BoJ to Continue Gradual Rate Hikes Next Year, Likely After June as Wage Growth Hinges on Spring Negotiations

COINOTAG News, December 19, cites EFG Bank economist Sam Jochim, who characterizes the Bank of Japan’s belated rate hike as more of an easing of the accelerator than a hard brake. He sees room for additional rate hikes in 2025, while noting that even after the move the policy rate will remain substantially low by historical standards.

Jochim says the trajectory hinges on the annual spring labor negotiations that shape wage growth; another BOJ rate hike before June is unlikely. He also warns that the central bank remains behind the curve, but the pace of tightening will stay very gradual.

For crypto markets, the gradual policy path in Tokyo suggests liquidity will be modest but predictable, shaping risk sentiment for Bitcoin and other digital assets. Traders will weigh BoJ signals alongside global central banks to assess potential liquidity-driven moves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

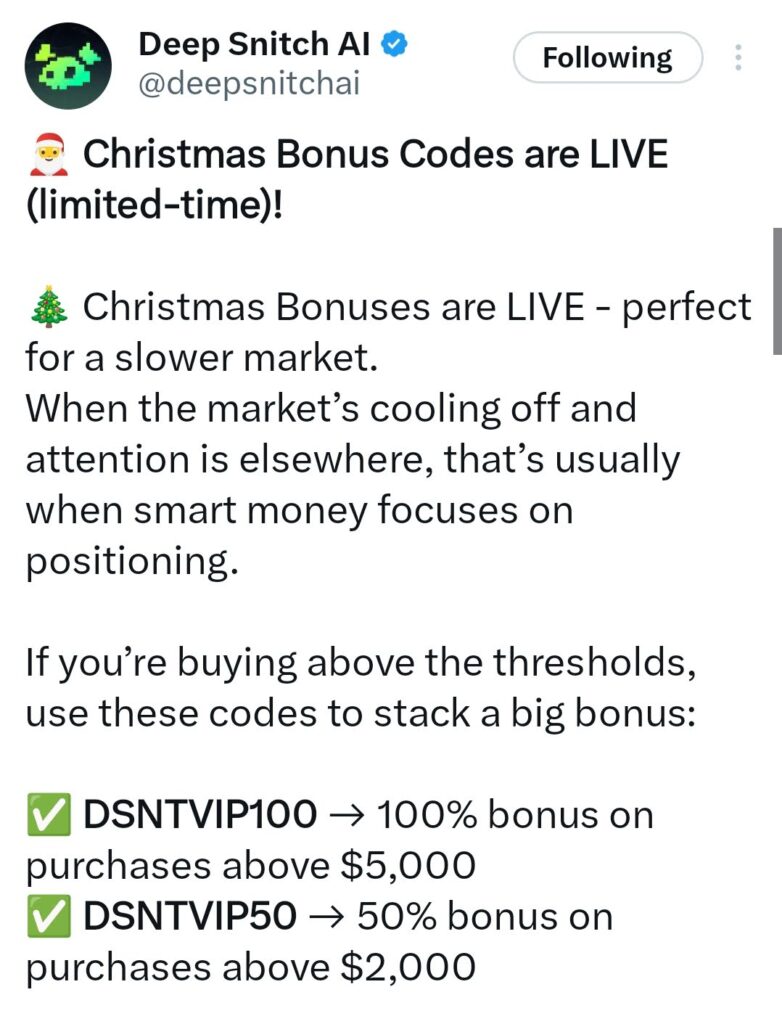

Bitcoin Hyper Price Prediction: DeepSnitch AI’s 300X Forecast Positions It as the Highest-ROI Opportunity In 2026

MocaPortfolio Goes Live with Magic Eden ($ME) Token Drop

Crypto market rally at risk as top Fed official warns on interest rates

Fed seeks public input on 'skinny master account' for limited access to the central bank