News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Power restructuring in probability games.

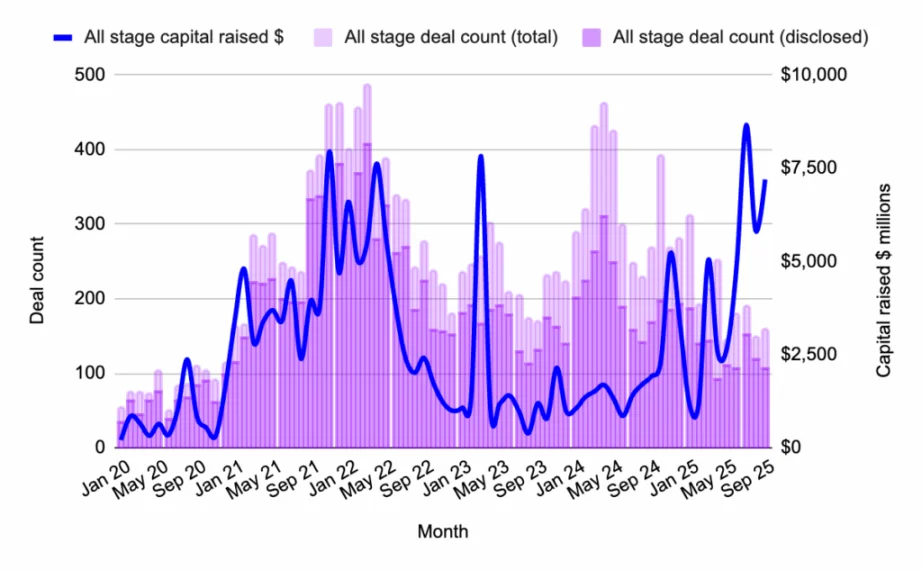

160 transactions raised $7.2 billions, marking the highest total since the spring surge.

ETF inflows dry up and digital asset trusts unwind as traders lose conviction; analysts say Bitcoin could revive sentiment with one strong breakout.

See how BlockDAG’s Buyer Battles boost activity, Hyperliquid gains from U.S. listings, and Cardano holds firm before a potential breakout.Hyperliquid Price Climbs After Robinhood LaunchCardano Maintains Strength Near $0.54 SupportBlockDAG’s Buyer Battles Drive Global Demand!Last Say: Which One Is the Best Crypto Investment

JPMorgan CEO Jamie Dimon says crypto is real and will improve transactions, marking a big shift from his earlier skepticism.Jamie Dimon: From Critic to Crypto Convert?Mainstream Finance Warming Up to CryptoWhy This Matters for the Industry

MicroStrategy earns $2.8B in Q3; Bitcoin holdings up $12.9B in 2025 with 26% BTC yield.Massive Bitcoin Holdings and High YieldWhat This Means for the Market

- 21:28The Dow Jones Index closed down 557.24 points, with both the S&P 500 and Nasdaq also declining.According to ChainCatcher, citing Golden Ten Data, the Dow Jones Industrial Average closed down 557.24 points, or 1.18%, at 46,590.24 points on Monday, November 17; the S&P 500 Index closed down 61.7 points, or 0.92%, at 6,672.41 points; and the Nasdaq Composite Index closed down 192.51 points, or 0.84%, at 22,708.07 points.

- 21:23U.S. Treasuries recover some of last week's losses as markets bet that data recovery will boost rate cut expectationsJinse Finance reported that, with UK government bonds leading the way, US Treasuries regained some of the ground lost last week. Despite an early setback in the corporate bond market at the start of this week—Amazon issued $12 billion in USD-denominated bonds (its first USD bond issuance since 2022)—the rebound in Treasuries was sustained. Also on Monday, an indicator measuring factory activity in New York State unexpectedly increased, reaching its highest level in a year. Nevertheless, most Treasury yields still fell by 1 to 3 basis points. Earlier forecasts suggested that, following the end of the six-week US government shutdown last week, the eventual restoration of federal economic statistics would revive expectations for another Fed rate cut next month. JPMorgan's rate strategists predict that by mid-2026, the yield on the US 10-year Treasury will fall to 3.75%, and in the most bullish scenario, could even reach 2.40%. While the fate of some US economic reports not released during the shutdown remains unclear, the Bureau of Labor Statistics stated it will publish the September data originally scheduled for October 3 on November 20. The Fed cut rates by 0.25 percentage points in both September and October to respond to signs of weakening labor demand, even though inflation remains above its 2% target.

- 21:23The US Dollar Index rose by 0.29% on the 17th.Jinse Finance reported that the US Dollar Index rose by 0.29% on the 17th, closing at 99.588 in the late foreign exchange market.