News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

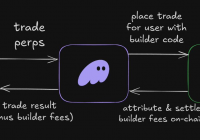

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Bitpush·2025/11/11 07:36

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

ForesightNews·2025/11/11 07:01

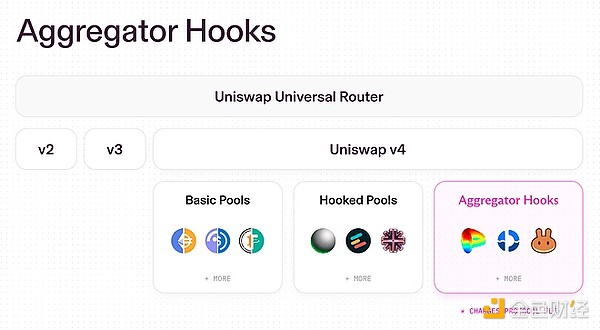

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

金色财经·2025/11/11 06:56

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.

BlockBeats·2025/11/11 06:33

The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.

ForesightNews 速递·2025/11/11 06:11

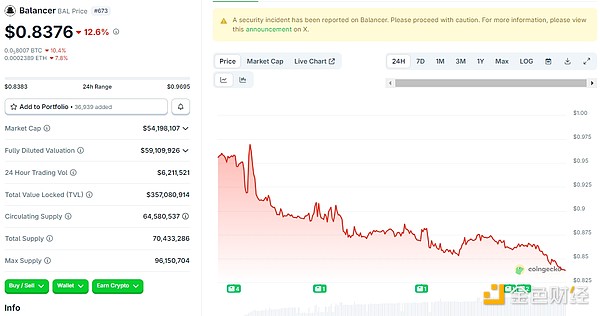

Behind the surge in privacy coins: a flash in the pan or the dawn of a new era?

金色财经·2025/11/11 06:09

What has the Trump family been up to recently?

金色财经·2025/11/11 06:09

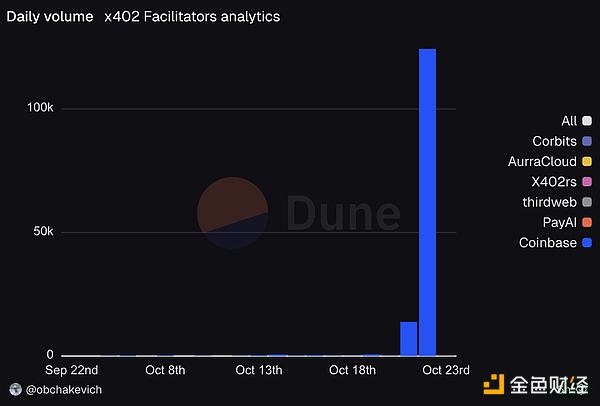

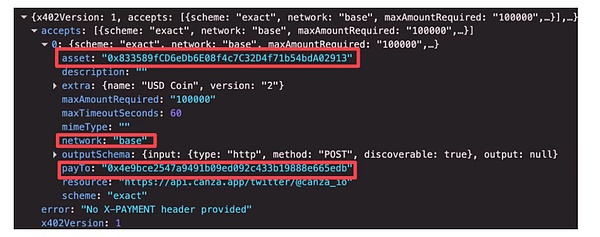

Speculation or real value? Will x402 trigger another Meme wave?

金色财经·2025/11/11 06:09

Flash

- 07:35Data: A certain whale/institution has cumulatively deposited 892 million USDT into a certain exchange and withdrawn 266,895 ETH in the past week.According to ChainCatcher, on-chain data analyst Yu Jin has monitored that the whale/institutional address, which previously made a profit of $24.48 million by shorting ETH and then switched to going long, has cumulatively borrowed 190 million USDT from Aave and transferred it to a certain exchange, then withdrew 75,418 ETH (approximately $269 million). Over the past week, a total of 892 million USDT has been transferred into a certain exchange platform, and 266,895 ETH has been withdrawn at an average price of $3,402.

- 07:10Argentine judge orders freezing of assets related to the Meme coin LIBRA supported by the country's President MileiAccording to ChainCatcher, market sources report that Argentine judge Marcelo Giorgi has ordered the freezing of assets related to the Meme coin LIBRA scandal supported by President Milei. An indefinite "prohibition order" has been imposed on the properties and financial assets of Hayden Davis and two cryptocurrency operators (Argentine Orlando Mellino and Colombian Favio Rodriguez). The wallets of these two operators have shown suspicious activity and are currently under judicial review. Federal prosecutor Eduardo Taino requested this measure, which was supported by technical reports from departments related to financial investigation and illegal asset recovery, and recommended prosecution against the three individuals. The judge determined that the case met the requirements of reasonable suspicion and risk of delay, and approved the asset preservation request. Investors have lost approximately $100 millions to $120 millions due to this incident. The judge emphasized that the prohibition order is only valid for the strictly necessary period and also ordered the National Securities Commission to be notified, expanding the scope of the asset freeze to all related platforms within Argentina. In addition, the prosecution found that 42 minutes after Milei posted a tweet with a selfie with Davis, Davis transferred $507,500 through Bitget. These transfers may constitute indirect bribery.

- 07:10Data: FARTCOIN market cap briefly drops 10%, with over $7.87 million in liquidations across the network in the past hour, ranking firstAccording to ChainCatcher, monitored by GMGN, the market cap of the meme coin FARTCOIN on the Solana chain reached 300 million USD, then briefly dropped by 10%, and is now quoted at 0.306 USD. As a result, in the past hour, total liquidations across the network exceeded 7.87 million USD, ranking first, and in the past 4 hours, liquidations reached 9.56 million USD, with long positions accounting for about 99%. Network-wide liquidations were second only to BTC. In addition, according to HyperInsight monitoring, FARTCOIN liquidations on Hyperliquid accounted for about 47% of the total network, with the largest FARTCOIN long position already showing an unrealized loss of 240,000 USD (97%), a position size of about 2.5 million USD, and a liquidation price of 0.297 USD, only about 2.3% away from liquidation. ChainCatcher reports that the recent volatility in the cryptocurrency market has increased significantly, and investors should pay attention to risk control.