News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Mizuho Securities equities researchers say Circle’s stock faces medium-term risks from slower-than-expected USDC growth, rising distribution costs, and a potential Fed rate cut. The analysts give a base case for CRCL of $84 and bear case of $40 through 2027, down from Wednesday’s closing price of $153.16 a day after the firm filed its quarterly earnings.

Quick Take Multiple forces are driving ETH’s rally toward its all-time high, including record spot ETF inflows, new U.S. policy moves, and growing corporate treasury diversification into ETH. Analysts and industry leaders see further upside, with Standard Chartered raising its year-end target to $7,500 and some predicting $6,000 in the near term — though profit-taking near record levels is possible.

Quick Take A wallet that previously dealt with the Ethereum Foundation has sold roughly 2,795 ETH worth $12.7 million amid the second-largest cryptocurrency’s move toward all-time highs. Solana surged 15% in 24 hours to reclaim the $200 level on Wednesday morning as optimism spreads across the altcoin space.

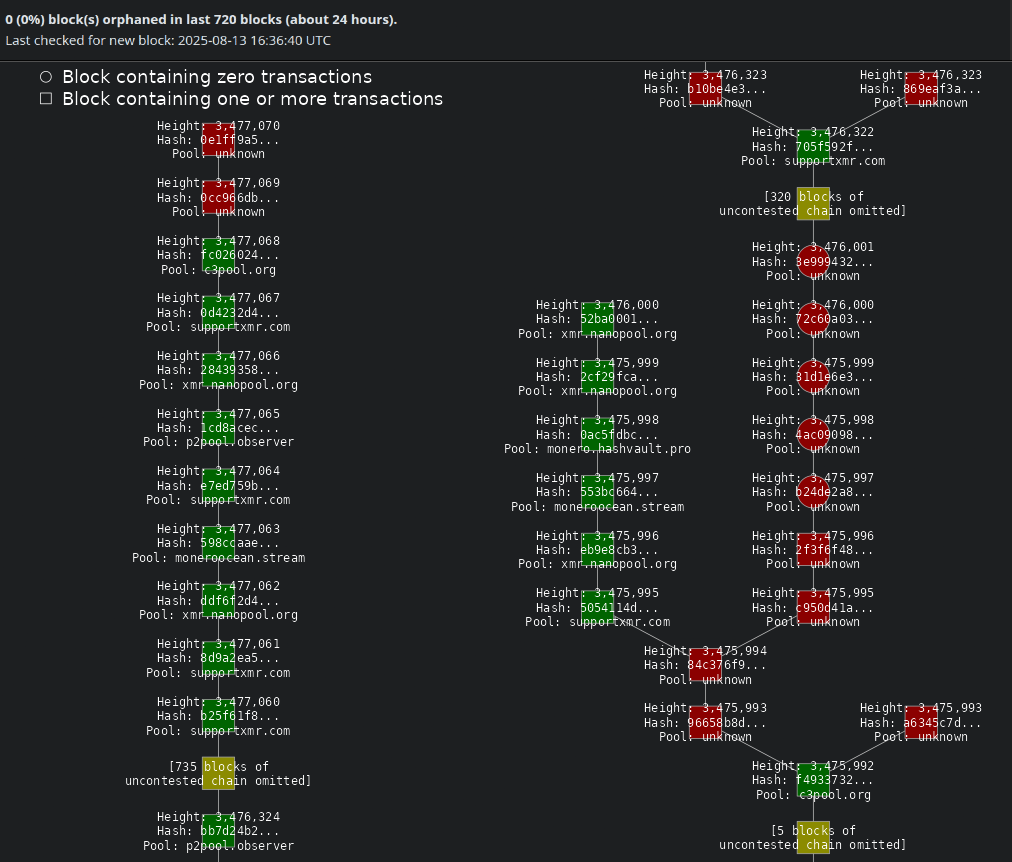

Monero has experienced 36 hours without selfish mining attacks following Qubic pool’s August 12 incident that caused a six-block reorganization. The event was incorrectly labeled a 51% attack, though Qubic controlled approximately 36% of network hashrate.

- 19:43U.S. Treasury Secretary: "Significantly Enhanced" Sanctions Against Russia to Be Announced Within a DayJinse Finance reported that U.S. Treasury Secretary Janet Yellen announced that the United States plans to announce a "substantial" increase in sanctions against Russia within the next day. Following the announcement, international oil and gold prices rose. Yellen told reporters at the White House on Wednesday: "We will announce a substantial increase in sanctions against Russia after the market closes today or early tomorrow." Yellen did not specify the details of the new measures. This news comes as the White House has just abandoned recent plans for a meeting between Trump and Putin.

- 19:41155 Crypto ETF Applications Await Approval in the US, Led by Bitcoin and SolanaAccording to Jinse Finance, citing Bloomberg, as of October 20, there have been 155 cryptocurrency-based Exchange Traded Product (ETP) applications in the United States, covering 35 digital assets. Among them, Bitcoin and Solana each have 23 applications, XRP has 20, and Ethereum has 16. Although the approval process was delayed by the U.S. government shutdown that began on October 1, industry experts remain optimistic that approval is imminent. Recently, issuers have actively submitted 2x and 3x leveraged ETFs as well as products with staking mechanisms, reflecting a “land grab” trend in the crypto ETF market. Analysts point out that investors prefer to diversify their investments in emerging digital assets through index and actively managed ETFs, rather than single tokens. Since the launch of spot Bitcoin and Ethereum ETFs in January and July 2024, BTC ETF assets under management have reached nearly $150 billions, while ETH ETF assets are about $24 billions.

- 19:41A certain whale opened a $32.5 million BTC short position with 18x leverage.Jinse Finance reported that a certain whale wallet "0xc2a3" closed its BTC long position with a profit of over $5.7 million, and immediately opened a $32.5 million short position with 18x leverage.