Whales Add $3 Million in AAVE as Governance Uncertainty Pressures Price

By:BeInCrypto

The AAVE price has been under steady pressure. The token is down nearly 5% over the past 24 hours and more than 18% over the past seven days. That weakness has played out alongside ongoing DAO governance disputes and renewed sell-off fears. On the surface, this looks like a distribution. Exchange balances are rising, and sentiment has cooled. But under the hood, something does not line up. While supply is moving toward exchanges, large holders have quietly stepped in, treating the sell-off as an entry point rather than an exit. The question now is simple. What bullish setup are whales positioning for while the market focuses on governance risk? Exchange Supply Rises as Governance Pressure Lingers Aaves sell-off did not appear out of nowhere. Governance tensions have been building for weeks, creating uncertainty around revenue flows and DAO control. That uncertainty has shown up clearly in on-chain supply data. 🚨 @aave is having a full blown civil warAnd it might be the biggest governance fight defi has ever seen.Heres a clean breakdown 👇Aave has two sides: Aave labs a centralised entity founded by stani Aave dao token holders who govern the protocolNow heres what pic.twitter.com/zFnhcN5vSc Observe (@obsrvgmi) December 22, 2025 Since December 16 (Poison Pill proposal day), AAVE supply on exchanges has climbed from roughly 1.22 million tokens to about 1.42 million tokens. That is an increase of nearly 200,000 AAVE, or roughly 16%, in just over a week. Aave DAO Faces Governance Clash Over Control of Aave Labs 👀An AAVE token holder has proposed a controversial poison pill strategy that would allow the Aave DAO to seize control of Aave Labs intellectual property, brand, and equity, effectively turning the company into a DAO pic.twitter.com/SC1gd1KYhs Karon (@pangestu_karon) December 18, 2025 Rising exchange balances usually signal potential selling pressure, and the price action confirms that concern, with AAVE sliding almost 18% over the same period. Exchange Balances Grow: Santiment Want more token insights like this?Sign up for Editor Harsh Notariyas Daily Crypto Newsletterhere. This shift is notable because it reverses what happened earlier in the month, on December 16. When Aaves regulatory overhang eased in mid-December, exchange balances dropped sharply as confidence improved. Now, with governance issues dragging on, supply has moved back toward exchanges, reinforcing near-term caution. On its own, this setup looks bearish. But the exchange supply is only one side of the market. Whales Buy the Dip as Sell-Off Fears Peak While exchange balances have increased, large holders have moved in the opposite direction. Over the past 24 hours, Aave whales increased their holdings by 12.63%, bringing their total stash to 183,987 AAVE. That implies fresh accumulation of roughly 20,600 tokens, worth about $3.1 million at current prices. At the same time, public figure wallets, which include verified funds and well-tracked entities, raised their holdings by 13.55%, lifting their balance to 274,652 AAVE. That increase represents roughly 32,700 tokens, or about $5 million. AAVE Whales: Nansen Combined, these two cohorts added more than 53,000 AAVE in a single day. At the current price, that is over $8 million accumulated directly into weakness. This divergence matters. When exchange supply rises, but whales accumulate, it often reflects short-term fear being absorbed by longer-term conviction. Instead of reacting to governance noise, large holders appear to be positioning around structure, not headlines. That brings us to the chart. The Bullish AAVE Price Trigger Whales Are Positioning For? The price action provides the missing link. AAVE has repeatedly defended the $147 zone, forming the head of a developing inverse head-and-shoulders pattern. This pattern typically signals a possible trend reversal after prolonged downside pressure, especially when it forms during elevated fear. The structure remains compressed under a descending neckline line, meaning sellers still control the broader trend. But the trigger is clear. A decisive move above $182 would begin to shift momentum. Clearing $193 would confirm the breakout and open upside toward $207, then $232, with $248 as the larger recovery target. AAVE Price Analysis: TradingView The risk is equally defined. If AAVE loses $147, the bullish structure breaks. That would likely invite renewed selling pressure, with downside risk toward $127. For now, whales appear to be betting that support holds, and structure resolves higher. Read the article at BeInCrypto

