News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Unlike typical crypto concepts, x402 has attracted the attention of many Web2 tech giants, and these companies have already begun to adopt the protocol in practice.

Where does value accumulate? If value accumulates in equity entities, why buy tokens? Are all tokens just meme coins?

Cryptocurrency is a zero-sum game, and you really need to fight for every advantage.

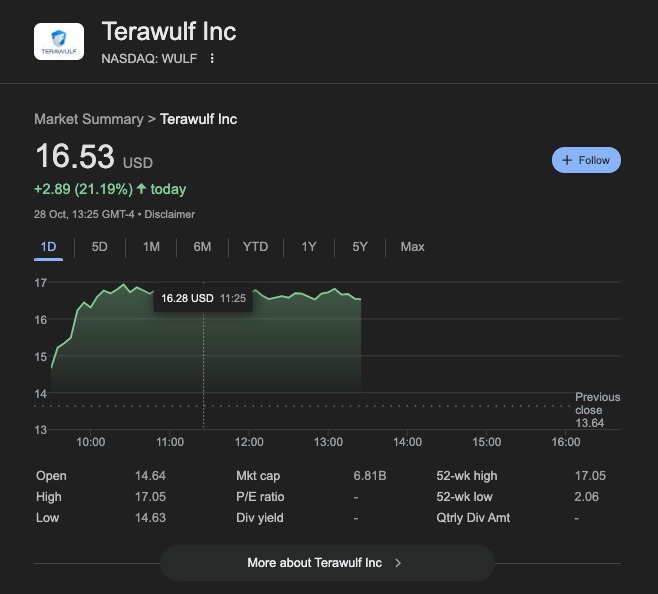

TeraWulf signed a 25-year, $9.5 billion lease with Fluidstack to deploy 168 MW of AI infrastructure at its Texas campus, with Google backing $1.3 billion.

SharpLink Gaming allocates $200 million in Ethereum to Linea’s zkEVM Layer 2, combining staking and restaking services to generate enhanced institutional yields.

Quick Take Visa is adding support for four stablecoins, running on four unique blockchains, CEO Ryan McInerney said. In the fourth quarter, stablecoin-linked Visa card spend quadrupled when compared to a year ago, he said.

Quick Take Hoodi represents the third and final testnet deployment, following successive activations on Holesky and Sepolia earlier this month. Fusaka will introduce several scalability and security improvements for Ethereum, including a paired down data sampling technique called PeerDAS.

Quick Take BitMine acquired $113 million worth of ETH on Tuesday. The company’s Monday disclosure revealed that its treasury holdings have surpassed 3.3 million ETH, worth over $13 billion.

- 02:18Bitwise advisor: Market volatility patterns indicate traders expect a rapid rebound, and volatility may remain elevatedOn November 23, Bitwise advisor Jeff Park posted on social media that a notable phenomenon in the recent sell-off is that market volatility characteristics are more akin to 'strike price stickiness' rather than 'Delta stickiness.' (This indicates that the current sell-off is not driven by mechanical dynamic hedging by market makers, but rather by market participants' concentrated views and actions at specific price points—strike prices.) This is in stark contrast to market performance during 'unlock days.' This characteristic sends out two possible signals: first, traders believe the market may experience a rapid rebound; second, volatility will remain at a high level.

- 02:18Data: Hyperliquid platform whales currently hold $4.456 billions in positions, with a long-short ratio of 0.87According to ChainCatcher, citing Coinglass data, whales on the Hyperliquid platform currently hold positions totaling $4.456 billions, with long positions amounting to $2.068 billions, accounting for 46.41% of the total, and short positions amounting to $2.388 billions, accounting for 53.59%. The profit and loss for long positions is -$242 millions, while for short positions it is $399 millions. Among them, the whale address 0x9eec..ab is holding a 15x leveraged full-position long on ETH at a price of $3,201.03, with an unrealized profit and loss of -$20.666 millions.

- 02:18Suspected BitMine address received 21,537 ETH from FalconX 8 hours agoAccording to a report by Jinse Finance, Lookonchain monitoring shows that a new wallet possibly related to BitMine received 21,537 ETH (worth $59.17 million) from FalconX 8 hours ago.