News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

As Peter Schiff launches Tgold, CZ challenges the notion of tokenized gold as “real” gold, igniting a broader debate on trust, custody, and the future of real-world asset tokenization.

After an $8.4 million exploit, Bunni becomes the latest DeFi casualty to shutter operations. The closure underscores growing concerns over security vulnerabilities and sustainability within the decentralized finance sector.

The Federal Reserve held its first payment innovation conference, discussing stablecoins, tokenization, and AI payments. The concept of a streamlined master account was proposed, and the legitimacy of the crypto industry was acknowledged, promoting the integration of traditional finance with digital assets. Summary generated by Mars AI.

- 20:21Dutch Bitcoin asset management company Blockris obtains MiCAR licenseForesight News reported that Dutch Bitcoin asset management company Blockrise has obtained a license from the Netherlands Authority for the Financial Markets (AFM) under the new European Markets in Crypto-Assets Regulation (MiCAR), allowing it to continue providing financial services in the Netherlands and planning to expand across Europe. In addition, Blockrise will offer this new Bitcoin-backed loan service to all corporate clients this week, with commercial loans starting at 20,000 euros. Earlier this year, Blockrise raised 2 million euros in a seed round from a consortium of venture capital firms and angel investors. This was the company's first external financing, aimed at driving business growth. With the acquisition of the MiCAR license, Blockrise is preparing for a Series A round, aiming to raise 15 million euros.

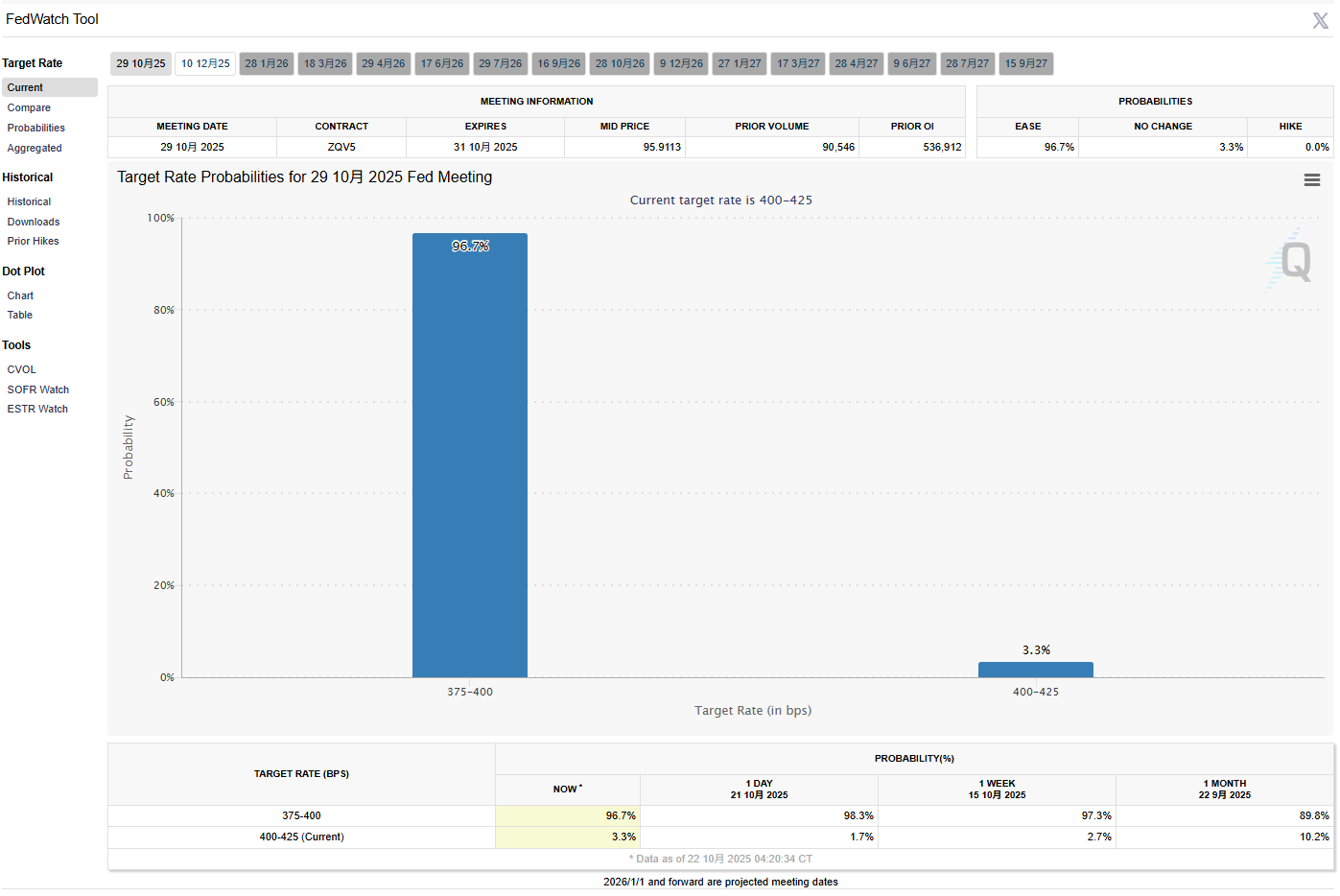

- 19:10Wall Street maintains an optimistic outlook for emerging markets in 2026Jinse Finance reported that major Wall Street banks are preparing to achieve further success in emerging markets, expecting that a weaker US dollar and the investment boom in the artificial intelligence sector will provide additional momentum for this asset class. These favorable factors are expected to drive further gains in emerging markets, with local currency bonds delivering a 7% return for investors—the best performance since 2020—and the currency index rising by more than 6%. Morgan Stanley strategists pointed out that as the US economy slows, the Federal Reserve may further cut interest rates, which will support the continuation of the market rally. The bank recommends that clients maintain long positions in emerging market local currency bonds, expecting returns to reach around 8% by mid-2026. For emerging market US dollar bonds, they forecast a "high single-digit" increase over the next 12 months.

- 18:41Data: If ETH breaks through $3,169, the cumulative short liquidation intensity on major CEXs will reach $1.077 billion.According to ChainCatcher, citing data from Coinglass, if ETH breaks through $3,169, the cumulative short liquidation intensity on major CEXs will reach $1.077 billions. Conversely, if ETH falls below $2,872, the cumulative long liquidation intensity on major CEXs will reach $750 millions.