News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

AICoin·2025/11/11 07:50

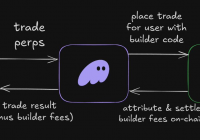

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Bitpush·2025/11/11 07:36

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

ForesightNews·2025/11/11 07:01

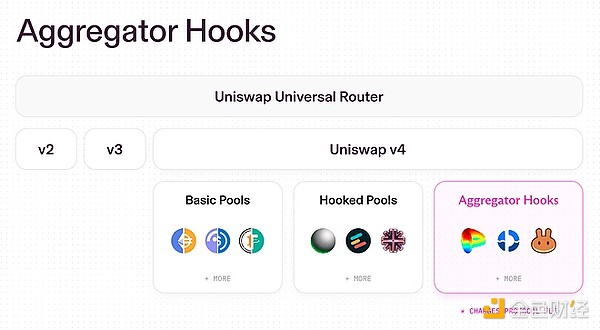

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

金色财经·2025/11/11 06:56

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.

BlockBeats·2025/11/11 06:33

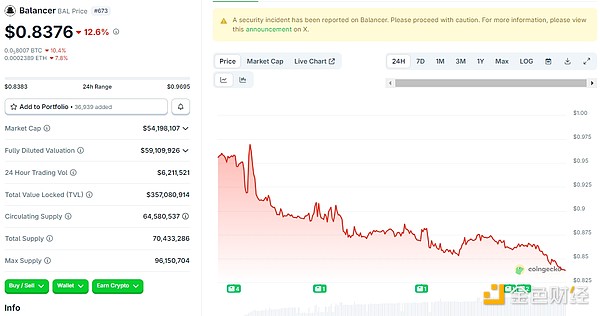

The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.

ForesightNews 速递·2025/11/11 06:11

Behind the surge in privacy coins: a flash in the pan or the dawn of a new era?

金色财经·2025/11/11 06:09

What has the Trump family been up to recently?

金色财经·2025/11/11 06:09

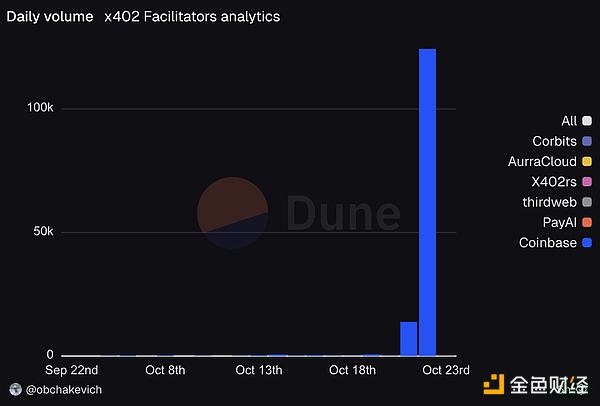

Speculation or real value? Will x402 trigger another Meme wave?

金色财经·2025/11/11 06:09

Flash

- 07:48Matrixport withdraws 872 BTC from a certain exchange, worth approximately $91.68 million.According to ChainCatcher, Lookonchain monitoring shows that Matrixport recently withdrew 872 BTC from a certain exchange, valued at approximately 91.68 million US dollars.

- 07:4210sSOON's second round trading volume overwhelmed a certain exchange's Facilitator, causing downtime; refunds have been completed.Foresight News reported that SOON has issued an announcement stating that due to excessive trading volume in the second round of the 10sSOON event (over 220,000 transactions completed within two hours), a Facilitator at a certain exchange experienced downtime. All 32,147 USDC refunds have now been processed, and half of the proceeds from the second round (61,019 USDC) have been added to the 10s token's LP. In addition, the official team stated that they are developing their own high-performance Facilitator. The third round of the event will introduce multiple Facilitators.

- 07:42CryptoQuant Analyst: STH MVRV Index Shows Signs of Stabilization, Rebounding from 0.9124 to 0.9514Foresight News reported that CryptoQuant analyst Axel Adler Jr tweeted, "On November 7, the STH MVRV index hit a local low of 0.9124, approaching the lower bound of its statistical range. As of today, the index has shown signs of stabilization, rebounding from 0.9124 to 0.9514. If this indicator remains above 0.92, it may start to move towards the upper bound of the range, which could correspond to $115,000 to $120,000." Foresight News notes that the STH MVRV index (Short-Term Holder Market Value to Realized Value Ratio) is an on-chain analysis metric for bitcoin, mainly measuring the average profit or loss status of Short-Term Holders.