Sudden Drop in Cryptocurrency

Sherpa, an analyst known for using the pseudonym Altcoin Sherpa, provided an intriguing assessment of the current situation. Few analysts acknowledge that we are at the bottom, and Sherpa is one of them. Although he generally believes the bottom point has been reached, he anticipates that Bitcoin might visit the $75,000 range briefly, which is the lowest level of the year.

“I think we have reached the local bottom, BUT I want to see one more wick below this level. Rapidly reaching the 75k level will serve as a great trigger for a long-term move and become ‘the bottom level.’ I consider this quite important.”

These days, the prevailing view is that Bitcoin will dip near the 70-75k dollar range. The breakdown in the bear flag, the negative news flow of January, the lack of volume in cryptocurrencies, and the continuity of strong exits from the ETF channel encourage the bears.

Potential Rise in Risky Assets

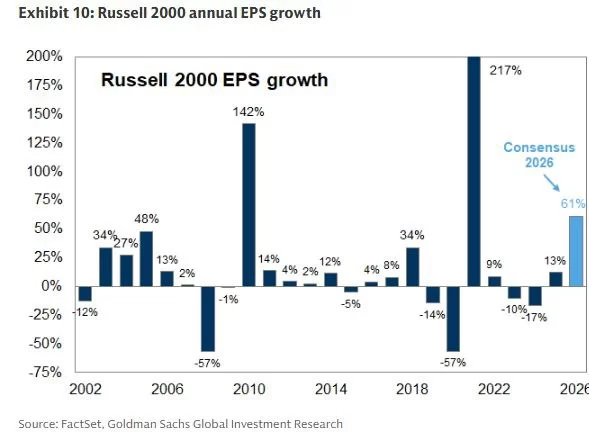

The Russell 2000 index is a significant gauge for the crypto bull. An increase here indicates a growing interest in risk assets, and Kyledoops predicts an upward trend for the next year if there are no major surprises. This scenario typically signals a rise in cryptocurrencies, and with the resolution of liquidity shortages, altcoins could return to their former days.

“Stocks of small-cap companies are being priced with an expectation of significant recovery.

Russell 2000 (IWM) index moves with a 61% EPS growth expectation, one of the most aggressive forward expectations on record.

This situation creates a clear risk-reward distribution:

- earnings expectations are being harshly redefined

- margin expansion is presumed

- growth is being priced in without confirmation

If macroeconomic conditions remain stable, stocks of small-cap companies have the potential to rise. The upcoming few quarters will determine whether this is a recovery or optimism beyond reality.”