- SHIB fell 2.9% to $0.057517 as it held above short-term support at $0.057425.

- Price remained within the range of the support of $0.057425 and resistance of $0.058011.

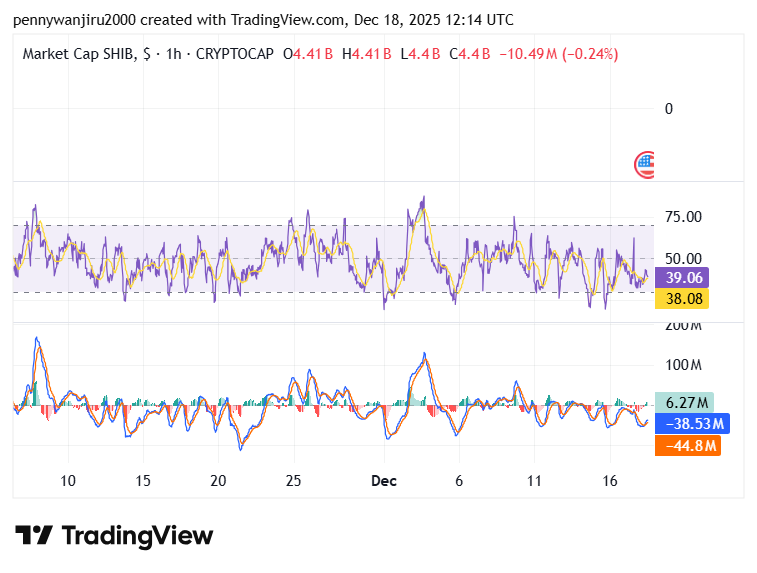

- RSI of approximately 43.91 and flat MACD indicators were indicative of further short term consolidation.

Shiba Inu was trading lower in the last session with the seller pressure continuing to dominate the wider meme coin sector。The token traded at $0.057517 which is a 2.9 percent fall in day. This action came after another phase of restricted volatility, in which the price action was compelled to remain within a tight intraday range. Subsequently, SHIB was still moving around established technical levels as opposed to trying to make a directional breakout.

Meanwhile, SHIB performed randomly in comparison with major trading pairs. The token dropped by 3.7 percent versus Bitcoin and had a slight increase by 0.6 percent versus Ethereum. These relative moves were associated with changing short-run positioning and not capital rotation. It is against this backdrop that the market participants were keen on support behavior and momentum readings.

SHIB Price Holds Near Key Support Zone

Notably, SHIB maintained price action above its immediate support at $0.057425. The market repeatedly tested this level but avoided a decisive breakdown. This behavior highlighted near-term demand defending the lower boundary of the recent trading range. Meanwhile, the 24-hour high at $0.058011 capped upside attempts, reinforcing resistance pressure.

However, repeated rejections near resistance limited upward follow-through. Price action stayed compressed between support and resistance, creating a short-term equilibrium. This structure reflected indecision rather than aggressive accumulation or distribution. As the range narrowed, volatility conditions remained subdued.

Momentum Indicators Reflect Short-Term Balance

Momentum indicators were in agreement with the horizontal price formation. Relative Strength Index was almost 43.91, which was below the midpoint and not at the oversold area. This position indicated a small amount of directional conviction on the part of either the buyers or the sellers. Meanwhile, the moving average line followed close to 37.51 akin to a neutral momentum bias.

Source:

TradingView

Source:

TradingView

At the same time, the MACD histogram was shown as close to 7.11M, and signals were -40.81M and -47.92M. These readings reflected superficial changes in momentum as opposed to growing strength in trends. This meant that momentum indicators supported consolidation and not acceleration of the trend

Market Cap Stability Shapes Short-Term Outlook

SHIB’s market capitalization held near $4.43 billion, unchanged despite intraday volatility. This stability reflected capital movement during the session. However, volume patterns suggested traders favored short-term positioning over directional exposure.

As momentum and price structure aligned, SHIB remained range-bound. For now, the market continued monitoring support resilience and resistance reactions. Short-term trends depended on how price behaves near these established technical levels.