Zcash Price Loses a Key Historical Support As 10% Downside Risk Builds

By:BeInCrypto

Zcash price has slipped sharply, falling more than 6% over the past 24 hours. Even after the drop, it is still up about 9% week-on-week. But this downside move does not look random. The market is reacting to a technical shift that has mattered repeatedly in recent months. ZEC is now testing a moment where trend, positioning, and selling pressure are starting to line up. If this setup is confirmed by the daily close, the downside risk grows fast. A Long-Held Technical Line Is Now Under Threat Zcash is breaking down from a level that has quietly acted as a backbone for price stability over the past few months. That level is the 50-day exponential moving average, or 50-day EMA. The EMA is a trend indicator that smooths price action and often acts as dynamic support during strong or healthy trends. In ZECs case, this line has mattered a lot. On November 30, when Zcash closed below the 50-day EMA, the price dropped nearly 30% within just a few days. A similar event played out again on December 14. Once the price closed below the same level, ZEC fell roughly 8% over the following sessions. Key ZEC Support: TradingView Now, Zcash is once again trading below this line. If todays candle closes under it, history suggests the move is not done. This is why the current breakdown matters more than an average red day. It signals a potential shift from consolidation into active downside continuation. Derivatives and Spot Flows Are Turning Bearish Together The reaction is already visible in trader behavior. Perpetual futures positioning shows most tracked cohorts leaning net short over the past 24 hours. Top traders, whales, and public figures (possibly KOLs) have all increased short exposure, suggesting growing conviction that price weakness is not finished. Smart money stands out slightly, having reduced short exposure by a small margin. But that shift is not strong enough to offset the broader positioning bias. Overall, derivatives data points to traders preparing for further downside rather than a quick recovery. Zcash Perps: Nansen Spot market data reinforces this view. On Solana-based ZEC markets, exchange balances jumped more than 47% in just one day. That kind of rise usually reflects coins moving toward exchanges, which often precedes selling pressure, even though the number isnt high. When both derivatives positioning and spot inflows lean the same way, it strengthens the signal. Spot Selling Continues: Nansen Together, these flows suggest that the loss of trend support is not being treated as a false break. The market is positioning as if follow-through risk is real. Zcash Price Levels And The 10% Risk? If the Zcash price breakdown confirms, the first level that matters is near $410. This zone has acted as short-term support during recent pullbacks. A failure to hold it would likely accelerate the move lower. Below that, the next major downside target sits near $371. A move from current levels to that zone would represent roughly a 10% drop, aligning closely with prior EMA-triggered declines. If selling pressure intensifies, even deeper levels near $295 come into view, based on prior consolidation zones. Zcash Price Analysis: TradingView The invalidation is clear. Zcash would need to reclaim the 50-day EMA decisively and then push above the $470 area to signal that the breakdown has failed. Only above that region does the structure start to stabilize again, with $549 becoming the next upside test. Until that happens, the balance of risk stays tilted lower. Zcash has lost a historically important trend guide, traders are positioned defensively, and spot flows suggest supply is moving toward the market. If the daily close confirms this setup, the path of least resistance remains down. Read the article at BeInCrypto

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Solana (SOL) Under Pressure Despite ETF Inflows as Traders Watch $110 Support Zone

Newsbtc•2025/12/23 20:03

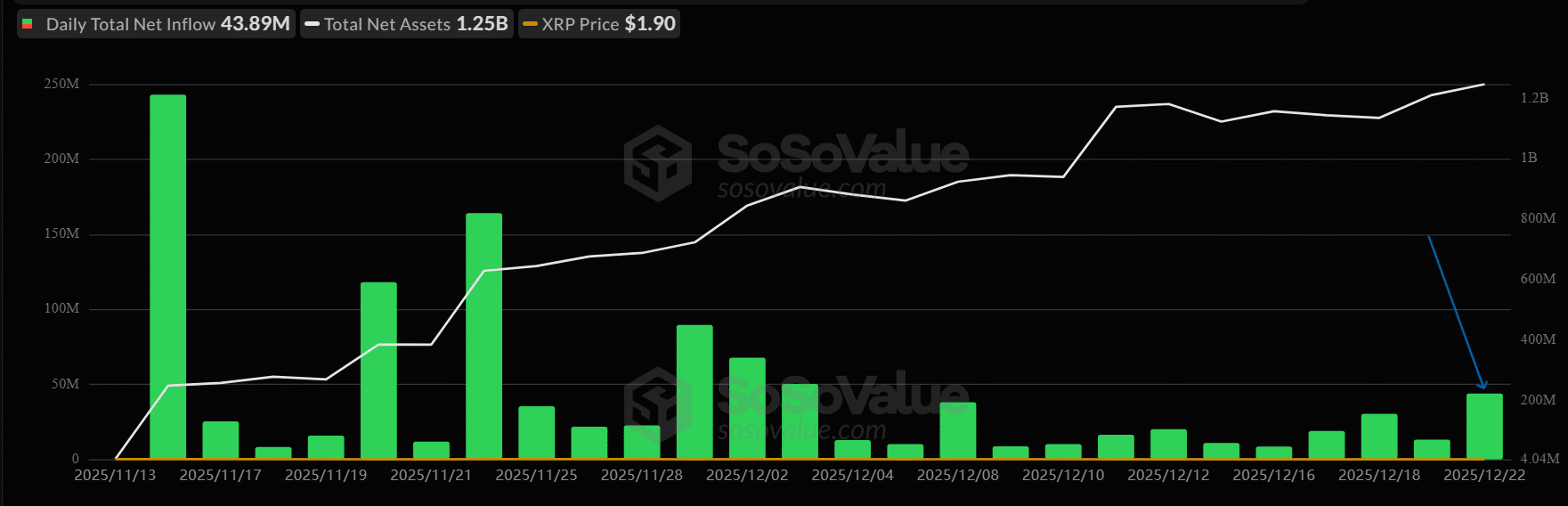

$43.89M flows into XRP ETFs despite falling sentiment – Here’s why

AMBCrypto•2025/12/23 20:03

PlayAstroon Taps Cache Wallet to Advance Web3 Onboarding and Security

BlockchainReporter•2025/12/23 20:00

ZOOZ Strategy Receives Nasdaq Delisting Warning As Bitcoin Treasury Stock Falls Below $1

BTCPeers•2025/12/23 20:00

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,518.41

-0.70%

Ethereum

ETH

$2,941.02

-1.39%

Tether USDt

USDT

$0.9995

-0.02%

BNB

BNB

$840.54

-1.99%

XRP

XRP

$1.88

-1.22%

USDC

USDC

$0.9998

+0.02%

Solana

SOL

$123.54

-1.17%

TRON

TRX

$0.2824

-0.72%

Dogecoin

DOGE

$0.1287

-2.56%

Cardano

ADA

$0.3608

-2.35%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now