News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 12)|Solana financial firm Upexi posts record quarterly results; Nick Timiraos: “Fed increasingly divided over December rate cut”; Injective launches native EVM mainnet, advancing MultiVM roadmap2Zero flow to Bitcoin ETFs: The market sulks despite a favorable context3Chainlink Price Prediction 2025: Is LINK Positioned to Gain Most from Tokenization Growth?

Bitcoin ‘Wave 3’ expansion targets $200K as sell-side pressure fades: Analyst

Cointelegraph·2025/11/12 03:30

Market sentiment in the crypto space remains fragile; even the positive news of the "U.S. government shutdown" ending failed to trigger a meaningful rebound in bitcoin.

After last month's sharp drop, Bitcoin's rebound has been weak. Despite traditional risk assets rising due to the US government reopening, Bitcoin has failed to break through a key resistance level, and ETF inflows have nearly dried up, highlighting a lack of market momentum.

ForesightNews·2025/11/12 03:12

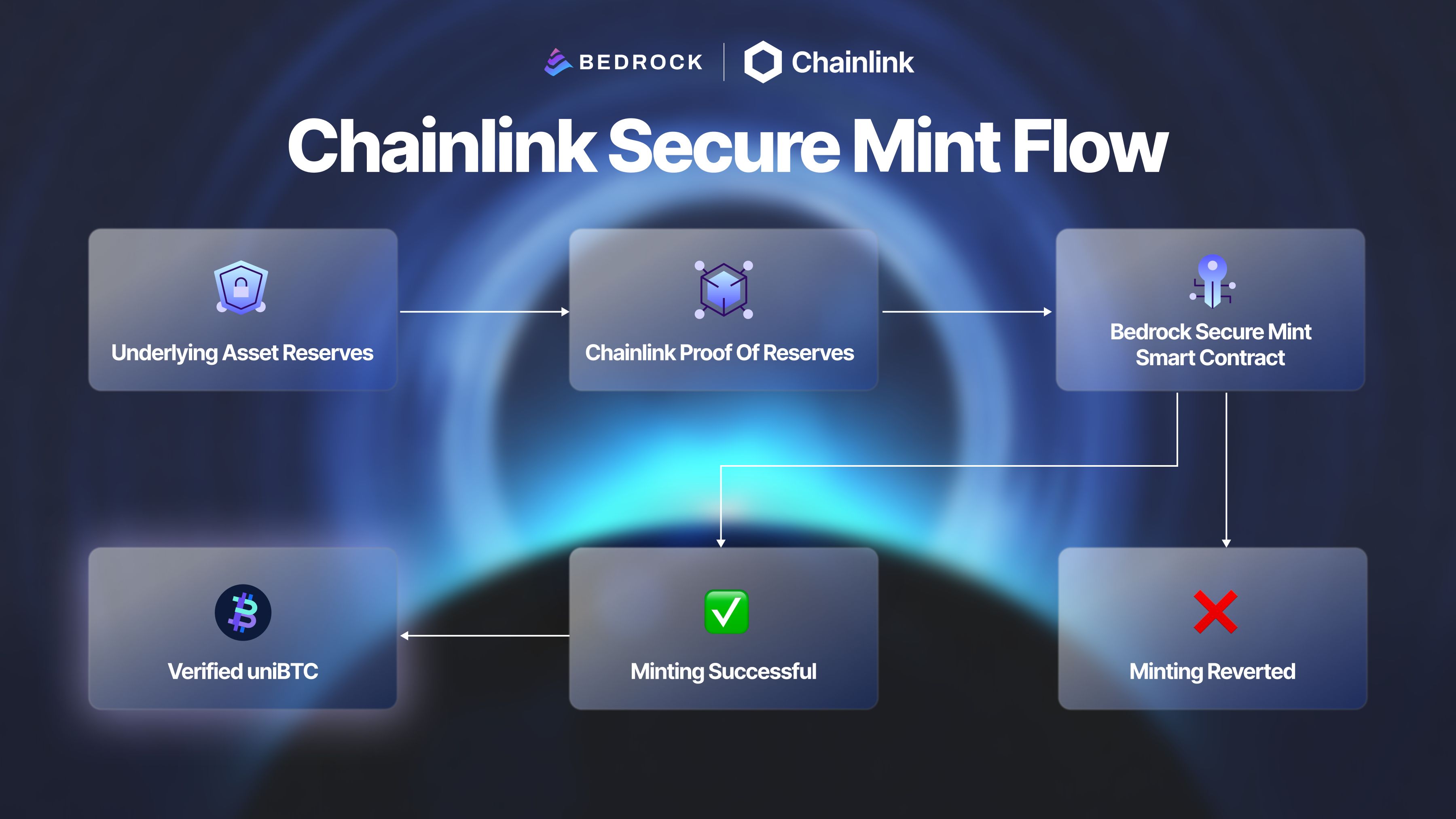

How Bedrock Strengthens BTCFi Security With Chainlink Proof of Reserve and Secure Mint

Bedrock·2025/11/12 02:48

By winning the championship with Faker, he earned nearly $3 million.

Faker's sixth championship also marks fengdubiying's legendary journey on Polymarket.

BlockBeats·2025/11/12 02:22

Warren Buffett's "Last Letter" in Full: "I Was Just Lucky," But "Father Time" Has Caught Up

Buffett concluded his legendary 60-year investment career with the British expression "I'm 'going quiet'" in his letter.

ForesightNews·2025/11/12 02:21

Bitcoin Eyes Year-End ‘Santa Claus Rally’ After October Setbacks

Cointribune·2025/11/11 23:51

SOL Price Prediction 2025: Is Solana Heading Toward a Deeper Correction Before 2025?

Coinpedia·2025/11/11 23:33

Metaplanet Sees 66% Surge in Japanese Shareholders, Reaching Nearly 0.2% of Population

Coinpedia·2025/11/11 23:33

How High Will XRP Price Go After Canary Capital’s XRP ETF Launch On Thursday?

Coinpedia·2025/11/11 23:33

Bitcoin Price Prediction: Bulls Holds the Line at $100K, But Is a Pullback Coming?

Coinpedia·2025/11/11 23:33

Flash

