News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 10)|Trump Proposes $2,000 Tariff “Dividend” for Every American, Market Sees Potential Boost for Bitcoin; CBOE to Launch Perpetual Bitcoin & Ethereum Futures Contracts2Can Bitcoin bulls avoid the cycle’s fourth ‘death cross’ at $102K?321Shares And Canary Ignite XRP ETF Approval Process

NEAR Price at $2.46 Consolidates Between $2.42 Support and $2.53 Resistance

Cryptonewsland·2025/08/22 01:20

Top AI Agent Tokens by Market Cap as FET Declines While TRAC Holds Strong

Cryptonewsland·2025/08/22 01:20

Five Biggest Daily Gainers as Altcoins Deliver 52+% Price Increases Today

Cryptonewsland·2025/08/22 01:20

Dogecoin Price Chart Targets $1.38 First With Long Cycle Roadmap Toward $3

Cryptonewsland·2025/08/22 01:20

Camp Network Apologizes, Reimburses Users After Airdrop Fee Controversy

Camp Network’s $10 “paid” airdrop stirred heavy criticism before the project removed the fee and pledged refunds, raising questions of trust.

BeInCrypto·2025/08/22 01:16

SOL Strategies Grows Treasury with Smart Validator Play

SOL Strategies boosts its treasury to 400,909 SOL by reinvesting validator revenue for cost-effective accumulation.How the Validator Model WorksLong-Term Vision Behind the Treasury

Coinomedia·2025/08/22 01:10

Bank of America: Stablecoin Demand for Treasuries to Surge

Bank of America forecasts stablecoin-driven demand for U.S. Treasuries could grow by $25B–$75B, signaling rising crypto-finance integration.Why Bank of America Sees a ShiftCrypto’s Expanding Role in Finance

Coinomedia·2025/08/22 01:10

Tornado Cash’s Roman Storm Faces 5 Years for a Crime DOJ Now Says It Won’t Prosecute

