News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Due to economic turmoil and foreign exchange controls, Argentinians are turning to cryptocurrency arbitrage, profiting from the difference between stablecoin rates and official or parallel market exchange rates. Cryptocurrency has shifted from a speculative tool to a means of protecting savings. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Uniswap v4 introduces Hook and Singleton architecture, supporting dynamic fees, custom curve logic, and MEV resistance, which enhances trading execution efficiency and developer flexibility. Aggregators face integration challenges and need to adapt to non-standardized liquidity pools. Brevis’s ZK technology provides a trustless gas rebate, accelerating the adoption of v4. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

CPI confirms the trend! U.S. core inflation unexpectedly eased in September, making an October rate cut almost certain. Traders are increasingly betting that the Federal Reserve will cut rates two more times this year...

Gasoline price increases were the main factor! U.S. inflation rebounded to 3% in September, with core price pressures remaining. Data collection was completed before the government funding interruption. The following is the full CPI report.

Reviewing GBTC and gold ETF to extrapolate trends in the crypto market.

President Trump’s rumored pick of Michael Selig as the next CFTC Chair marks a potential shift in U.S. crypto oversight. With SEC ties and industry intrigue surrounding the move, Selig’s confirmation could reshape regulatory collaboration.

While all eyes are on Plasma, what exactly is Stable doing?

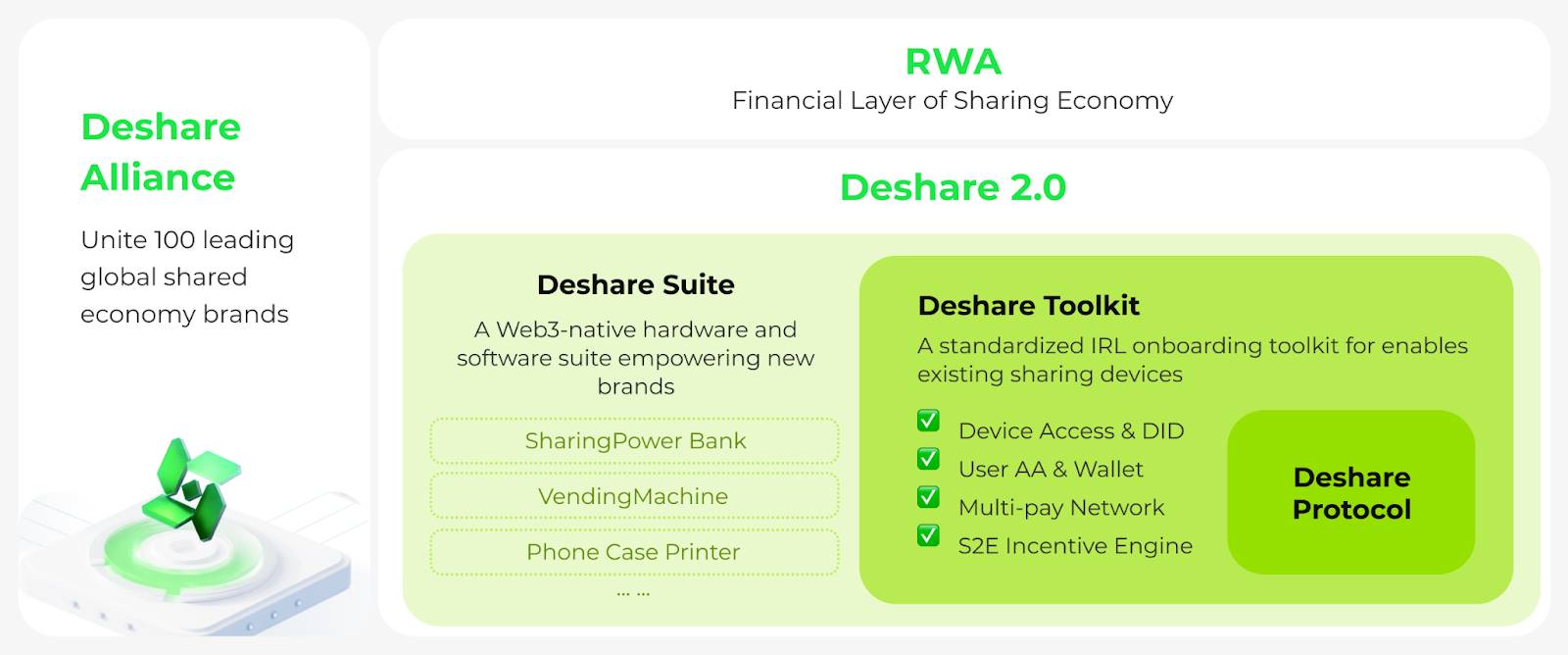

Deshare 2.0 marks an upgrade in shared economy infrastructure: moving from "trusted data" to "trusted devices."

The role of cryptocurrency in Argentina has fundamentally changed: it has shifted from being a novelty that sparked curiosity and experimentation among the public, including Milei himself, to becoming a financial tool for people to protect their savings.

- 00:01Data: 40.8 WBTC transferred out from Flowdesk, worth approximately $3.53 millionAccording to ChainCatcher, Arkham data shows that at 07:48 (UTC+8), 40.8 WBTC (worth approximately $3.53 million) were transferred from Flowdesk to an anonymous address (starting with 0x7391...).

- 2025/11/23 23:47A whale sold 32,195 SOL held for 10 months yesterday, incurring a loss of $2.04 million.According to ChainCatcher, monitored by Lookonchain, whale GJwCUj sold 32,195 SOL worth $4.18 million. These SOL were purchased and staked by him 10 months ago—this sale resulted in a loss of $2.04 million for him. Two years ago, this whale bought 400,000 SOL at an average price of $89, worth $35.7 million, and staked them. He then sold them within less than two months at a price of $108, making a profit of $8.15 million. After his sale, SOL continued to surge—if he had held until the peak, his profit could have exceeded $82 million.

- 2025/11/23 22:23The address that liquidated its ZEC long position yesterday with a loss of $846,000 has now opened a $2.66 million short position.Foresight News reported, according to monitoring by Lookonchain, the address starting with 0x152e closed its ZEC long position yesterday with a loss of $846,000. As the price of ZEC rebounded, this address shorted 4,574.87 ZEC with 5x leverage in the past 40 minutes, worth approximately $2.66 million. At the same time, the address also went long on 367.36 BTC with 20x leverage, worth about $31.63 million.