News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

A single address is suspected to have contributed over 60%. Will such "old-school" front-running still appear in 2025?

The role of cryptocurrencies in Argentina has fundamentally changed: from a novelty that once sparked curiosity and experimentation among the public, including Milei himself, to a financial tool used by citizens to protect their savings.

The harsh truth of the market may be that what we are creating is a liquidity black hole, not a flywheel.

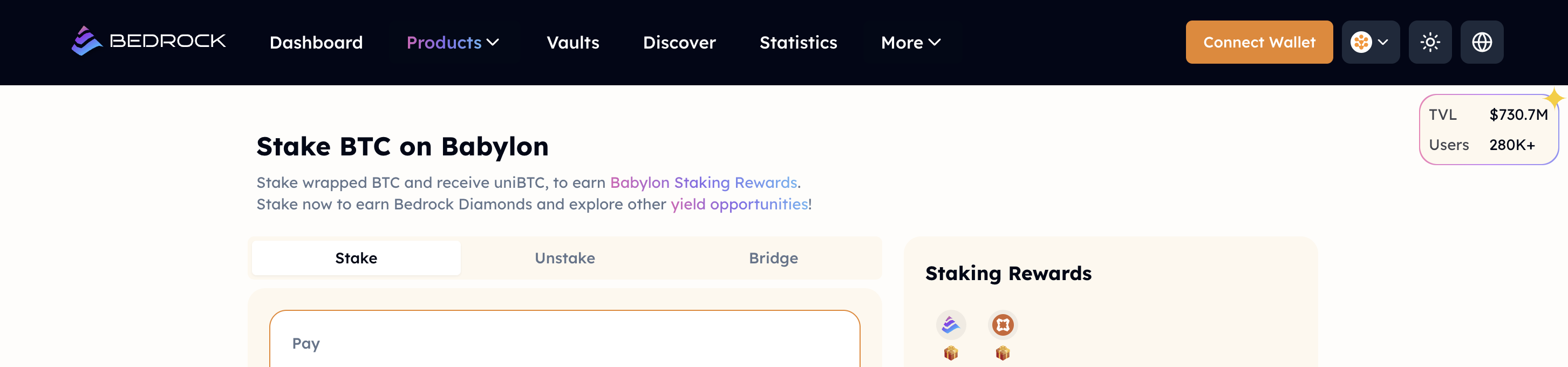

The trend is set, but challenges remain.

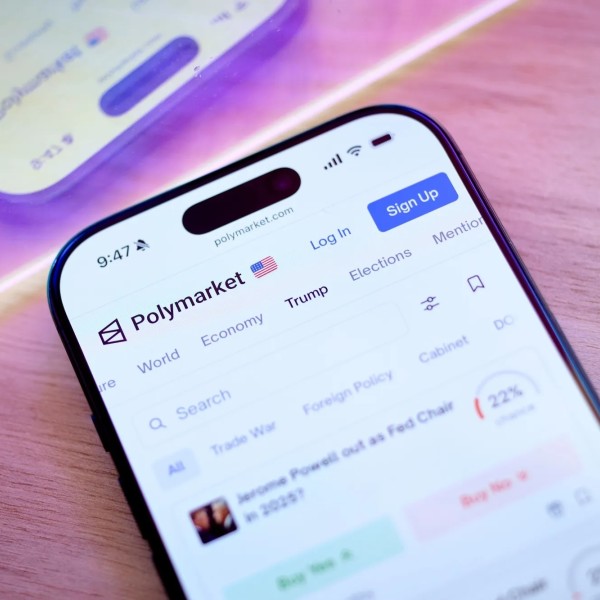

An in-depth analysis of the underlying logic and core value of prediction markets, along with a preliminary assessment of their key challenges and future development directions.

Is the Web3 phone truly an innovative product with real value, or is it merely a "pseudo-demand" that can only survive through external incentives?

Vibe Coding is an early-stage project with clear structural growth, strong potential for platform moat, and diverse, scalable application scenarios.

Solo is building a "trusted and anonymous" on-chain identity system based on its original zkHE architecture, which is expected to break through the long-standing challenges...

- 07:22Data: CryptoQuant: The Bitcoin bull market cycle is not over yet, with short-term support at $100,000.ChainCatcher news, according to CryptoQuant's weekly report analysis, as of now, whale addresses (addresses holding 100 to 1,000 bitcoins) collectively hold approximately 5.16 million BTC, accounting for 26% of bitcoin's circulating supply, making them the most important holding group in the current market. In 2025, whale addresses have accumulated an increase of about 681,000 BTC, while other address groups have shown a net decrease, indicating a trend of institutional investors absorbing retail investors' sell-offs. The annual growth rate of whale holdings is 907,000 BTC, higher than the 365-day average of 730,000 BTC, indicating that long-term demand remains strong. However, short-term momentum has weakened, and if the monthly accumulation rate fails to accelerate again, bitcoin's price may struggle to break through a new high of $126,000. Currently, bitcoin's resistance level is at $115,000, and the support level is at $100,000. If it falls below $100,000, it may trigger a further correction to around $75,000. Historical data shows that when the annual growth rate of whale holdings falls below the 365-day average, it often signals the end of a bull market. Current data suggests the market may still be in the late stage of a bull market, and future trends will depend on whether this group's accumulation speed can accelerate.

- 07:22Analysis: On the macro level, BTC interest has dropped to an accumulation zone, aligning with position accumulation before another growth phaseChainCatcher reported that CryptoQuant analyst Axel Adler Jr stated that the macro-level bitcoin heat has dropped to the bottom/accumulation area, indicating that speculative pressure has recently decreased. In a bull market, a decline in macro heat coincides with a period of position accumulation before the next growth phase. For a rebound to occur, volatility needs to decrease, and there should be no negative global triggers within a week.

- 07:08The U.S. September CPI report is scheduled to be released tonight at 20:30.Jinse Finance reported that the US September CPI report is scheduled to be released tonight at 20:30. As the US government shutdown enters its fourth week and less than a week remains before the Federal Reserve's October meeting, the risk of inflation returning to the "3" level is influencing the outlook for consecutive interest rate cuts. The recent surge in gold and silver prices during the data vacuum period will also face a major test. Investors are advised to pay close attention to related risks. (Golden Ten Data)