News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Is the Cryptocurrency Bull Market Finished? Insights Drawn from Mining and Market Statistics

101 finance·2026/01/14 09:06

BTC ETFs Log $753M in Inflows, Short Liquidations Skyrocket

Coinspeaker·2026/01/14 09:00

Bitcoin Exchange Upbit Announces It Will List the Stablecoin Developed by Ethereum!

BitcoinSistemi·2026/01/14 09:00

Dash Price Prediction 2026: Evolution Smart Contracts and Privacy Surge Battle July 2027 EU Ban

CoinEdition·2026/01/14 08:45

China’s Zhipu Introduces Latest AI Model Powered by Huawei Chips

101 finance·2026/01/14 08:33

BP Warns of Up to $5 Billion in Energy Transition Impairments

101 finance·2026/01/14 08:33

Bitcoin Surge Eliminates $600 Million in Short Crypto Positions

101 finance·2026/01/14 08:33

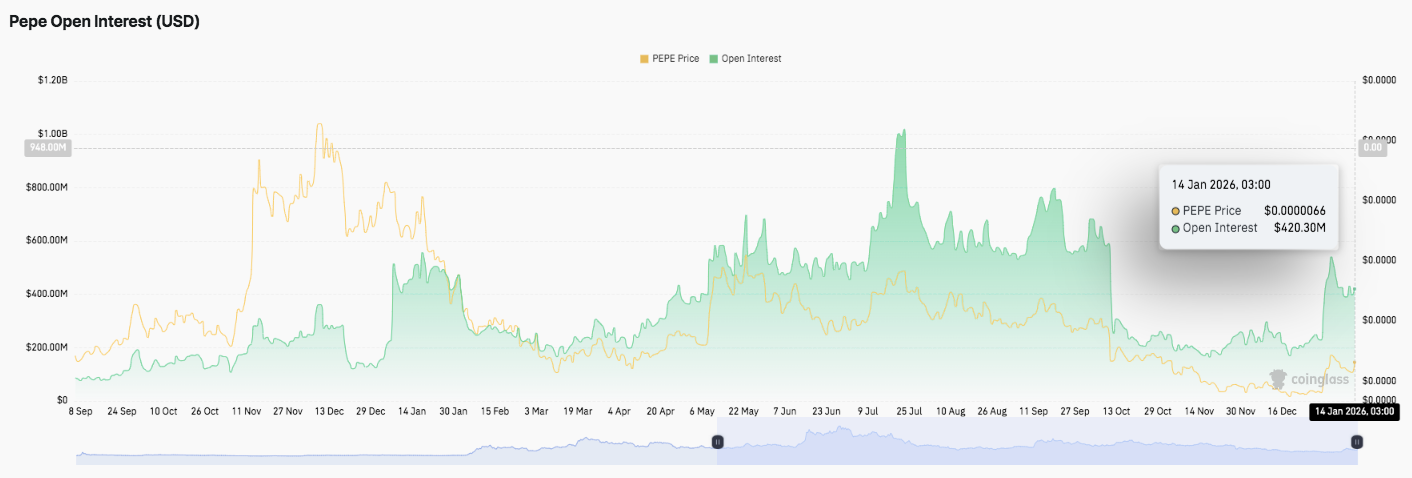

Pepe Price Prediction: PEPE Eyes Recovery as Support Holds and Market Activity Stabilizes

CoinEdition·2026/01/14 08:33

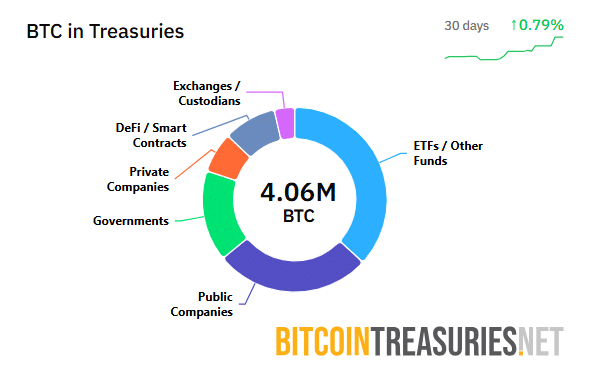

Crypto Treasuries Are Buying Bitcoin 3x Faster than It’s Mined

Coinspeaker·2026/01/14 08:30

Flash

03:29

Remora Markets: Five tradable commodity tokens, including gold, are now live on SolanaForesight News reported that Remora Markets (formerly Moose Capital product) has announced the launch of five new RWA tokens on Solana, including gold, silver, platinum, palladium, and copper.According to previous Foresight News reports, Solana ecosystem data analytics platform Step Finance has acquired early-stage startup Moose Capital. Moose Capital specializes in the tokenization of traditional stocks, aiming to allow users to buy and sell shares of companies such as Nvidia and Tesla directly on the Solana blockchain. In addition to acquiring the Moose Capital product (now renamed Remora Markets), Step Finance has also integrated the startup's team and regulatory licenses, preparing for a launch in the first quarter of 2025.

03:27

Next Week's Macro Outlook: Trump Returns to Davos, Bank of Japan Interest Rate Decision ApproachingBlockBeats News, January 18, next week Trump will lead a record-sized U.S. delegation to return to the Davos Forum and deliver a speech on "How We Can Cooperate in an Increasingly Competitive World." Whether topics such as tariff policies, military intervention in Venezuela, and the threat to acquire Greenland will be discussed is a major focus. The U.S. Supreme Court will also hear the case of Federal Reserve Governor Cook, whom Trump is attempting to replace. The legality of Trump’s tariffs may also be decided next week. An overview of upcoming macro events and data releases is as follows: Monday: Trump leads the delegation to attend the Davos World Economic Forum Annual Meeting; China’s full-year 2025 GDP growth rate, fourth quarter annualized GDP, and total annual GDP will be released Tuesday: European Central Bank President Lagarde and BlackRock CEO Fink will attend a panel discussion at the World Economic Forum Wednesday: Trump will deliver a speech at the World Economic Forum Annual Meeting on "How Can We Cooperate in an Increasingly Competitive World?" Thursday: The European Central Bank will release the minutes of its December monetary policy meeting; U.S. initial jobless claims for the week ending January 17; U.S. November core PCE price index, personal spending monthly rate; U.S. third quarter real GDP, final annualized core PCE price index, final real personal consumption expenditure quarterly rate; Japan December core CPI annual rate; Bank of Japan interest rate decision and economic outlook report for January 23, and Governor Ueda will hold a monetary policy press conference Friday: U.S. January final University of Michigan Consumer Sentiment Index, U.S. January final one-year inflation expectations

03:26

Data: 22.7 billion new USDT issued on the Tron network in one year, with over 70.6 million holdersPANews, January 18 — According to monitoring by Lookonchain, over the past year, Tron has newly issued 22.7 billions USDT, bringing the total USDT supply to 82.4 billions. Meanwhile, the number of USDT holders on Tron increased by 11 millions in the past year, with the total number of holders now exceeding 70.6 millions.

News