News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

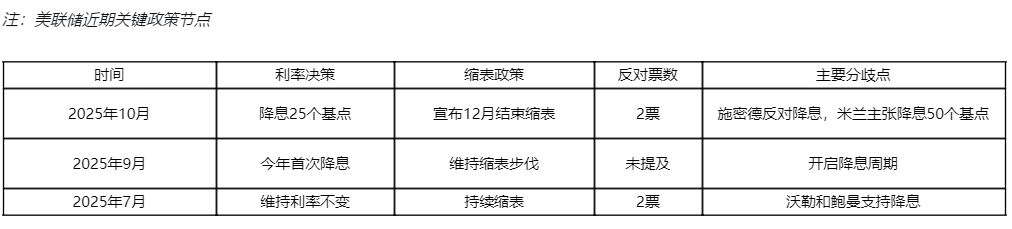

Global markets are experiencing multiple transformative catalysts supporting the recovery of risk assets. For instance, Trump has revived his proposal to distribute $2000 "tariff dividend" checks to every American using tariff revenues. While the plan faces hurdles such as congressional approval and inflationary concerns, it has already boosted consumer confidence and is expected to inject trillions of dollars in liquidity, benefitting high-growth technology sectors. Meanwhile, the U.S. government shutdown has reached a record 41 days. With the Senate having reached an agreement, it's expected to end on November 11—potentially triggering a renewed fiscal injection of tens of billions of dollars and a V-shaped rebound similar to past shutdown recoveries. Market expectations for a rate cut at the Federal Reserve's December FOMC meeting are also rising, with a 62.6% probability priced in for a 25-basis-point cut. Some Trump-backed officials even advocate for a 50-basis-point reduction, which would extend the easing cycle and further stimulate investment in crypto and AI infrastructure. Together, these factors may drive a 5–10% rebound in total crypto market capitalization, creating a window of opportunity for allocation to high-quality projects.

Trump desires low interest rates, but the Federal Reserve chair candidates he favors advocate for restricting the central bank's primary tool for achieving low rates—quantitative easing.

Options market pioneer Cboe has announced its entry into the prediction market. Instead of following the sports trend, it is firmly taking a financially sound path and plans to launch its own products linked to financial outcomes and economic events.

The $35 billion includes ETPs and ETFs with $33.9 billion in assets under management (mainly Bitcoin, Ethereum, and SOL related products), as well as $1.1 billion in private funds.

A wave of risk is sweeping across global assets, with US stocks plunging simultaneously.

- 10:23Bridgewater's Q3 holdings revealed: reduced position in NvidiaJinse Finance reported that in the early morning of November 14, East 8th District time, the world's largest hedge fund Bridgewater released its holdings report as of the end of the third quarter of this year. The report shows that as of the end of the third quarter, Bridgewater held 2.51 million shares of Nvidia, a decrease of 65.3% compared to 7.23 million shares at the end of the second quarter. It is worth noting that in the second quarter of this year, Bridgewater had increased its holdings of Nvidia by as much as 154.37%. This reduction in holdings indicates that Bridgewater has become more cautious about Nvidia's future performance.

- 10:14Data: A certain whale continues to inject multiple assets such as UNI and LINK into a certain exchange and is bearing significant unrealized losses.According to ChainCatcher, market sources report that a whale, after depositing 1.19 million UNI (approximately $10.54 million) to an exchange, subsequently deposited multiple other assets and is currently in a significant loss position: 74,281 LINK, currently valued at about $1.07 million, representing a loss of $752,000 compared to the purchase price; 764,376 PENDLE, currently valued at about $1.85 million, with a loss of $1.77 million; 8,936 AAVE, currently valued at about $1.66 million, with a loss of $570,000. This address also sold 220,351 AERO in exchange for $186,000 USDC and still holds 150,000 AERO.

- 10:14Yilihua: Still optimistic about the future US stock market, repeatedly recommends buying spot rather than contractsChainCatcher reports that JackYi, founder of Liquid Capital, stated, "Returning to the decisive factor for the crypto market: the US stock market. It is indeed difficult to judge whether the US stock market will continue to pull back or rebound, but considering that most negative factors have been priced in and referencing the earnings reports of the seven major US tech companies, I remain optimistic about the future performance of US stocks. This is where the divergence lies, so I repeatedly recommend buying spot rather than contracts, because from an investment perspective, the upside potential outweighs the downside risk."