News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

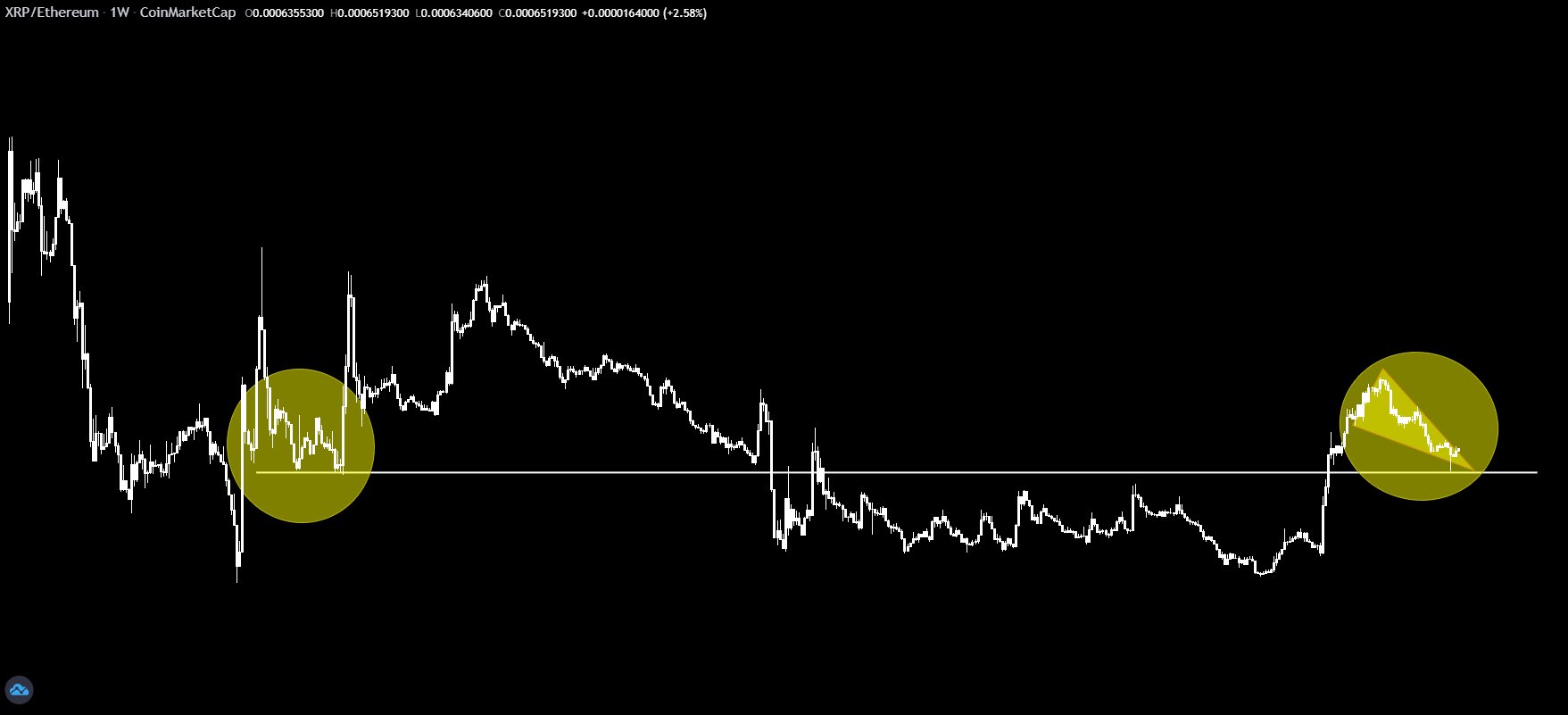

Zcash’s 400% rally may be hitting a crossroads. Momentum and money flow show early weakness, but the bullish structure still holds — for now.

TON Society co-founder Jack Booth discussed the future of decentralization, the impact of central bank digital currencies (CBDCs), and the path to mass adoption of cryptocurrencies in an interview with Cointelegraph. He believes that promoting the decentralization of The Open Network (TON) is crucial, emphasizing that decentralized networks allow users to have better control over their data and finances. Booth warned that CBDCs could undermine the principles of decentralization, but supports a hybrid solution combining CBDCs and decentralized networks. He also pointed out that decentralized technologies must offer high availability and user-friendliness in order to achieve mass adoption. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Trump-appointed governor Milan, as before, advocates a 50 basis point rate cut, while another voting member, Schmid, supports holding rates steady.

- 14:35The three major U.S. stock indexes opened higher, Nvidia surged 5%Jinse Finance reported that U.S. stocks opened collectively higher, with the Dow Jones up 1.08%, the Nasdaq up 2.19%, and the S&P 500 Index up 1.6%. Nvidia surged 5%, with its third-quarter revenue reaching $57 billion, a 62% year-on-year increase; it is expected that fourth-quarter revenue will be around $65 billion, while the market expected $62 billion. AMD rose nearly 4%, and AMD plans to build and operate up to 1 GW of AI infrastructure in Saudi Arabia by 2030.

- 14:31Analyst: The Federal Reserve has room to wait for more data, and the market's reaction to the non-farm payroll report varies.Jinse Finance reported that Seema Shah, an analyst at Principal Asset Management, commented on the US September non-farm payrolls: The market's response to the non-farm employment report was mixed. The stock market welcomed the higher-than-expected employment numbers, indicating that the economy remains robust; meanwhile, the bond market focused more on the rising unemployment rate and slowing wage growth, which could leave the possibility of a Federal Reserve rate cut in December. Today's employment data is unlikely to make the Fed inclined to cut rates in December. Even so, holding steady in December would not be a serious mistake. Although low consumer confidence highlights concerns about job security, the labor market, while somewhat soft, is far from recession, giving the Fed breathing room to act decisively once there is enough compelling data. (Golden Ten Data)

- 14:30CME Group and CF Benchmarks to launch two new Bitcoin volatility indicesChainCatcher News, according to PR Newswire, CME Group and CF Benchmarks have announced plans to launch two new Bitcoin volatility indices on December 2—the CME-CF Bitcoin Volatility Real-Time Index (BVX) and the CME-CF Bitcoin Volatility Settlement Index (BVXS). These indices are forward-looking, market-based indicators designed to measure the expected volatility of Bitcoin prices over a fixed 30-day period until expiration. These indices are not tradable futures products, but they serve as transparent indicators reflecting the implied volatility in CME Group’s regulated Bitcoin futures and Micro Bitcoin futures options contracts.