Cryptocurrency Prices Surge as Inflation Numbers Surprise Experts

2025/12/19 09:50

2025/12/19 09:50By:

Summarize the content using AI ChatGPT Grok Today marked a significant day for cryptocurrencies, as major economic events coincided. The UK announced an interest rate cut, while the European Central Bank maintained rates as expected. Concurrently, the U.S. inflation report was released, shedding light on pivotal employment and inflation figures ahead of the upcoming January interest rate decision. Contents U.S. Data: Breaking News Implications for Cryptocurrency U.S. Data: Breaking News Federal Reserve members, acknowledging the overemphasis on customs duties’ impact on inflation, have been reducing interest rates over the past three meetings. However, even among those supporting cuts, many believe rates remain 50-100 basis points above the neutral level. This realization places additional constraints on further reductions unless significant declines in inflation or employment issues are observed. The latest U.S. inflation rate stands at 2.7%, falling short of the anticipated 3.1%, while the core inflation rate reached 2.6%, missing both expected and previous marks of 3%. These figures underscore a broader economic narrative with potentially profound implications for financial markets. Implications for Cryptocurrency These numbers, falling well below expectations, bring favorable news for the cryptocurrency sector. With the unemployment rate at its highest in recent years, the easing back of inflation to 2.6% levels suggests the possibility of a rate cut in January. Today’s developments may prompt President Trump to again criticize Fed Chairman Powell for not executing more aggressive rate cuts. Following the publication of the report, Bitcoin $90,357.50 prices swiftly climbed past the $88,000 mark and approached a crucial support level of the bear flag. Such a sharp move reinforces the impact of macroeconomic indicators on digital currencies. These events highlight how sensitive cryptocurrencies are to broader economic trends and policies. The interplay between traditional financial indicators and the burgeoning world of digital assets continues to evolve with each significant economic release. Investors now eye January’s interest rate decisions, which hinge on additional data and the Federal Reserve’s subsequent analyses. As the cryptocurrency landscape shifts, monitoring these key economic indicators becomes indispensable for navigating market volatility.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

