News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 14)|Czech Central Bank Becomes First to Buy Bitcoin; White House Warns of 1.5% Q4 GDP Hit; Monad Mainnet and MON Token Launch Set for Nov 242The most important crypto moments of the year3Bitcoin falls to $98K as futures liquidations soar: Should bulls expect a bounce?

Latest Speech by US SEC Chairman: Farewell to a Decade of Chaos, Crypto Regulation Enters an Era of Clarity

The US SEC Chairman further elaborated on the "Project Crypto" initiative, outlining new boundaries for token classification and regulation.

ForesightNews 速递·2025/11/14 21:34

Grayscale, which once confronted the SEC, is about to be listed on the New York Stock Exchange

Since the launch of GBTC in 2013, Grayscale's assets under management have exceeded $35 billion.

ForesightNews 速递·2025/11/14 21:32

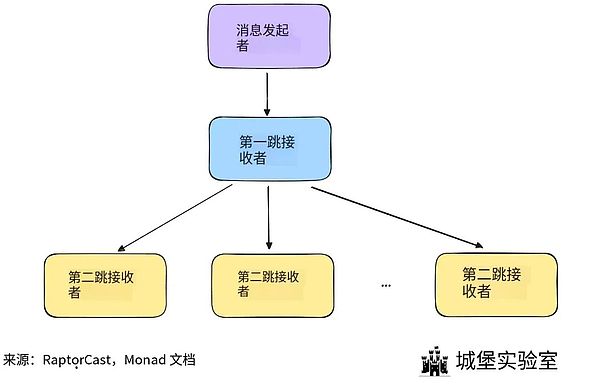

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

深潮·2025/11/14 18:42

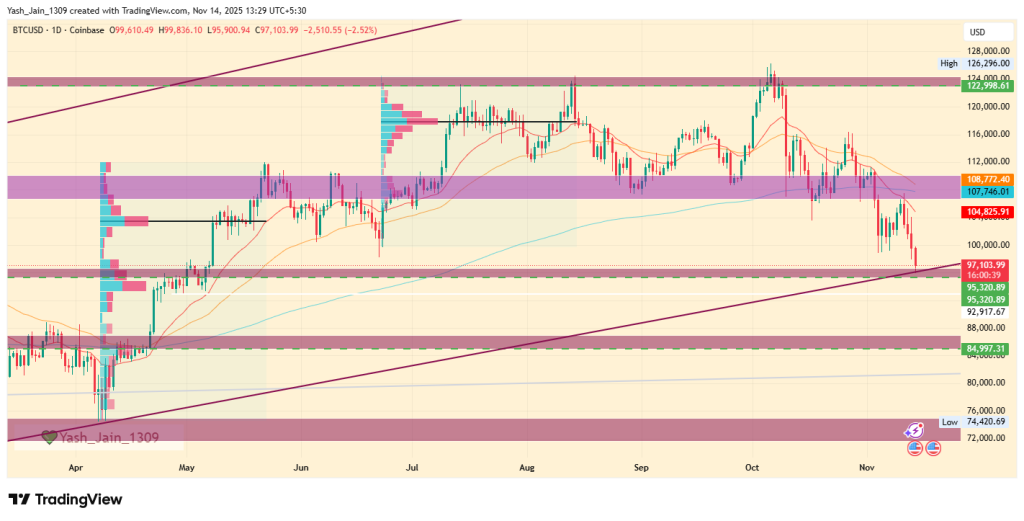

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.

深潮·2025/11/14 18:40

Options exchange Cboe enters the prediction market, focusing on financial and economic events

Options market leader Cboe has announced its entry into the prediction market. Rather than following the sports trend, it is firmly committed to a financially stable path and plans to launch its own products linked to financial outcomes and economic events.

深潮·2025/11/14 18:38

Grayscale formalizes its IPO filing

Cointribune·2025/11/14 18:06

Czech Bank Tests Crypto Assets In Pilot Program

Cointribune·2025/11/14 18:06

New XRP ETF Draws $58M Trading Volume, Tops This Year’s ETF Debuts

Cointribune·2025/11/14 18:06

Bitzuma Launches Research & Education Hub to Elevate Crypto Knowledge

DeFi Planet·2025/11/14 18:03

Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

Coinpedia·2025/11/14 17:42

Flash

- 21:39The three major U.S. stock indexes closed mixed.Jinse Finance reported that the three major U.S. stock indexes closed mixed, with the Dow Jones Index down 0.65%, the S&P 500 Index down 0.05%, and the Nasdaq Composite Index up 0.13%. Technology stocks showed mixed performance: Oracle rose over 2%, Microsoft and Nvidia both rose over 1%, Netflix fell over 3%, and Intel and Amazon both fell over 1%.

- 21:10The US Dollar Index rose by 0.14% on the 14th.Jinse Finance reported that the US Dollar Index rose by 0.14% on the 14th, closing at 99.298 in the foreign exchange market.

- 21:10Federal Reserve Governor Milan: Data Supports Rate Cuts, Fed Should Be More DovishJinse Finance reported that Federal Reserve Governor Milan stated that recent economic data supports the case for the Fed to cut interest rates. Since the Fed's September policy meeting, "I believe all the data we have received points to a dovish stance," Milan said. "Inflation data has been better than we expected," he noted, adding that labor market data has already weakened. Regarding the issue of further rate cuts, "all of this should make us more dovish, not the opposite."