News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Liberalism gives vitality to Bitcoin; democratization gives it scale. The network effect is the invisible bridge connecting the two, and also proves that freedom grows through participation.

Due to Western sanctions and US-India trade negotiations, India significantly reduced its purchases of Russian crude oil in December, with its five major core refineries placing no orders.

SoftBank Group has completely sold its Nvidia holdings, cashing out $5.8 billions. Founder Masayoshi Son is shifting the strategic focus, allocating more resources to the artificial intelligence and chip-related sectors.

The real large-scale liquidity release may not happen until May next year, after Trump takes control of the Federal Reserve, similar to what happened in March 2020.

A brief selection of projects curated by Monad Momentum.

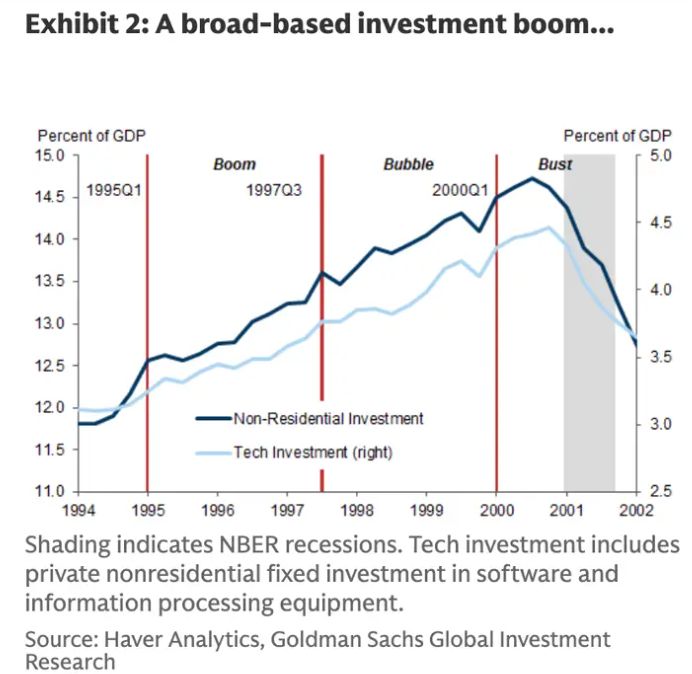

While the entire market is cheering for the future of AI, strategists at Goldman Sachs are sounding the alarm.

- 12:18Commerzbank: The US dollar may weaken as delayed data could affect rate cut expectationsAccording to ChainCatcher, citing Golden Ten Data, Thu Lan Nguyen from Commerzbank stated in a report that if the delayed data supports further rate cuts, the potential end of the US government shutdown could be negative for the US dollar. She pointed out that the recent rise of the dollar was due to the lack of official data during the shutdown, which supported the Federal Reserve's stance of pausing further rate cuts. Nguyen believes that the recent decline in rate cut expectations is unreasonable and sees it more as another argument for a weaker dollar.

- 12:18Hyperscale Data: Bitcoin treasury allocation expands to $75.25 million, current holdings increase to approximately 267.6 BTCChainCatcher news, NYSE American-listed company Hyperscale Data announced that it has expanded its bitcoin treasury allocation to $75.25 million, including its current holdings and funds allocated for committed bitcoin purchases. Its wholly-owned subsidiary Sentinum currently holds approximately 267.6862 bitcoins (including 223.5868 bitcoins acquired on the open market and about 44.0994 bitcoins obtained through its bitcoin mining operations). In addition, $47.25 million in cash has been allocated for purchasing bitcoin on the open market.

- 11:59US Senators Propose New Bill to Transfer Crypto Regulatory Authority to CFTCAccording to ChainCatcher, citing Dlnews, U.S. Senators John Boozman and Cory Booker have introduced a bipartisan bill aimed at transferring cryptocurrency regulatory authority from the Securities and Exchange Commission (SEC) to the Commodity Futures Trading Commission (CFTC). The bill would authorize the CFTC to define and regulate digital commodities, establish a registration system for crypto trading venues, enforce new disclosure rules, and impose fees on certain transactions. CFTC Acting Chair Caroline Pham stated that she is committed to "making the United States the world's crypto capital," with plans to advance spot crypto trading by the end of the year and issue stablecoin guidelines in early 2026. This move is part of a shift in the U.S. government's stance toward the $3.6 trillion digital asset industry. SEC Chair Paul Atkins has already announced that "the crypto era has arrived" and has launched a deregulation "crypto initiative."