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Solana (SOL) Under Pressure Despite ETF Inflows as Traders Watch $110 Support Zone

Newsbtc•2025/12/23 20:03

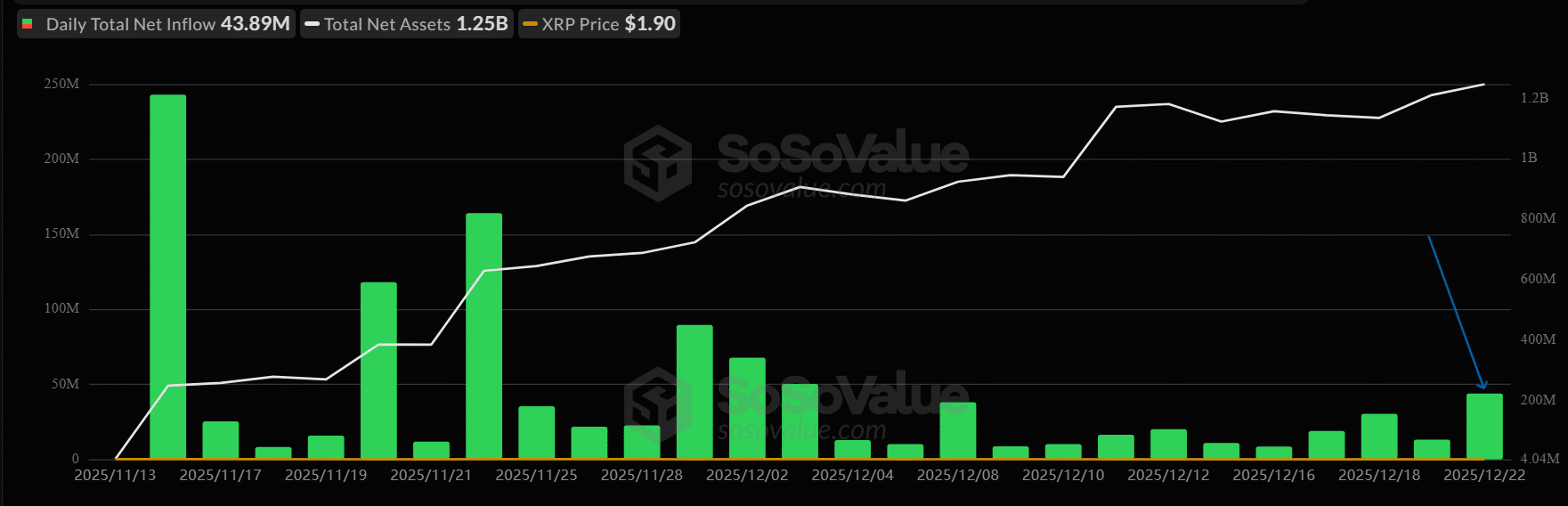

$43.89M flows into XRP ETFs despite falling sentiment – Here’s why

AMBCrypto•2025/12/23 20:03

PlayAstroon Taps Cache Wallet to Advance Web3 Onboarding and Security

BlockchainReporter•2025/12/23 20:00

ZOOZ Strategy Receives Nasdaq Delisting Warning As Bitcoin Treasury Stock Falls Below $1

BTCPeers•2025/12/23 20:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,518.41

-0.70%

Ethereum

ETH

$2,941.02

-1.39%

Tether USDt

USDT

$0.9995

-0.02%

BNB

BNB

$840.54

-1.99%

XRP

XRP

$1.88

-1.22%

USDC

USDC

$0.9998

+0.02%

Solana

SOL

$123.54

-1.17%

TRON

TRX

$0.2824

-0.72%

Dogecoin

DOGE

$0.1287

-2.56%

Cardano

ADA

$0.3608

-2.35%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now