News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

![[October 11 Short Whale] Sells Another 200 BTC—What Kind of Market Trend Will Collide with the Federal Reserve Decision?](https://img.bgstatic.com/multiLang/image/social/79491c3fe8d0d3b17d283ebd2a9faa8e1761739967786.png)

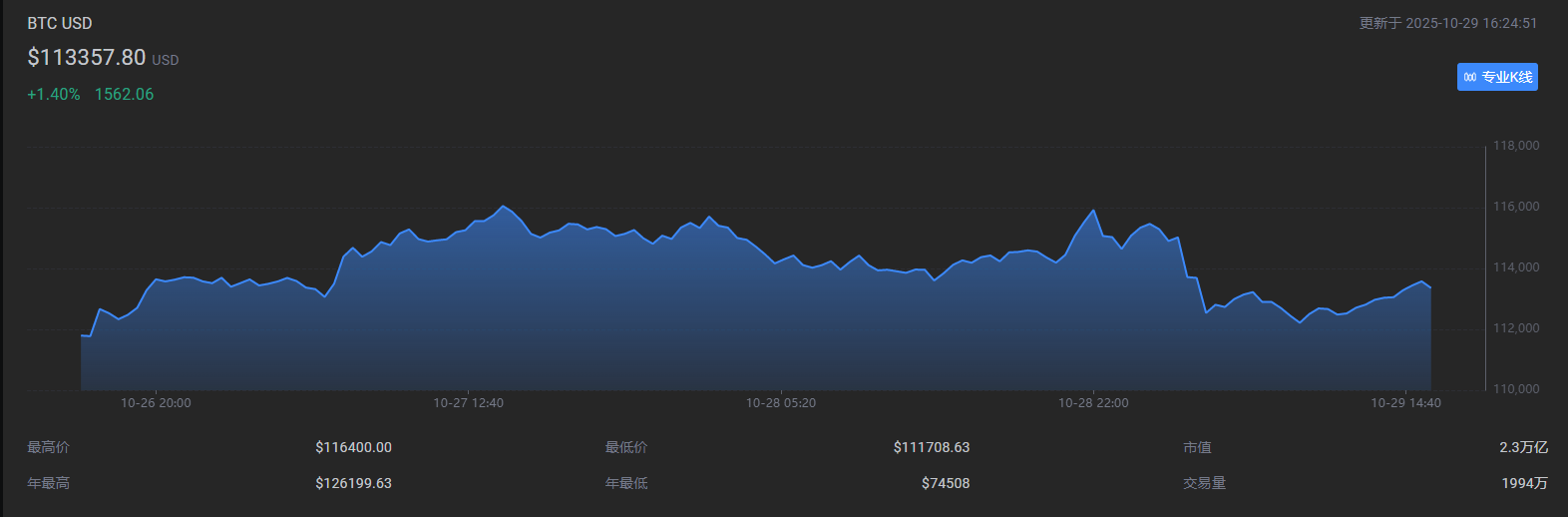

The cryptocurrency market showed signs of recovery in October 2025, with investor sentiment shifting from cautious to cautiously optimistic. Net capital inflow turned positive, institutional participation increased, and the regulatory environment improved. Bitcoin spot ETF saw significant capital inflows, while the approval of altcoin ETFs injected new liquidity into the market. On the macro level, expectations of a Federal Reserve rate cut intensified, and the global policy environment became more favorable. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved and updated.

Quick Take Summary is AI generated, newsroom reviewed. Ethereum’s Fusaka upgrade is now live on the Hoodi testnet for testing. Mainnet launch is scheduled for December 3, 2025, with improved security and scalability. Key features include PeerDAS, increased blob capacity, and network stability improvements. Users can expect faster transactions, lower fees, and a more reliable Ethereum network.References Ethereum's Fusaka fork goes live on Hoodi testnet, setting the stage for Dec. 3 mainnet launch with secur

Quick Take Summary is AI generated, newsroom reviewed. Ethereum price analysis shows ETH rebounded from the $3,900 support zone ahead of the FOMC meeting. ETH market sentiment remains cautiously optimistic as traders await Powell’s tone. The FOMC meeting impact could determine whether Ethereum breaks above $4,100 or consolidates further. Will Powell’s tone spark another rally? Explore today’s Ethereum price analysis and what’s driving market sentiment.References $ETH had a sharp correction yesterday but bo

In the investment in the emerging field of stablecoins, a balance must be found among three key dimensions: technological innovation, regulatory compliance, and market demand.

- 05:02Eugene: Premature bottom-fishing was “punished” by the market, currently in a wait-and-see modeOn November 22, trader Eugene Ng Ah Sio posted on his personal channel, saying, "I got caught reaching into the 'cookie jar' too early. The current market is truly at hell-level difficulty. I can only lick my wounds for now and continue to observe." Previously, on November 18, trader Eugene Ng Ah Sio stated that he had increased his long positions in ETH and SOL. "The swing indicator has clearly returned to the oversold zone, and I believe it's time to start increasing risk exposure in this market again."

- 04:28Aerodrome: The official primary domain may have been subject to DNS hijacking, please do not use it. Investigation is in progress.ChainCatcher news, Base ecosystem DEX Aerodrome has posted on X that the team is investigating a potential DNS hijacking incident. Please do not use the website's main domain; the issue is currently under investigation.

- 04:23Aave founder: ETHLend will be relaunched in 2026ChainCatcher news, Aave founder and CEO Stani posted on X, stating: "Bitcoin collateral is real Bitcoin, not wrapped. I guarantee that ETHLend will be relaunched in 2026." It is reported that ETHLend is an independent lending application and the predecessor of Aave. After rebranding from ETHLend in 2018, Aave evolved into a decentralized peer-to-peer lending marketplace.