News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Estimates show U.S. jobless claims fell to around 215,000 last week

Cointime·2025/10/17 14:48

Ethereum Price Slides Below $4,000 Support As Sellers Tighten Their Grip

Newsbtc·2025/10/17 14:27

Bitcoin falls below $110,000, whose wallet is losing money again?

Market sentiment has fallen into extreme fear.

ForesightNews 速递·2025/10/17 14:23

21Shares Files with SEC for 2x Leveraged HYPE ETF Tracking Hyperliquid Index Performance

Cryptonewsland·2025/10/17 14:06

Ghana Targets December 2025 for Crypto Rules as Enforcement Team Remains Unfilled

Cryptonewsland·2025/10/17 14:06

ACI Worldwide and BitPay Partner to Enable Merchants to Accept Crypto and Stablecoin Payments Globally

Cryptonewsland·2025/10/17 14:06

SEC’s Hester Peirce Calls for Financial Privacy as Tokenization Gains Momentum

Cryptonewsland·2025/10/17 14:06

France Boosts AML Checks on Crypto Exchanges

France’s ACPR tightens AML rules on crypto firms like Binance amid MiCA compliance efforts.Major Exchanges Face Regulatory ReviewMiCA Brings a New Compliance Era

Coinomedia·2025/10/17 14:06

Japanese banks to launch yen and dollar stablecoins

Portalcripto·2025/10/17 14:00

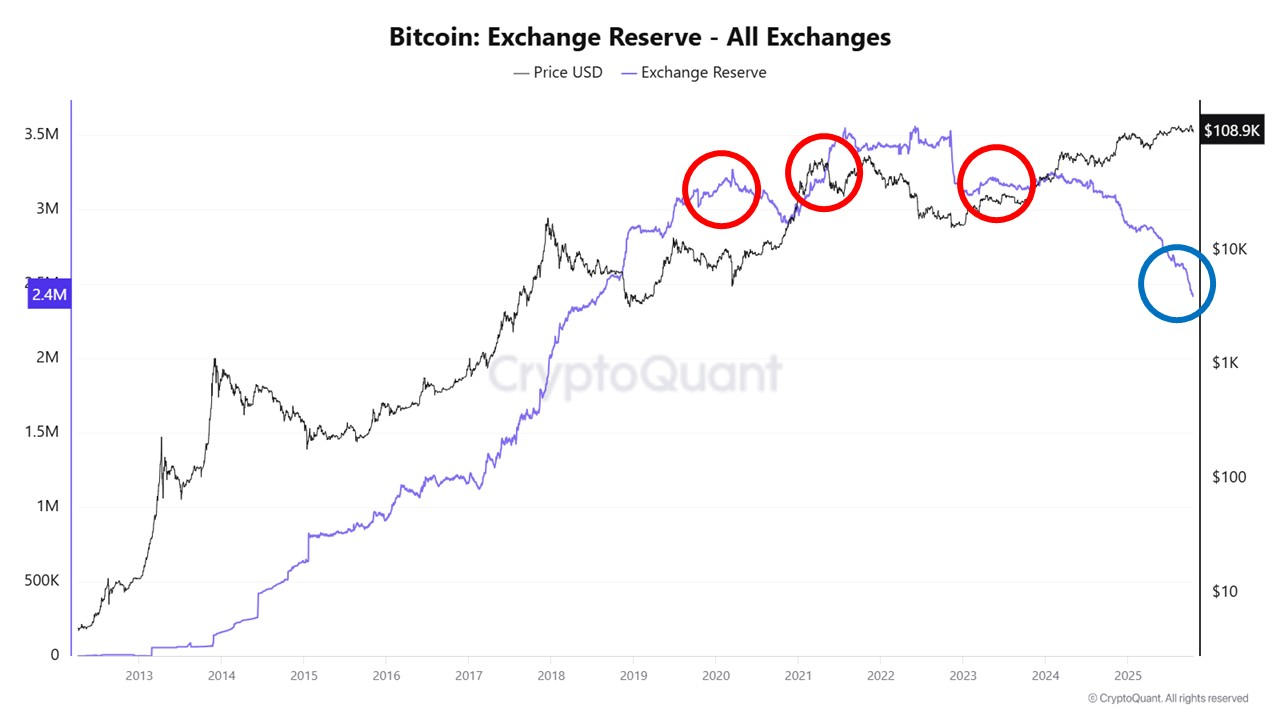

October Crypto Crash Shows Stark Contrast to 2021 Selloffs, Analyst Finds

CryptoNewsNet·2025/10/17 13:57

Flash

- 14:34OneKey responds to Milk Sad incident, confirms vulnerability does not affect the security of its software and hardware walletsAccording to ChainCatcher, OneKey's Chinese Twitter stated that regarding the recent "Milk Sad incident" involving a random number vulnerability, the OneKey team clarified that this vulnerability does not affect the security of mnemonic phrases and private keys in OneKey's software or hardware wallets. The vulnerability originates from the pseudo-random number generator in Libbitcoin Explorer (bx) version 3.x, which uses system time and the Mersenne Twister-32 algorithm, with a seed space of only 2³² bits. Attackers can deduce private keys through prediction or brute-force enumeration. The affected scope includes some old versions of Trust Wallet and all products using bx 3.x or old versions of Trust Wallet Core. OneKey stated that its hardware wallets use EAL6+ secure chips with built-in TRNG true random number generators; older devices have also passed SP800-22 and FIPS140-2 entropy tests; software wallets use system-level CSPRNG entropy sources to generate random numbers, meeting cryptographic standards. The team emphasized that users are advised to manage assets with hardware wallets and should not import mnemonic phrases generated by software wallets into hardware wallets to ensure the highest level of security.

- 14:28A certain whale increased holdings by 187.5 BTC at an average price of $105,410 after today's drop.According to Jinse Finance, monitored by Ember CN, a whale/institution that bought 379.2 BTC (45.57 million USD) at a price of 120,151 USD one week ago, has once again increased its holdings today after the price drop, spending 19.77 million USDC to purchase an additional 187.5 BTC at an average price of 105,410 USD. This whale/institution has spent a total of 65.34 million USD to buy 566.9 BTC at an average price of 115,260 USD, and is currently facing an unrealized loss of 5.37 million USD.

- 14:17A certain whale/institution spent 19.77 million USDC to purchase 187.5 BTC and is currently facing an unrealized loss of about 5.37 million USD.ChainCatcher news, according to on-chain analyst Yu Jin, a certain whale/institution bought 379.2 BTC at an average price of $120,151 (approximately $45.57 million) a week ago. After the price dropped, they bought another 187.5 BTC with 19.77 million USDC at a transaction price of $105,410. In total, they spent $65.34 million to purchase 566.9 BTC, with a combined average price of $115,260. Calculated at the current price, they are facing an unrealized loss of about $5.37 million.