News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Prediction markets are becoming the focus of community discussions; however, beneath the immense spotlight, several major questions and concerns are gradually emerging.

For exchanges and market makers, keeping retail investors trading continuously, engaging in repeated speculation, and retaining them long-term is far more profitable than "flushing out retail investors once a year."

Everyone should have their own mission, no matter how big or small, as long as it makes you happy.

A brutal "Squid Game".

USDe withstood the test during a record-breaking liquidation day in October, and remains safe unless multiple "black swan events" occur simultaneously.

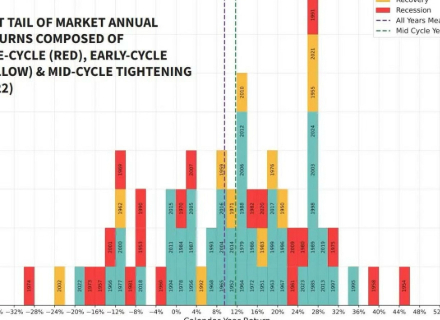

The global economy faces risks from feedback loops among policy, leverage, and confidence. Technology supports growth, but fiscal populism is on the rise and trust in currency is gradually eroding. Trade protectionism and speculative AI-driven finance are intensifying market volatility. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

- 06:50Pepperstone: Unless there is a macroeconomic downside risk, the potential for further gains in US Treasury bonds will diminish.Jinse Finance reported that during the Asian trading session, U.S. Treasury yields edged lower, with the 10-year Treasury yield further falling below 4%. Pepperstone analyst Michael Brown stated in a report: "I find it difficult to justify the two-year (U.S. Treasury yield) dropping significantly below 3.50% or the 10-year (U.S. Treasury yield) dropping significantly below 4.00%, because the U.S. is outperforming other countries, inflation remains high, and overall risk appetite is positive." He said that unless there are major, potentially unexpected macroeconomic downside risks, the room for further gains in U.S. Treasuries is expected to diminish, especially for long-term bonds. (Golden Ten Data)

- 06:50Nikkei 225 Index hits record-high closing levelJinse Finance reported that the Nikkei 225 Index closed up 130.56 points, or 0.27%, at 49,316.06 points on Tuesday, October 21. (Golden Ten Data)

- 06:43SpaceX transfers BTC worth $268 million again after three monthsChainCatcher news, recently, according to on-chain analyst Ai Aunt (@ai_9684xtpa), SpaceX has once again transferred BTC worth $268 million after a three-month interval. Among them, 1,187 BTC have been transferred to address bc1qq...4sduw, and 1,208 BTC have been transferred to address bc1qj7...6kqef. Currently, neither of the receiving addresses has moved or sold the BTC. It is worth noting that in July, the receiving address for SpaceX's transfer was marked by Arkham as a Prime Custody address of an exchange, so this time it may also just be a wallet reorganization.