News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 17) | $127M in Liquidations Across the Market in the Past 4 Hours; Major Token Unlocks This Week for ZRO, ZK and Others; Michael Saylor Releases New Bitcoin Tracker Update2Bitcoin hits 6-month low as AI fears add to risk-off mood: How are pro traders positioned?3Spain Pins X for Illegal Crypto Promotion

CZ's personal lawyer responds to "insider deal of money and pardon with Trump"

What is the likelihood of CZ returning to Binance?

BlockBeats·2025/11/17 10:23

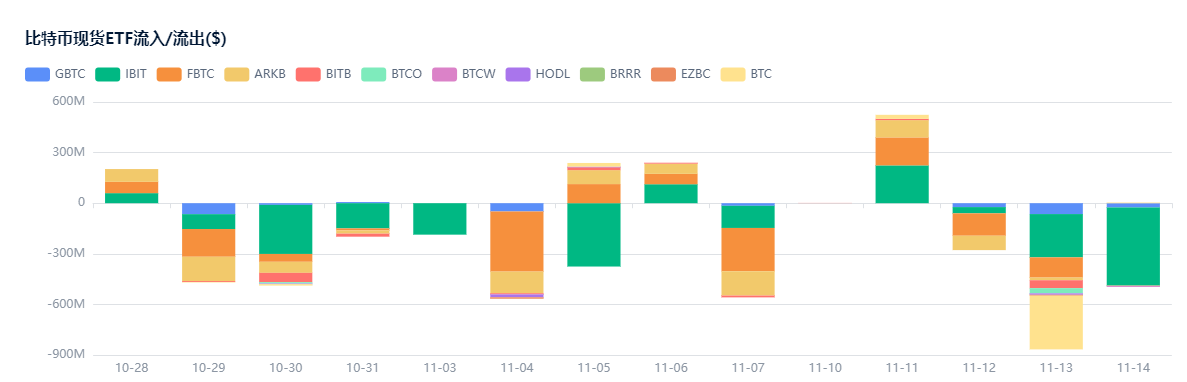

Data Insights: Who is Buying and Who is Selling BTC and ETH?

Long-term BTC holders continue to sell and take profits.

ForesightNews 速递·2025/11/17 10:02

Zhao Changpeng's lawyer shares the behind-the-scenes story of the "pardon"

Exclusive Interview with CZ’s Lawyer: Reasons for the Pardon, Process Details, and Clarification of “Money-for-Power” Allegations

Chaincatcher·2025/11/17 09:50

Bitcoin falls below $94,000 as the bear market continues to deepen!

AICoin·2025/11/17 09:43

After the major reshuffle in the crypto market, the true structural bottom has emerged.

Bitpush·2025/11/17 09:35

ReChange: NFT-driven engine on the TBC public chain, making every transaction flow like a stream

ReChange enables NFTs to "circulate endlessly."

ForesightNews·2025/11/17 08:23

In this bull market, even those who stand still will be eliminated: only "capital rotation" can survive the entire cycle.

BTC_Chopsticks·2025/11/17 07:13

Summary of the 7 deadly mistakes in the crypto market: 99% of traders keep repeating them

BTC_Chopsticks·2025/11/17 07:13

Flash

- 10:23SlowMist Reports Critical Vulnerability in NOFX AI Automated Trading System, Urges Immediate UpgradeAccording to ChainCatcher, the SlowMist security team recently analyzed the open-source automated futures trading system NOFX AI, which is based on DeepSeek/Qwen, and discovered multiple critical authentication vulnerabilities. They pointed out that the system has a "zero authentication" mode enabled by default, where the administrator mode is directly activated, allowing all requests to pass without verification. Attackers can access /api/exchanges and obtain the complete API key and private key. In the "authorization required" mode, although JWT is added, the default jwt_secret still exists, and if the environment variable is not set, it will revert to the default key. In addition, in this mode, sensitive fields are still output as raw JSON, so if the token is forged or stolen, it will also lead to key leakage. SlowMist stated that so far, they have identified over a thousand publicly deployed instances using vulnerable configurations and have coordinated with a certain exchange's security team to complete the replacement of related credentials. The team reminds all users to upgrade their systems immediately, especially those running bots on Aster or Hyperliquid, who should check their settings as soon as possible.

- 09:59RootData releases a "zombie projects" compilation and will regularly disclose inactive crypto projects.ChainCatcher reports that RootData has released a compilation of "zombie projects," which will be continuously updated. This compilation aims to help investors identify potential risks and promote the healthy development of the industry ecosystem. It is reported that the first batch of this compilation exposes 76 "zombie projects," covering areas such as DeFi, NFT, GameFi, and infrastructure. Most of these projects originated during the bull-to-bear transition period of 2022-2023. After the financing boom subsided, these projects became inactive, with no updates to product features or operational activities in the past six months, thus becoming "zombie" projects. Risk Warning

- 09:53US crypto-related stocks generally rise in pre-market tradingChainCatcher news, according to Golden Ten Data, after the prices of bitcoin and ethereum rose, US stocks related to cryptocurrencies moved higher in pre-market trading. Riot Platforms (RIOT.O) rose 0.6%, Hut 8 Mining increased by 2.5%, Mara Holdings was up 1.4%. A certain exchange rose 1%, Bitfarms increased by 2.3%, and Strategy was up 1.4%. PROSHARES Bitcoin Strategy ETF rose 1.6%, and iShares Bitcoin Trust increased by 1.5%. .