News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

Crypto Capitalism, Crypto in the Age of AI

As volatility in the crypto industry continues to decrease, especially for industry professionals, where should they go next?

佐爷歪脖山·2025/11/11 16:22

Starknet Price Prediction 2025: Can STRK Recover 250% Surge Again?

Coinpedia·2025/11/11 16:21

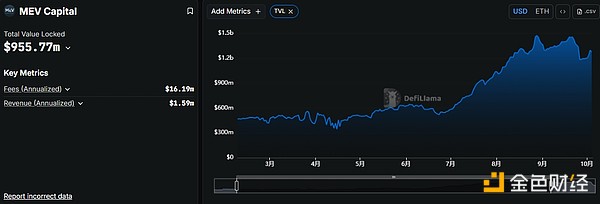

The Culprit Behind Stream’s Collapse: The Risks and Opportunities for DeFi Curators

金色财经·2025/11/11 16:15

Recent Bitcoin Drop Driven by Speculators, Not True BTC HODLers — Samson Mow

CryptoNewsFlash·2025/11/11 16:09

STRK Price Outlook: Zcash Connection Sparks Bullish Breakout for Starknet

CryptoNewsFlash·2025/11/11 16:09

Stellar Leverages LayerZero to Power a Unified Cross-Chain Value Network — $800M for Under $1 in Fees

CryptoNewsFlash·2025/11/11 16:09

Litecoin Founder Reflects on 14 Years of Innovation as LTC Gears Up for a Bullish Breakout

CryptoNewsFlash·2025/11/11 16:09

How Chainlink Is Powering ISO 20022 Messaging for the World’s Largest Financial Institutions

CryptoNewsFlash·2025/11/11 16:09

Canary XRP ETF Approved: Nasdaq Greenlights Spot XRP Listing With Ticker XRPC

CryptoNewsFlash·2025/11/11 16:09

XRP Takes Center Stage as Ripple Evolves Into a Global Finance Leader — CNBC Report

CryptoNewsFlash·2025/11/11 16:09

Flash

- 16:18Curvance completes $4 million strategic financingChainCatcher reported that the decentralized lending platform Curvance has announced the completion of a $4 million strategic funding round, led by F Prime Capital and 0xPrimal, with participation from Auros, GSR, Flowdesk, Q42, v3v ventures, and others. The project is positioned as a decentralized lending and collateral platform, supporting collateralization of yield assets such as LST, LRT, stablecoins, Pendle PT, and LP tokens. The team stated that the architecture is self-developed, introducing security designs such as dual oracle pricing, circuit breaker mechanisms, and MEV capture liquidation auctions. The funds from this round will be used for launch, auditing, team expansion, and integration of additional assets.

- 16:18A certain whale purchased 523,007 UNI through FalconX, worth $4.44 million.According to ChainCatcher, Lookonchain monitoring shows that a certain whale purchased 523,007 UNI through FalconX, worth 4.44 million US dollars.

- 16:15Bank of England Deputy Governor Broadbent: Weakening stablecoin regulation poses risksJinse Finance reported that Bank of England Deputy Governor Breeden stated that more work needs to be done to guide consumers in identifying unsafe tokens issued by El Salvador. Previous incidents involving Silicon Valley Bank and Circle withdrawals have provided guidance for the latest stablecoin proposals. Weakening stablecoin regulation poses risks. The UK needs to take a different approach from the US on stablecoin issues.