News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The Philippines introduced a bill to acquire 10,000 BTC over five years, locking holdings for two decades. Supporters highlight diversification benefits, while critics warn of risks as global governments accelerate sovereign Bitcoin accumulation.

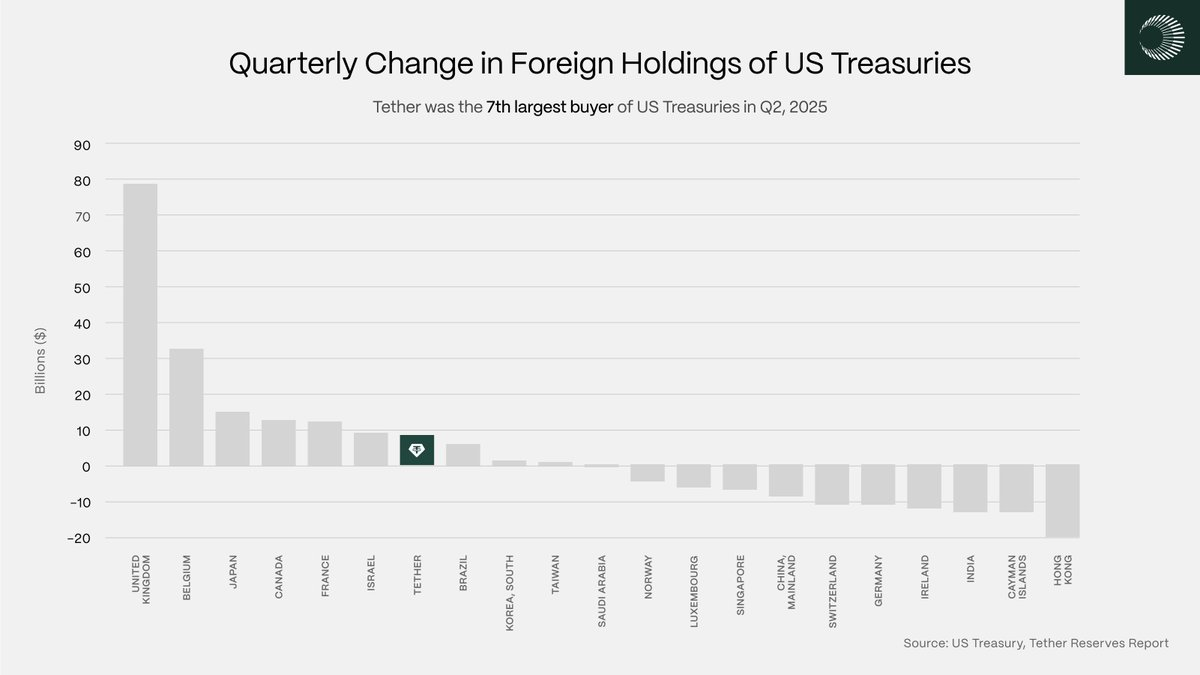

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users

BTC and ETH rally on dovish Fed signals

Japan’s Financial Services Agency (FSA) is preparing sweeping changes to its digital asset framework. The changes, which combine tax reforms and regulatory upgrades, could introduce exchange-traded funds (ETFs) tied to cryptocurrencies. The initiative signals Japan’s intent to integrate crypto into mainstream finance and attract broader investment. Tax Burden Under Review The reform package, reported domestically, … <a href="https://beincrypto.com/japan-fsa-crypto-tax-overhaul-etf-reforms-2026/">Con

- 01:05Spot SOL ETF saw a net inflow of $26.2 million yesterday.According to Jinse Finance, monitored by Farside Investors, the spot SOL ETF saw a net inflow of $26.2 million yesterday, with BSOL accounting for a net inflow of $23 million.

- 00:58KULR releases Q3 financial report: revenue reaches $6.88 million, up 116% year-on-yearJinse Finance reported that KULR Technology Group (NYSE American: KULR) released its Q3 2025 financial report, with revenue reaching $6.88 million, a year-on-year increase of 116%, and product sales growing by 112% to $1.62 million. During the same period, the company announced the launch of the KULR ONE Air battery product line for drone systems in cooperation with Amprius and Molicel, established a 3.3 MW bitcoin mining hosting partnership with Soluna Holdings, and introduced six new CubeSat batteries and a next-generation battery management system. Despite significant revenue growth, the company's gross margin dropped from 71% in the same period last year to 9%, and the net loss for the third quarter was $6.97 million, mainly due to one-time impairment charges and credit losses on accounts receivable.

- 00:58A single entity has accumulated 2,800 bitcoin in the past two weeks at an average price of $101,700.On November 19, according to monitoring by Emmett Gallic, a single entity has accumulated a total of 2,800 bitcoin (worth $264 million) through multiple addresses over the past two weeks. Most of the bitcoin accumulated was withdrawn from a certain exchange, and in the past 24 hours, another 45 bitcoin were withdrawn from this CEX at an average price of $101,700.