News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 4.42% 2️⃣ stETH...

$RAVE is not just a token; it represents a sense of belonging and the power of collective building. It provides the community with tools to create together, share value, and give back influence to society.

The ERC-8021 proposal suggests embedding builder code directly into transactions. Along with a registry, developers can provide wallet addresses through the registry to receive revenue.

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

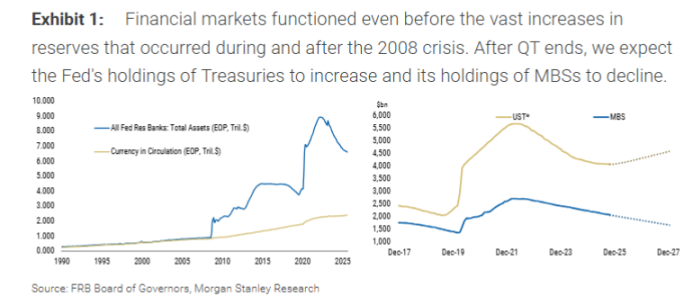

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.

- 21:20The three major U.S. stock indexes closed mixed.Jinse Finance reported that the three major U.S. stock indexes closed mixed. The Dow Jones Index rose by 1.18%, the S&P 500 Index increased by 0.21%, while the Nasdaq Composite Index fell by 0.25%. Chip stocks generally declined, with Micron Technology dropping over 4%, ARM falling over 3%, and Nvidia, AMD, and Applied Materials all down more than 2%. Major technology stocks showed mixed performance: Apple rose over 2%, Netflix increased by more than 1%, while Oracle fell over 2% and Tesla dropped more than 1%.

- 21:13YZi Labs invests in regenerative medicine company Renewal BioForesight News reported that YZi Labs has announced an investment in the regenerative medicine company Renewal Bio, marking YZi Labs' first biotechnology investment since expanding its investment scope in early 2025. Renewal Bio focuses on using its proprietary Stembroid™ platform to generate human cells and tissues with fully matched DNA from patients' own cells, aiming to address the global organ shortage crisis. Renewal Bio reprograms ordinary skin or blood cells into stem cells by simulating early human developmental environments, generating various functional cells including hematopoietic, liver, heart, and pancreatic cells. The company was co-founded in 2022 by Professor Jacob Hanna of the Weizmann Institute of Science and his two doctoral students, Vladislav Krupalnik and Ohad Gafni. This round of financing will accelerate the preclinical development of Stembroid-derived hematopoietic stem cells for the treatment of leukemia and immune diseases, and support the expansion of laboratory infrastructure.

- 21:13Lighter completes $68 million financing round, led by Founders Fund and Ribbit CapitalForesight News reported, according to Fortune Magazine, Lighter has announced the completion of a $68 million financing round, led by Founders Fund and fintech investment firm Ribbit Capital, with participation from Haun Ventures and Robinhood. Following this round, Lighter's company valuation has reached $1.5 billion.