News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

Bitcoin Reacts Sharply To Shutdown Resolution

Cointribune·2025/11/11 09:15

XRP News: ETF Launch Dates Confirmed as Wall Street Turns to Ripple’s Token

Coinpedia·2025/11/11 08:57

Bitcoin (BTC) Climbs on Economic Optimism: Here Are 5 Things to Know This Week

CryptoNewsFlash·2025/11/11 08:51

Stablecoins Can’t Kill XRP — Here’s What Most Critics Miss

CryptoNewsFlash·2025/11/11 08:51

IOTA Integrates Stablecoins to Drive Real Transactions and Ecosystem Adoption

CryptoNewsFlash·2025/11/11 08:51

Morning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

Overview of major market events on November 10.

Chaincatcher·2025/11/11 07:54

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

AICoin·2025/11/11 07:50

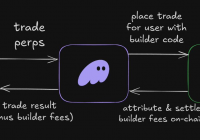

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Bitpush·2025/11/11 07:36

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

ForesightNews·2025/11/11 07:01

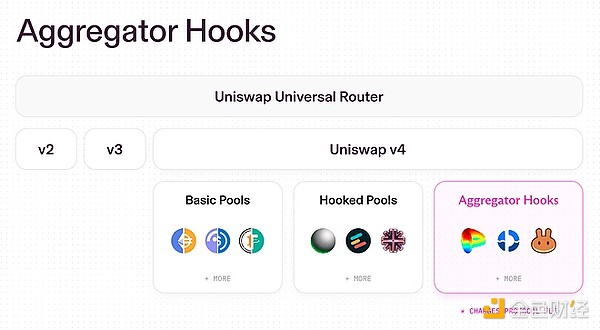

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

金色财经·2025/11/11 06:56

Flash

- 09:28CryptoQuant: Market deleveraging is approaching a critical point, analysts see it as a buy signalAccording to ChainCatcher, market sources report that analyst GugaOnChain stated that the open interest (OI) in the cryptocurrency market has dropped by 11.32%, approaching the critical threshold of 12%, which is seen as a strong buy signal. This deleveraging indicates that the market is clearing excessive speculative leverage, and historically, such events have been considered a necessary process for a healthy market "reset." Bitcoin has previously experienced OI declines ranging from 8% to 19%, with the total open interest dropping by more than 10 billions USD in extreme cases. Although current market sentiment may still be in a state of "extreme fear," major financial institutions such as JPMorgan believe that after large-scale leverage clearing, Bitcoin has "significant upside potential." Analysts believe that the current market is building a more stable foundation, creating favorable opportunities for long-term investors.

- 09:09Japanese company Startale launches super app for Sony Soneium blockchain ecosystemChainCatcher reported that Startale Group and Sony Blockchain Solutions Lab have jointly announced the launch of the Startale App, an all-in-one super application designed as the gateway to Sony's Ethereum Layer 2 network Soneium and its ecosystem. This app will serve as the access portal for future token generation events, airdrops, and Soneium ecosystem rewards. According to the official announcement, multiple projects on this network plan to distribute airdrops, rewards, and exclusive experiences through this application. The announcement states that the Startale App adopts account abstraction technology, eliminating the need for mnemonic phrases, enabling gas-free transactions, and simplifying wallet management to promote activity within the Soneium ecosystem. The app supports mini-program functionality, allowing developers to build applications directly on the network without the need for standalone websites. Currently, the app is in closed testing, and the official launch date has not yet been announced.

- 09:05Trade tensions resurface as Bitcoin retreats from one-week highJinse Finance reported that bitcoin retreated after reaching a one-week high overnight, having touched $107,454 and now down 0.5% to $105,011. The market is optimistic that the record-breaking U.S. government shutdown may soon end, but risk sentiment in Asian markets has suffered a setback as new concerns over trade tensions emerge. (Golden Ten Data)