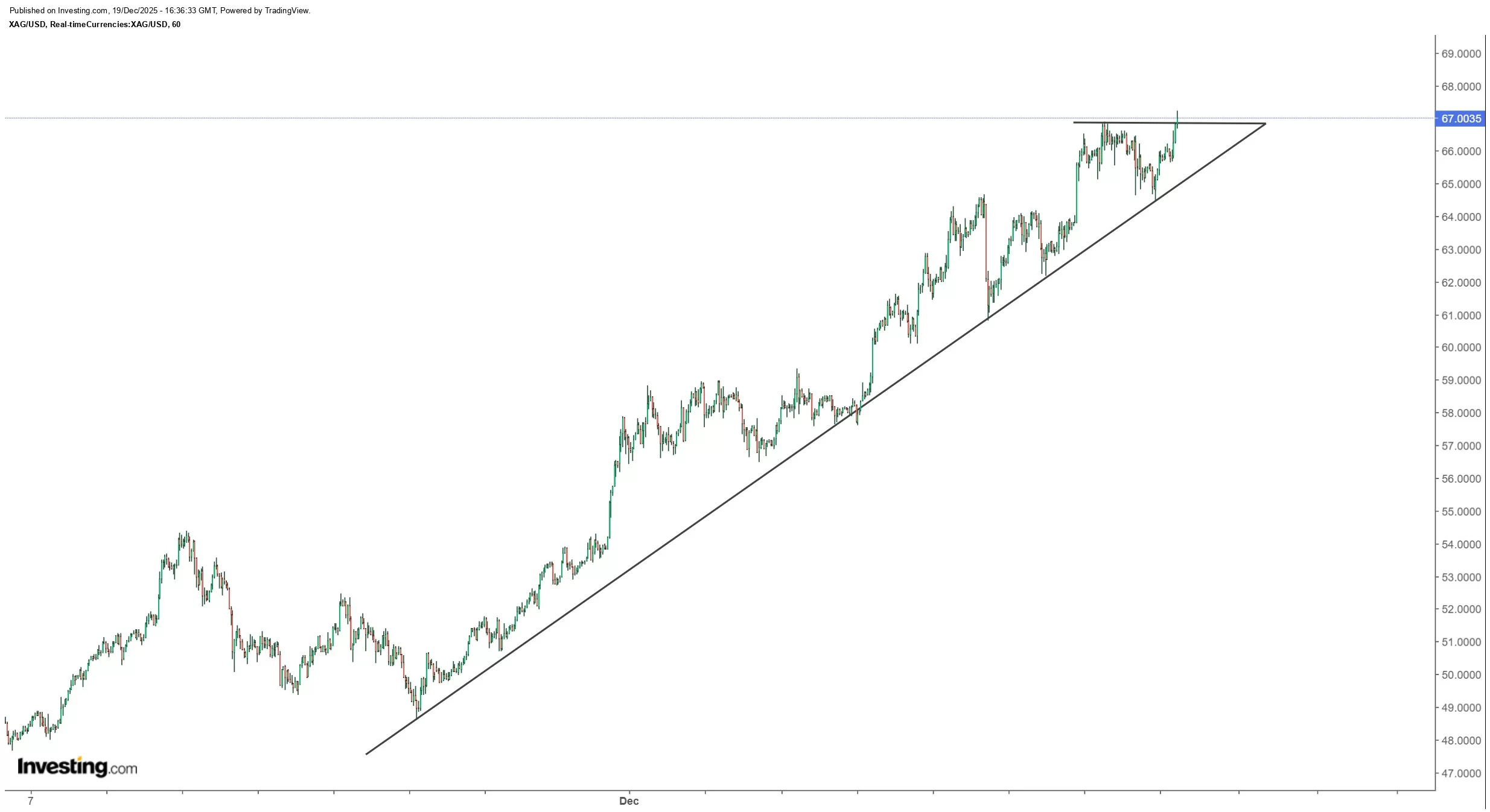

Silver Shatters Records with Unprecedented Performance This Year

Cointurk•2025/12/19 17:42

Ethereum Traders Chase Upside With Historic Leverage – Breakout Fuel Or Fragile Setup?

Newsbtc•2025/12/19 17:34

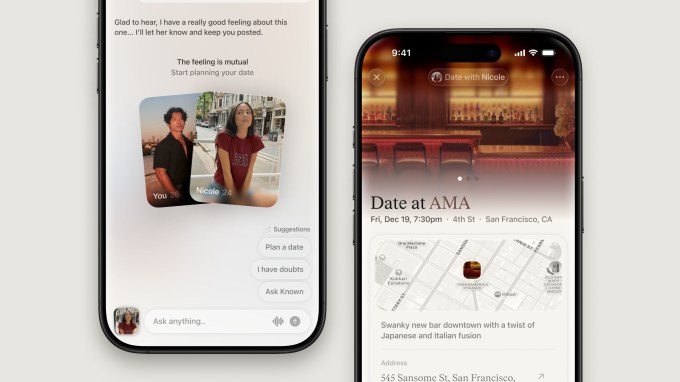

Known uses voice AI to help you go on more in-person dates

TechCrunch•2025/12/19 17:33

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$87,595.55

+1.99%

Ethereum

ETH

$2,967.37

+5.51%

Tether USDt

USDT

$1

+0.07%

BNB

BNB

$847.44

+2.63%

XRP

XRP

$1.89

+2.27%

USDC

USDC

$1

+0.06%

Solana

SOL

$125.3

+2.84%

TRON

TRX

$0.2787

-0.31%

Dogecoin

DOGE

$0.1314

+7.25%

Cardano

ADA

$0.3751

+6.08%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now