News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

Behind the surge in privacy coins: a flash in the pan or the dawn of a new era?

金色财经·2025/11/11 06:09

What has the Trump family been up to recently?

金色财经·2025/11/11 06:09

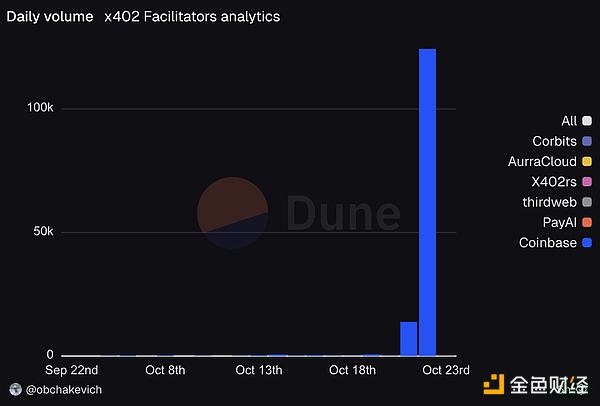

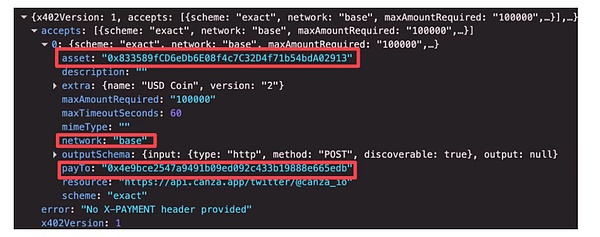

Speculation or real value? Will x402 trigger another Meme wave?

金色财经·2025/11/11 06:09

0xKevin: Insights for UXUY from BNB's All-Time High

金色财经·2025/11/11 06:07

Interpreting ERC-8021 Proposal: Will Ethereum Replicate Hyperliquid's Developer Get-Rich-Quick Myth?

ERC-8021 proposes to embed builder code directly into the transaction, along with a registry where developers can provide a wallet address to receive rewards.

BlockBeats·2025/11/11 05:30

$RAVE Unveils Tokenomics, Igniting the Decentralized Cultural Engine Powering Global Entertainment

$RAVE 不仅仅是一种代币,它代表着归属感与共同构建的力量。它为社区提供工具,让人们可以共同创作、分享价值,并将影响力回馈社会。

BlockBeats·2025/11/11 03:15

Burn, Uniswap's Final Ace

Hayden's new proposal may not necessarily save Uniswap.

BlockBeats·2025/11/11 03:08

With Faker's carrying, he won nearly $3 million dollars

Faker's 6th Crown, fengdubiying's Mythical Journey on Polymarket

BlockBeats·2025/11/11 02:40

Flash

- 06:52A certain whale address deposited 1.71 million UNI previously accumulated into an exchange at a loss.According to Jinse Finance, Lookonchain monitoring shows that a whale has deposited all 1.71 million UNI (worth $15 million), accumulated between February 4 and October 12, into an exchange. Selling now would result in a loss of $1.45 million.

- 06:52SoftBank Group: Sold its Nvidia shares in OctoberSoftBank Group stated that it sold its holdings in Nvidia for $5.83 billion in October. (Golden Ten Data)

- 06:46Bitget CEO: If the Federal Reserve pauses quantitative tightening and begins a rate-cutting cycle, bitcoin may reach a historic highChainCatcher News: In a recent article published by Forbes, Bitget CEO Gracy Chen's latest views on ETF capital inflows and the impact of institutional funds were cited. She pointed out that the core driving force behind the current bitcoin price has shifted to US market liquidity, rather than capital from Europe, the Middle East, or Asia. Funds from these regions are more inclined to flow into gold and the stock market, which also explains the strong performance of gold, AI-related US stocks, and Chinese stock indices since the beginning of this year. Gracy Chen believes that once the US government ends the shutdown in November, fiscal spending and market liquidity will restart; if the Federal Reserve pauses quantitative tightening in December and begins a rate-cutting cycle, a new bitcoin bull market may officially begin. As early as January this year, Gracy Chen boldly predicted, "BTC is expected to break through $130,000 and further surge towards $150,000 to $200,000." Although this target has not yet been achieved, she emphasized that once the government shutdown ends and the Federal Reserve turns to easing, it is only a matter of time before bitcoin reaches $150,000, whether in the fourth quarter of this year or the first quarter of next year. Personally, I have gone all in again, looking forward to witnessing bitcoin reach a new all-time high together with everyone.