News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The infinite computing layer leads the way for real-world applications.

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

Digital intelligence gains embodiment, with thought and action merging in the field of robotics.

A "long-awaited" data release and an unchanged decision? Although inflation is expected to return to the "3 handle," traders are almost fully betting that the Federal Reserve will cut interest rates again later this month.

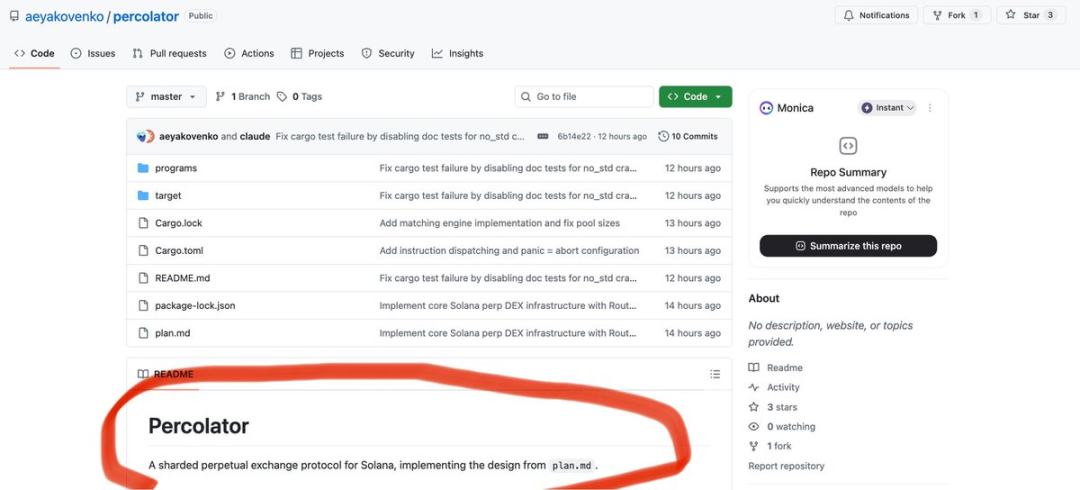

Solana has the potential to provide Perp DEX infrastructure with a real application scenario that can meet the trading demands of traditional financial assets, rather than remaining limited to native crypto asset trading.

When Trump's decision to cancel the summit and the heavy blow targeting the lifeblood of the Russian economy struck simultaneously, the Kremlin remained unexpectedly silent...

DeriW may be becoming the starting point of a new round of dividends. In March 2025, Hyperliquid due to ...

- 13:05Lindsay Rosner: Today's report is not enough to make the Federal Reserve "panic," and a rate cut in December is still possibleAccording to ChainCatcher, citing Jinse Finance, Lindsay Rosner, Head of Multi-Sector Fixed Income Investing at Goldman Sachs, stated that ahead of the Federal Reserve's expected rate cut next week, today's report is not sufficient to cause "panic," and the possibility of a rate cut in December still exists.

- 13:03Aster: Plans to use 70-80% of S3 fees for ASTER buybacks, with specific allocation depending on market conditionsOn October 24, Aster announced that its current goal is to allocate 70-80% of S3 fees for ASTER buybacks, with the specific distribution depending on market conditions. The final results will be announced after the end of S3. The team stated that as a growing project, maintaining operational flexibility is crucial in the current uncertain market environment. Details regarding future quarters’ airdrops and buybacks will be announced separately once confirmed.

- 12:53US September inflation rate rises to 3%, providing grounds for Fed rate cutsAccording to ChainCatcher, citing Jinse Finance, the U.S. Consumer Price Index (CPI) for September rose by 3% year-on-year, lower than the market expectation of 3.1%, and up from 2.9% in August. This data paves the way for the Federal Reserve to continue cutting interest rates next week, with the market widely expecting the Fed to cut rates by another 25 basis points at this policy meeting. The U.S. dollar and Treasury yields edged down slightly as a result.