News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The government shutdown has delayed official employment data, so ADP data has stepped in to reveal the truth: in the second half of October, the labor market slowed down, and the private sector lost a total of 45,000 jobs for the entire month, marking the largest decline in two and a half years.

The upcoming Fusaka upgrade on December 3 will have a broader scope and deeper impact.

Although these projects are still generally down about 90% from their historical peaks, their recent surge has been driven by multiple factors.

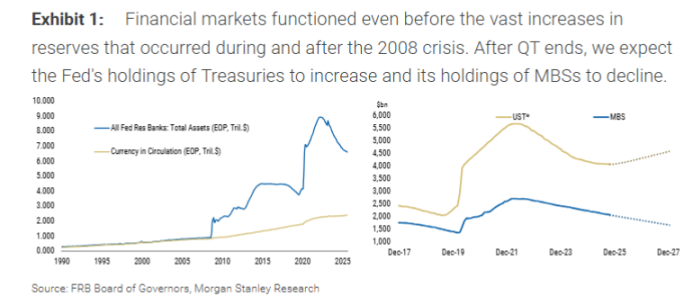

Morgan Stanley believes that the Federal Reserve ending quantitative tightening does not mean a restart of quantitative easing.

In Brief A whale resumed purchases, accumulating 371 million PI coins worth over $82 million. Pi Network is strengthening infrastructure with AI and DeFi enhancements. Technical indicators suggest a possible upward move in the PI coin value.

In Brief Standard Chartered partners with DCS to introduce the stablecoin-based DeCard in Singapore. DeCard simplifies cryptocurrency transactions for everyday purchases akin to traditional credit cards. With regulatory backing, DeCard plans to expand beyond Singapore to a global market.

- 19:02The probability of the US government reopening by the end of this week has reached 95% on Polymarket.According to Jinse Finance, data from the Polymarket prediction market shows that there is a 95% probability that the U.S. government will reopen before the end of this week.

- 19:01AMD expects data center revenue to reach several billions of dollars by 2027Jinse Finance reported that AMD expects its data center revenue to reach "several tens of billions of dollars" by 2027, with an anticipated overall data center compound annual growth rate of over 60%. The company also expects its server CPU market share to exceed 50%, and its PC (personal computer) market share to surpass 40%.

- 18:39Data: If ETH breaks through $3,647, the cumulative short liquidation intensity on major CEXs will reach $1.248 billion.According to ChainCatcher, citing Coinglass data, if ETH breaks above $3,647, the cumulative short liquidation intensity on major CEXs will reach $1.248 billion. Conversely, if ETH falls below $3,312, the cumulative long liquidation intensity on major CEXs will reach $562 million.