News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

What has the Trump family been up to recently?

金色财经·2025/11/11 06:09

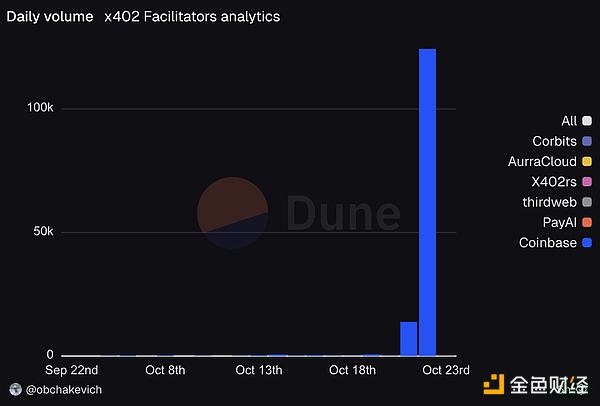

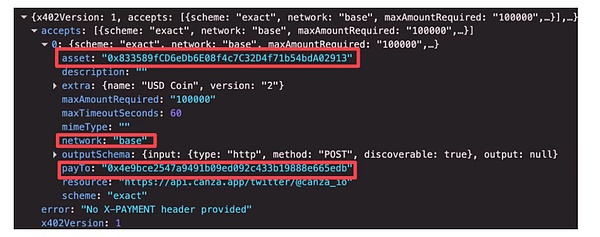

Speculation or real value? Will x402 trigger another Meme wave?

金色财经·2025/11/11 06:09

0xKevin: Insights for UXUY from BNB's All-Time High

金色财经·2025/11/11 06:07

Interpreting ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid's Developer Get-Rich-Quick Myth?

ERC-8021 proposes to embed builder code directly into the transaction, along with a registry where developers can provide a wallet address to receive rewards.

BlockBeats·2025/11/11 05:30

$RAVE Unveils Tokenomics, Igniting the Decentralized Cultural Engine Powering Global Entertainment

$RAVE 不仅仅是一种代币,它代表着归属感与共同构建的力量。它为社区提供工具,让人们可以共同创作、分享价值,并将影响力回馈社会。

BlockBeats·2025/11/11 03:15

Burn, Uniswap's Final Ace

Hayden's new proposal may not necessarily save Uniswap.

BlockBeats·2025/11/11 03:08

With Faker's carrying, he won nearly $3 million dollars

Faker's 6th Crown, fengdubiying's Mythical Journey on Polymarket

BlockBeats·2025/11/11 02:40

SignalPlus Macro Analysis Special Edition: Is Work Resuming Soon?

Macro assets faced a tough week, with the Nasdaq Index experiencing its worst weekly decline since the "Liberation Day" in April, mainly due to concerns over an artificial intelligence bubble...

SignalPlus·2025/11/11 02:21

Flash

- 06:46Bitget CEO: If the Federal Reserve pauses quantitative tightening and begins a rate-cutting cycle, bitcoin may reach a historic highChainCatcher News: In a recent article published by Forbes, Bitget CEO Gracy Chen's latest views on ETF capital inflows and the impact of institutional funds were cited. She pointed out that the core driving force behind the current bitcoin price has shifted to US market liquidity, rather than capital from Europe, the Middle East, or Asia. Funds from these regions are more inclined to flow into gold and the stock market, which also explains the strong performance of gold, AI-related US stocks, and Chinese stock indices since the beginning of this year. Gracy Chen believes that once the US government ends the shutdown in November, fiscal spending and market liquidity will restart; if the Federal Reserve pauses quantitative tightening in December and begins a rate-cutting cycle, a new bitcoin bull market may officially begin. As early as January this year, Gracy Chen boldly predicted, "BTC is expected to break through $130,000 and further surge towards $150,000 to $200,000." Although this target has not yet been achieved, she emphasized that once the government shutdown ends and the Federal Reserve turns to easing, it is only a matter of time before bitcoin reaches $150,000, whether in the fourth quarter of this year or the first quarter of next year. Personally, I have gone all in again, looking forward to witnessing bitcoin reach a new all-time high together with everyone.

- 06:38Analyst: Short-term holders' MVRV rebounds to 0.95, possibly indicating Bitcoin will rebound to $115,000–$120,000Jinse Finance reported that Cryptoquant analyst Axel Adler Jr released a market analysis stating that on November 7, the MVRV indicator for short-term holders (STH) reached a local low of 0.9124, approaching the lower boundary of its statistical range. As of today, data shows that this indicator has shown signs of stabilization, rebounding from 0.9124 to 0.9514. If the indicator can consistently remain above 0.92, it may begin to move toward the upper boundary of the range, corresponding to a bitcoin price range of approximately $115,000 to $120,000.

- 06:36Orama Labs completes first PYTHIA buyback and burn, marking the official entry of PYTHIA into a deflationary eraChainCatcher reported that DeSci & AI asset issuance protocol Orama Labs today announced the execution of its first burn of governance token $PYTHIA. A total of 215,310 PYTHIA tokens were burned, marking the official launch of its deflationary mechanism and further strengthening the long-term value support of its token economic model. This burn follows the successful launch of Orama Labs' first ecosystem project, ZENO. According to previously announced Tokenomics, the platform will return 50% of fee income directly to project creators to continuously support the development of ecosystem projects, while the remaining portion will be used to promote value-empowering measures including buyback and burn. As an issuance protocol in the Solana ecosystem focused on DeSci and AI assets, Orama Labs has demonstrated its commitment to building a sustainable, deflationary token economy through this burn.