News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

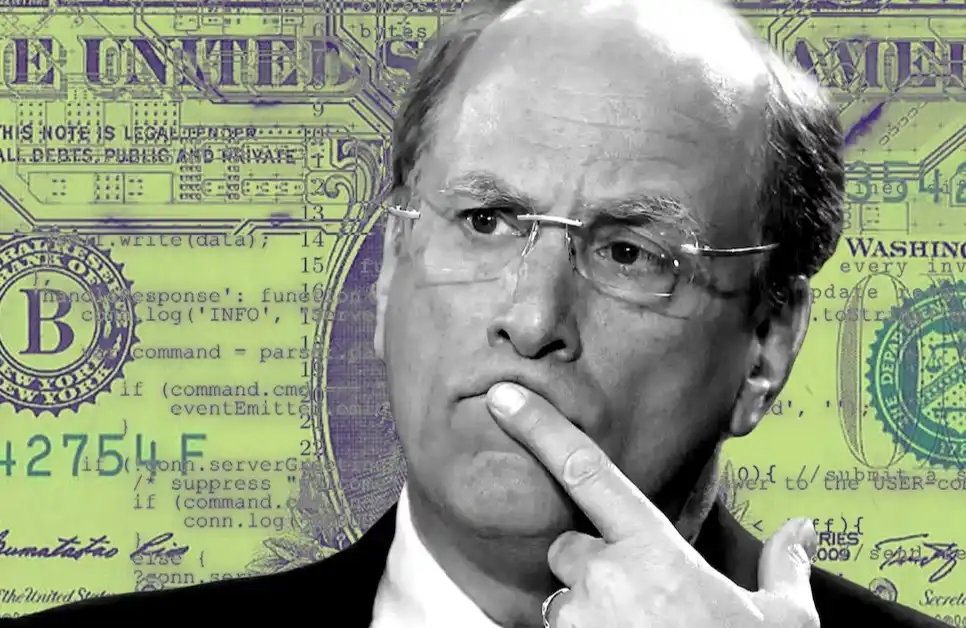

BlackRock has revealed that its goal is to bring traditional investment products such as stocks and bonds into the digital wallet, which is over a $4 trillion ecosystem.

From a $1.9 billion crypto collapse to new stablecoin and tokenization projects, global markets are struggling amid escalating US-China trade tensions and increasing regulatory pressure.

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average of only 6.9 seconds, using just 64 RTX 5090 GPUs.

Orderly ONE proves that sticking to one thing and doing it to the extreme is the right approach.

Brevis has achieved proof for 99.6% of Ethereum blocks within 12 seconds, with an average time of only 6.9 seconds, using just 64 RTX 5090 GPUs.

SBF interview: The bankruptcy lawyers won, the creditors received full repayment, and the one who could have made them even richer is now waiting for the day when the world recognizes the truth.

- 12:26Dolenc: The European Central Bank's future actions could be either raising or lowering interest ratesChainCatcher news, according to Golden Ten Data, European Central Bank Governing Council member Dolenc stated that the next move by the European Central Bank could be either a rate hike or a rate cut. The decline in inflation in 2026 may be lower than expected, and inflation risks are roughly balanced. He pointed out that it is difficult to find reasons for the European Central Bank to adjust interest rates in the coming months.

- 12:26BlackRock to launch a money market fund compliant with the GENIUS Act this ThursdayAccording to ChainCatcher, market sources report that BlackRock will launch a money market fund on Thursday that complies with the "Genius Act" bill, aiming to simplify the reserve asset custody process for stablecoin issuers.

- 12:26Federal Reserve Governor Waller Advocates Gradual Interest Rate CutsJinse Finance reported that Federal Reserve Governor Waller stated that officials could gradually ease monetary policy by cutting rates by 25 basis points at a time to support a weakening labor market; meanwhile, Milan continued to advocate for larger rate cuts. Waller said on Thursday: "You don't want to make a mistake, and the way to avoid mistakes is to proceed cautiously—cut by 25 basis points first, observe the results, and then decide what to do next." On the same day, Milan reiterated that a larger 50 basis point rate cut should be adopted, as rising trade tensions have increased downside risks to the economy, thus requiring a more rapid monetary policy easing. "I think we are very likely to see three rate cuts of 25 basis points each this year," Milan said. (Golden Ten Data)