News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Holesky testnet shutdown begins this week, with operators deactivating nodes over ten days. Ethereum Foundation cites completion of Fusaka testing and technical evolution as reasons for closure. Validators should migrate to Hoodi, while developers move to Sepolia for application testing. The shift marks Ethereum’s new modular testnet era, ensuring faster, cleaner, and scalable testing environments.References 🚨 UPDATE: Ethereum Foundation announces Hol

A monologue from an ETH Maxi.

Prediction markets are becoming the focus of community discussions; however, beneath the immense spotlight, several major questions and concerns are gradually emerging.

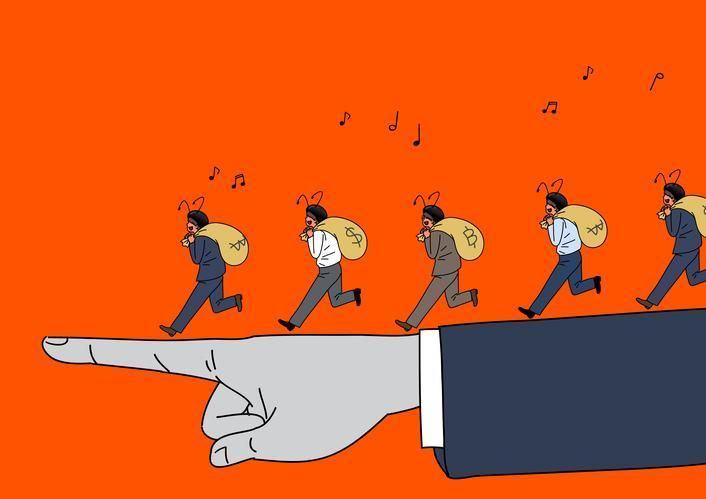

For exchanges and market makers, keeping retail investors trading continuously, engaging in repeated speculation, and retaining them long-term is far more profitable than "flushing out retail investors once a year."

Everyone should have their own mission, no matter how big or small, as long as it makes you happy.

A brutal "Squid Game".

- 09:00An investment institution sold 733,000 HYPE and accumulated 142,000 SOL within 4 hours.According to ChainCatcher, on-chain analyst EmberCN (@EmberCN) monitored that an investment institution, which received an allocation of 1 million SOL, sold 733,000 HYPE (worth $26.31 million) in the past 4 hours. Subsequently, the institution bridged USDC back to the Solana network and purchased 142,000 SOL. Currently, the institution holds 1.216 million SOL (worth $224 million) and 1.42 million HYPE (worth $50.5 million).

- 08:47Swing whale (0x469) opened a 40x short position on BTC at $107,700, with a position value reaching $10.53 million.According to ChainCatcher, monitored by HyperInsight, in the past two hours, a whale with address starting 0x469 closed a long position in BTC at $107,700 for a stop loss and then opened a 40x short position. The current notional value of the position is approximately $10.53 million. Additionally, monitoring shows that this address has been actively buying low and selling high across multiple tokens in recent days, with a 24-hour profit of about 15%. Furthermore, the total notional value of this address's positions is approximately $43.48 million, with the main positions distributed as follows: $12.04 million in XRP shorts, $10.53 million in BTC shorts, and $9.21 million in SOL longs.

- 08:35About 1,500 BTC were transferred from Ceffu to an exchange approximately 6 minutes ago, valued at around $162 millions.According to ChainCatcher, as monitored by Whale Alert, 1,500 bitcoins were transferred from the custody platform Ceffu to an exchange 6 minutes ago, with a value of approximately $161,709,511.