- 04:51Analyst: $100,000 is the next key support level for bitcoin; further decline could trigger more sell-offs and increase market volatility.BlockBeats News, November 12, according to The Block, Kronos Research Chief Investment Officer Vincent Liu stated: "The decline in bitcoin was mainly due to profit-taking and a large number of long positions being closed after failing to reclaim the $107,000 resistance level." He pointed out that bitcoin's brief rebound was driven by the U.S. Senate passing the government restart bill, which boosted market risk appetite. However, this was not enough to offset the pressure from profit-taking, leveraged liquidations, and ongoing technical weakness. Vincent Liu said: "The rebound brought by macro positives quickly faded." He noted that $100,000 is the next key psychological support level, and "further declines could trigger more selling and intensify market volatility."

- 04:36RISE announces acquisition of BSX Labs; 1.5% of the total RISE token supply will be allocated to circulating BSX tokens.ChainCatcher reported that Ethereum Layer 2 network RISE has announced the acquisition of BSX Labs, the team behind the Base network Perp DEX platform BSX. BSX Labs will assist RISE in developing EVM-based, synchronizable and composable order book infrastructure components to bridge with traditional financial markets. BSX token holders will be eligible to receive an airdrop of RISE’s upcoming native token, with 1.5% of the total RISE token supply allocated to BSX tokens currently circulating in the market. The BSX DEX will officially shut down on November 11, 2025, at 15:00 (UTC).

- 04:36Trader Eugene: Uniswap's activation of the fee switch is positive for DeFi, and the future of the crypto market will become more similar to traditional stock markets.ChainCatcher News, trader Eugene Ng Ah Sio posted on his personal channel, stating, "There is a phenomenon of 'missing the forest for the trees' in the discussion about Uniswap enabling the fee switch. What we are witnessing is how crypto-friendly regulatory frameworks are changing value accrual strategies at the protocol level, which ultimately benefits token holders. This is a very positive step forward for the entire DeFi industry and sets a useful precedent for future protocols. As insider selling gradually comes to an end, active market participants will be able to value these protocols more reliably based on fundamentals. At that point, the crypto market will have fewer casino-like characteristics and more features of the traditional stock market."