financing. according to the Financial Times: Sequoia Capital plans to make a significant investment in the AI startup Anthropic. Anthropic is seeking to raise funds at a valuation of $350 billion, planning to raise a total of $25 billion or more. Microsoft and Nvidia have committed to investing up to $15 billion in the company.

11:22

Anthropic plans to raise $25 billion with Sequoia Capital participating in the investmentArtificial intelligence startup Anthropic is seeking funding at a valuation of $350 billion, aiming to raise $25 billion or more. Sequoia Capital plans to participate in this round of financing, while Microsoft and Nvidia have already committed to invest a total of up to $15 billion in the company.

11:15

Insight: Nearly 80% of Hacked Cryptocurrency Projects Fail to Fully Recover, Operational and Trust Breakdowns Cited as Major ReasonsBlockBeats News, January 18th, according to Cointelegraph, Web3 security platform Immunefi CEO Mitchell Amador stated that nearly 80% of crypto projects that have experienced a major hack have never fully recovered. Most protocols are fundamentally unaware of the level of risk they face from hacking and are not prepared operationally for a major security event.

Mitchell Amador said that the first few hours after a vulnerability occurs are usually the most destructive. Without a pre-established incident response plan, teams hesitate, argue about the next steps, and underestimate the potential depth of the vulnerability's impact. This period is often a critical moment when additional losses occur.

Out of concern for reputational damage, project teams often hesitate to pause smart contracts and completely cut off communication with users. Maintaining silence often exacerbates panic rather than containing the problem. Nearly 80% of projects that have been hacked have never fully recovered, primarily because of the breakdown in operations and trust systems during the response process.

News