CryptoNewsNet·2025/08/22 01:10

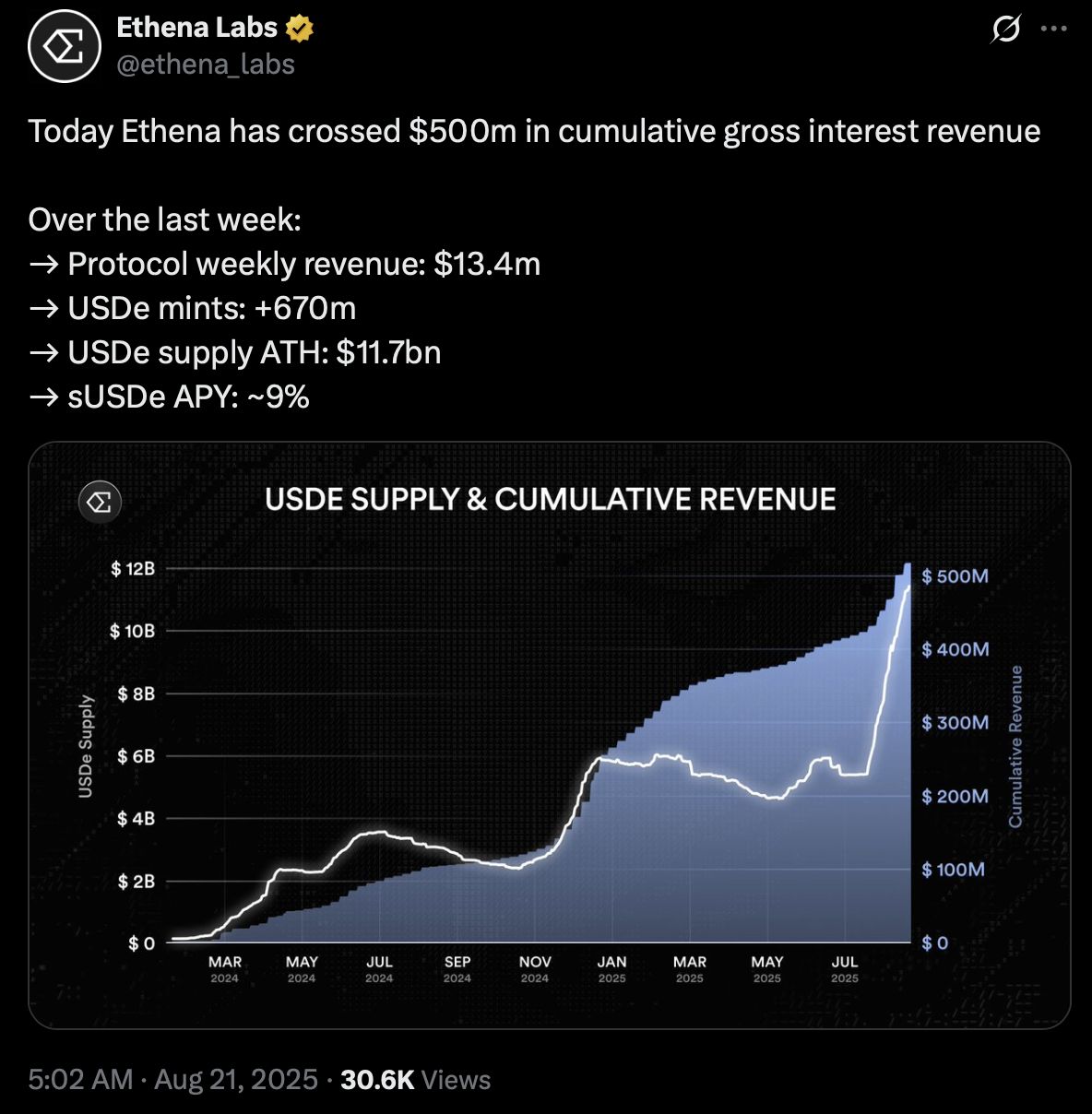

Ethena crosses $500M in cumulative revenue as synthetic stablecoins gain ground

CryptoNewsNet·2025/08/22 01:10

Crypto Gaming Handheld Shipments Delayed Over 'Excessive' Import Duties

CryptoNewsNet·2025/08/22 01:10

Flash

- 07:19Canton Network (CC) unveils dynamic supply model, denies fixed maximum supply capChainCatcher News, Canton Network recently issued an announcement to clarify the market's misunderstanding that its native token Canton Coin (CC) has a "supply cap" of 100 billions, and explained its dynamic supply model. The official statement said that CC adopts a supply mechanism similar to Ethereum and Solana, with an unlimited cap but actually stable supply. CC has no fixed cap, but every transaction burns CC, offsetting new issuance. The higher the network usage, the more is burned, resulting in lower net issuance and ultimately forming a mint-burn equilibrium (BME). The official emphasized that the value of CC should be measured by market capitalization rather than the theoretical supply cap. Supply outlook and key milestones: After entering BME, the total supply will fluctuate stably around network demand. According to the current model, if equilibrium is achieved in 2026, the total supply in 2034 may be less than 50 billions. January 1, 2026 will see a "double halving": total block issuance will be halved, and the Super Validator (SV) share will drop from 48% to 20%. Another "double halving" will occur three years later, with the SV issuance share further reduced to 10%, making it the only major source of inflation that gradually shrinks. Canton Network stated that more than 1 billion CC have been cumulatively burned, with the current daily burn value at about $900,000. As issuance decreases, it is expected that by the early 2030s, the inflation rate of CC will become one of the lowest among mainstream Layer-1s.

- 07:19Data: "Top 100% win rate" whale places 25x leveraged ETH long orders; if fully filled, position size will reach $15 millionAccording to ChainCatcher, HyperInsight monitoring shows that the “100% win rate” whale placed the remaining $600,000 principal in their account as a pending order to open a 25x leveraged long position on ETH, with an average pending order price of $3,610. Currently, only part of this order has been filled, with a position size of approximately $4.07 million. If fully filled, the position size would reach $15 million.

- 07:12South Korea's four major financial groups compete to partner with tech giants to enter the stablecoin marketChainCatcher News, according to the Korea Times, South Korea's four major financial holding companies—KB, Shinhan, Hana, and Woori—are competing to establish partnerships with major tech companies such as Naver, Kakao, and Samsung Electronics in order to gain an advantage in the rapidly emerging stablecoin market. The domestic stablecoin trading volume in South Korea has already exceeded 60 trillion won (approximately $41.15 billions). Financial regulators are preparing to submit a stablecoin regulatory bill to the National Assembly by the end of 2025. Banks are considered the primary issuers of won-pegged stablecoins.