News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 27) | Initial jobless claims for the week ending November 22 came in at 216,000; Nasdaq ISE has proposed raising the IBIT option position limit to 1 million contracts2Bitcoin final leverage flush below $80K is possible, warns analyst3Bitcoin price risks decline below $80K as fears of ‘MSTR hit job’ escalate

Horizen Based: ZEN is Now Live on Base

Horizen·2025/10/24 10:00

Horizen Appchain Testnet is Live with DarkSwap: Private, Bot-Proof DeFi Arrives on Base

Horizen·2025/10/24 10:00

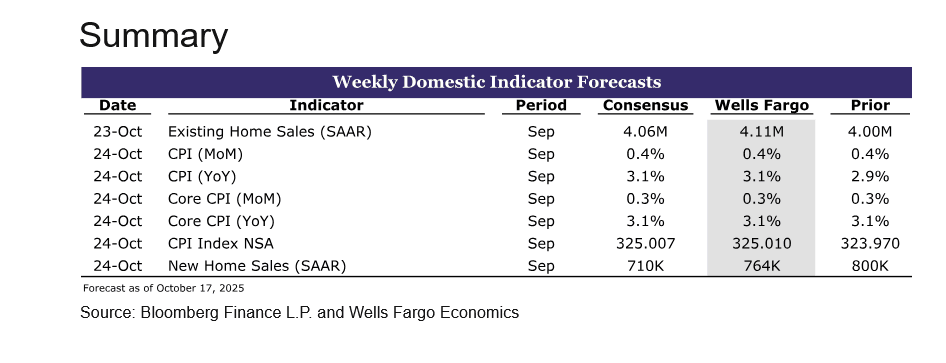

Will Rising Inflation Spark a WLFI Comeback or Sink It Further?

Cryptoticker·2025/10/24 09:57

Ethereum Sets Glamsterdam Deadline and Fusaka Mainnet Date

Coinlineup·2025/10/24 09:24

How XRP’s renewed role is driving crypto-fiat settlement and innovation worldwide

CryptoSlate·2025/10/24 09:00

Interview with Brevis CEO Michael: zkVM Scaling Far More Effective than L2

Infinite Compute Layer Leads to True Mainstream Adoption

BlockBeats·2025/10/24 09:00

![[October 11 Insider Whale] Twelve consecutive wins harvest 12.6 million, profiting from both long and short positions and leading market followers](https://img.bgstatic.com/multiLang/image/social/41e5d1ea953744c460d0cf212fd2c61b1761294785118.png)

Rhythm Interview with Stable CEO: With the Stablecoin Chain Race Accelerating, Where Does Stable Outperform Plasma?

When all eyes are on Plasma, what is Stable really up to

BlockBeats·2025/10/24 08:36

When veterans sell and miners exit: Bitcoin supply and demand enter a period of conflict

Bitpush·2025/10/24 08:27

Flash

- 22:44BIS warns of liquidity risks in tokenized money market fundsJinse Finance reported that the Bank for International Settlements (BIS) has released a briefing stating that tokenized money market funds (MMFs) face liquidity mismatch risks between daily redemptions and T+1 settlements, which become particularly prominent under market stress. However, industry solutions have already emerged. For example, Broadridge's DLR system enables intraday transfer and monetization of government bonds, providing a technological pathway to alleviate liquidity mismatches.

- 22:44YZiLabs: Plans to Expand the BNC Board of DirectorsJinse Finance reported that YZiLabs has submitted a preliminary consent statement to the US SEC, proposing to expand the board size of Nasdaq-listed company CEA Industries Inc. (BNC) and elect several new directors through a written shareholder consent solicitation. YZiLabs stated that its investment in BNC is based on confidence in the company's fundamentals, its BNB-centric Digital Asset Treasury (DAT) strategy, and its potential to become a "category-defining DAT company." However, since completing a $500 million PIPE financing this summer, BNC's stock price performance has clearly diverged from this logic, even though BNB's price has seen a considerable increase during the same period. YZiLabs said it will soon announce the specific list of board candidates, aiming to unlock the company's potential value through stronger board governance without undermining BNC's Digital Asset Treasury vision.

- 22:44Analysis: Global inflation drives increased cryptocurrency adoptionJinse Finance reported, citing Cointelegraph, that many countries continue to face high inflation pressures, prompting both the public and governments to turn to cryptocurrencies as alternative solutions. Venezuela's inflation rate is as high as 172%, Argentina's is 31.3%, Turkey's is 32%, Iran's is 45.3%, and Bolivia's is 22.23%. The cryptocurrency trading volume in these countries has grown significantly.