News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Senate Banking Committee cancels crypto market structure markup

101 finance·2026/01/15 04:51

TSMC Q4 2025 Earnings Preview: AI-Driven Revenue Beats and Gross Margin Resilience

Bitget·2026/01/15 04:38

China’s economic forecast: Navigating the challenges ahead for China’s dual-track economy in 2026

101 finance·2026/01/15 04:24

CleanSpark buys Texas land to build AI and HPC data centers as BTC mining shifts

Cointelegraph·2026/01/15 04:21

USD/JPY Outlook: Takaichi’s actions limit Yen’s potential gains

101 finance·2026/01/15 04:21

Apple expands Apple Pay cross-border payment support for Mainland China users

格隆汇·2026/01/15 03:40

Duke Energy Activates 50-MW Grid Battery at Former Allen Coal Facility

101 finance·2026/01/15 03:24

Inflation Concerns Resurface as Officials Dampen Sentiment!

美投investing·2026/01/15 03:09

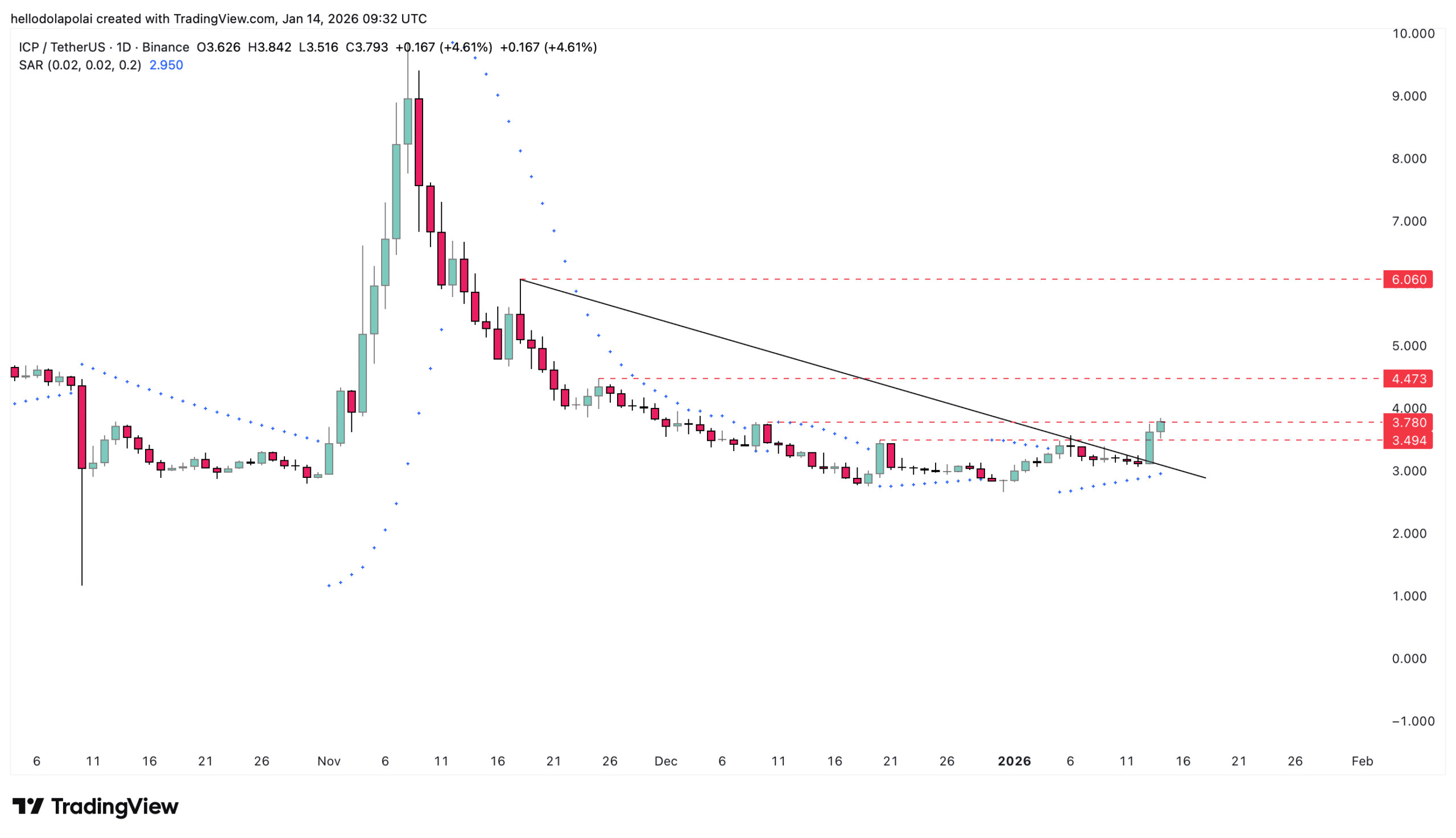

Internet Computer rallies 12% – But THESE levels still stand in ICP’s way

AMBCrypto·2026/01/15 03:03

AbbVie Plans to Expand in the Obesity Treatment Market

格隆汇·2026/01/15 02:36

Flash

18:33

Genius Terminal sets a new record with a single-day trading volume of $787 millionJinse Finance reported that Genius Terminal set a new single-day trading volume record of $787 million. The platform's weekly trading volume has exceeded $2 billion, and traders expect that the platform may conduct an airdrop through its Genius Points (GP) program.

17:07

Trump denies offering JPMorgan CEO Dimon the position of Federal Reserve ChairmanU.S. President Trump stated on the social media platform "Truth Social" that the claim made in a front-page article of The Wall Street Journal, which said he had offered the position of Federal Reserve Chairman to JPMorgan CEO Jamie Dimon, is completely fabricated and that he has never made such an offer. Trump also revealed that he will sue JPMorgan in the next two weeks because the bank terminated its business relationship with him after the January 6 protest incident. In addition, he denied ever intending to nominate Jamie Dimon as Treasury Secretary and said that the current Treasury Secretary, Janet Yellen, has performed extremely well.

16:00

Total Liquidations in the Last 24 Hours: $78.792 million, Largest Single LiquidationBlockBeats News, January 17th, according to Coinglass data, the total liquidation across the network in the past 24 hours was $78.792 million, with $30.397 million in long liquidations and $48.394 million in short liquidations.

In the past 24 hours, a total of 68,643 people were liquidated globally. The largest single liquidation occurred on Hyperliquid - xyz:AMZN-USD, amounting to $1.3055 million.

News