News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Reviewing GBTC and gold ETF to extrapolate trends in the crypto market.

While all eyes are on Plasma, what exactly is Stable doing?

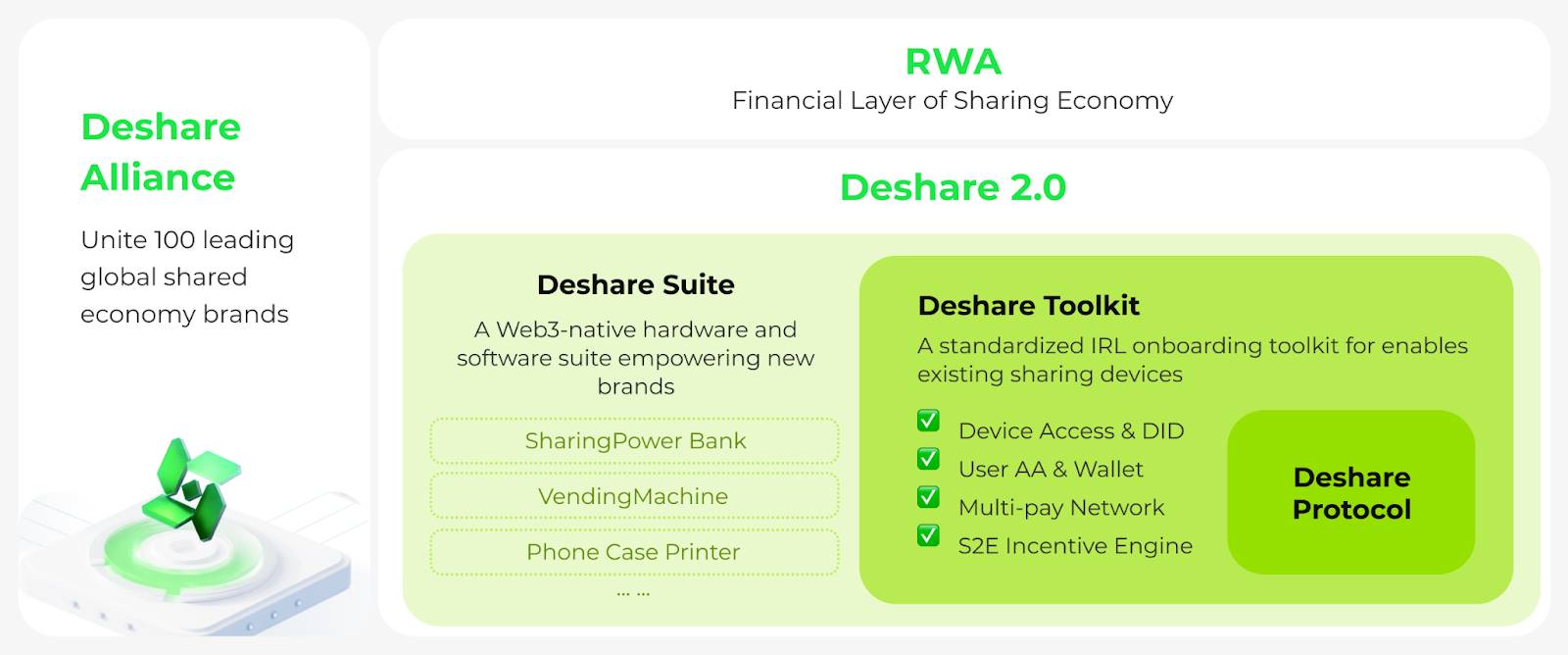

Deshare 2.0 marks an upgrade in shared economy infrastructure: moving from "trusted data" to "trusted devices."

The role of cryptocurrency in Argentina has fundamentally changed: it has shifted from being a novelty that sparked curiosity and experimentation among the public, including Milei himself, to becoming a financial tool for people to protect their savings.

The Uniswap Foundation has granted funding to Brevis to develop and implement a "Trustless Routing Rebate Program," offering up to $9 million in gas fee rebates for routers integrating v4 Hook pools.

Bitcoin's Uptober could break its 8-year green streak. Will Moonvember bring a turnaround?Can Moonvember Save the Trend?What to Watch Next

- 20:05All three major U.S. stock indexes closed higher, each reaching new record highs.Jinse Finance reported that all three major U.S. stock indexes closed higher, each reaching new record highs. The Nasdaq rose 1.15%, the Dow Jones increased by 1.01%, and the S&P 500 index gained 0.79%.

- 19:11US government "shutdown" enters its 24th day, over 500,000 federal employees fail to receive salariesJinse Finance reported that on October 24 local time, as the U.S. government shutdown entered its 24th day, more than 500,000 federal employees failed to receive their full paychecks on time this week. The Senate is currently in recess, and the shutdown is expected to continue until next Monday. Due to significant differences between the Republican and Democratic parties on core issues such as healthcare-related welfare spending, the Senate failed to pass a new temporary funding bill before the end of the last fiscal year on September 30, resulting in the federal government running out of funds to maintain normal operations and entering a "shutdown" starting October 1.

- 18:41Tether plans to launch the US-compliant stablecoin USAT in December, targeting 100 million US users.Jinse Finance reported that Tether CEO Paolo Ardoino stated the company plans to launch the US dollar stablecoin USAT, compliant with the GENIUS Act regulations and targeting the US market, in December. By leveraging platforms such as Rumble, Tether aims to expand its potential user base to 100 millions. USAT will be issued by a joint venture between Tether and the regulated crypto bank Anchorage Digital. Ardoino said the company will continue to invest in content platforms and social media to drive creator economy payment applications, competing for market share with rivals such as PayPal. Meanwhile, Tether's flagship stablecoin USDT supply has increased to 182 billions, maintaining its dominant position in the approximately 300 billions stablecoin market. The market value of XAUT, backed by physical gold, has surpassed 2.2 billions this year, more than tripling since the beginning of the year, mainly driven by retail demand.