US November CPI Release on December 18 as Shutdown Delays Blur October Data; Markets Eye December Inflation Readings

Market participants await the November CPI release on December 18, with disruption from the prior U.S. government shutdown complicating price data collection. Because October’s CPI and most month‑on‑month sub-items were incomplete, the reference value for November may carry limited interpretive weight, shifting analysts’ attention to December inflation figures. Street consensus points to year‑over‑year CPI at about 3.1% and a 3.0% core CPI, signaling a mild rebound trend that aligns with the late‑year macro backdrop.

In crypto markets, inflation data and the dollar trajectory influence risk appetite and liquidity. A cooler inflation print can bolster a softening of policy expectations and support a risk-on tilt for Bitcoin and other digital assets, while data revisions introduce volatility. Traders should monitor the CPI trajectory as part of a broader macro framework, combining with other indicators to assess potential shifts in Fed policy and capital flows into crypto equities and tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Pepe Coin price eyes 30% dip as whales start capitulating

Solana Stabilizes Near $128 as Support at $124 and Resistance at $134 Define Trading Range

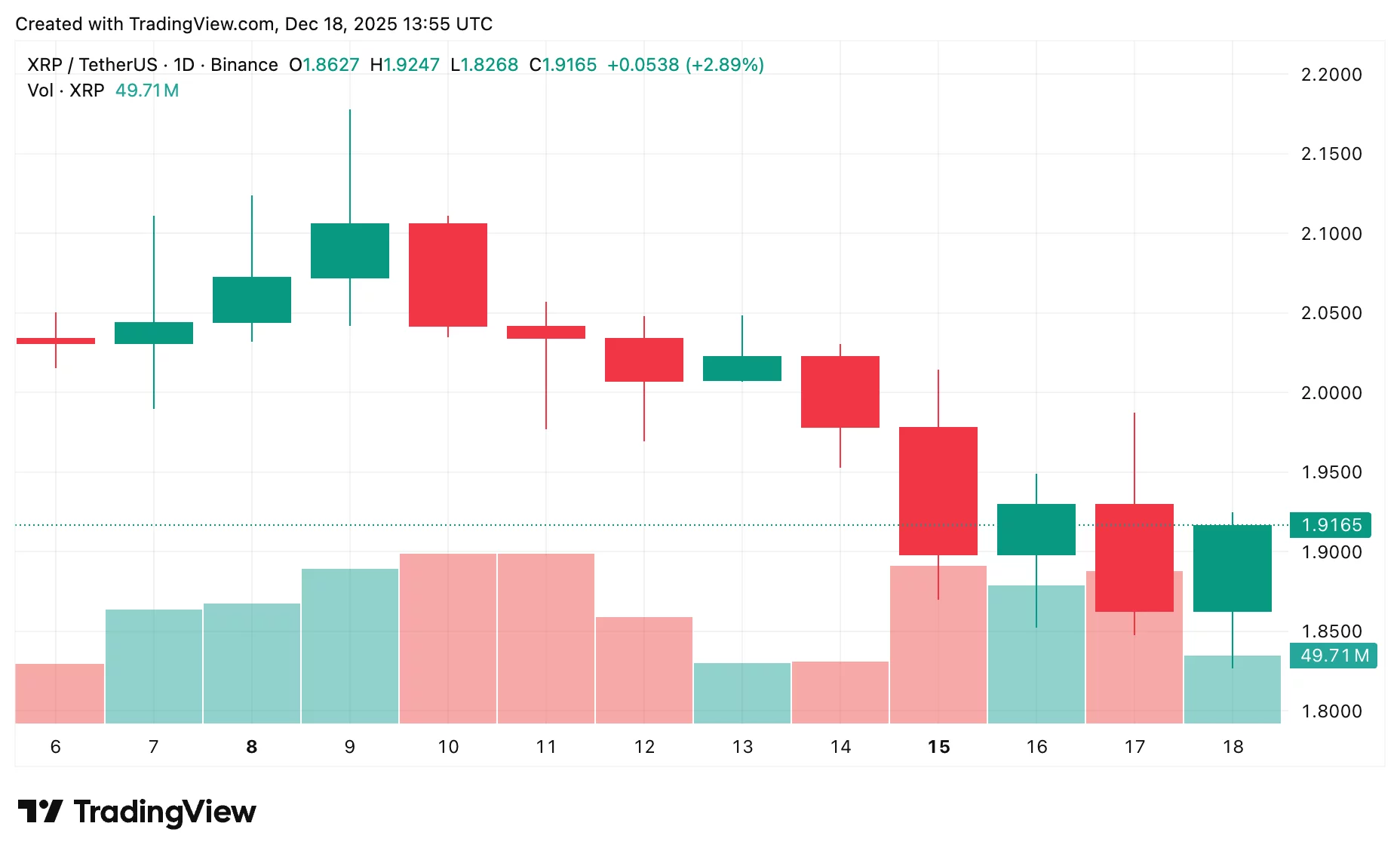

XRP price prediction: Will Ripple break $2 or slide lower?

XRP Faith Hits New Highs as Long-Term Holders Talk of a Historic Endgame